Community USDH Governance and ETF Ambitions Put Hyperliquid in the Spotlight

Hyperliquid opens community governance for its USDH stablecoin while VanEck’s HYPE ETF plans fuel momentum and investor attention.

Hyperliquid opened a community governance protocol on its upcoming USDH token, agreeing to have no direct influence on the vote’s outcome. Native Markets is the current favorite to win.

Between this and VanEck’s plans to launch a HYPE ETF, Hyperliquid’s bullish momentum seems liable to continue.

Hyperliquid and USDH

Hyperliquid is already in the spotlight right now, as a recent token rally brought HYPE’s price to an all-time high. The company confirmed plans of a VanEck HYPE ETF earlier today, but it’s continuing to make important announcements: Hyperliquid is now opening a vote regarding the USDH stablecoin to community governance.

Over the past week, the community engaged with teams’ proposals for the USDH ticker for a Hyperliquid-first, Hyperliquid-aligned, compliant, and natively minted USD stablecoin. While USDH is no more than a reserved ticker at the protocol level, it has come to represent a…

— Hyper Foundation (@HyperFND)

Specifically, Hyperliquid has been planning to launch a USDH stablecoin for several days, but there have been a few complications. Several blockchain firms are interested in building this new asset’s infrastructure, so Hyperliquid developers put it to a community vote. They also removed their own holdings from eligibility.

Who Will Win the Stablecoin Vote?

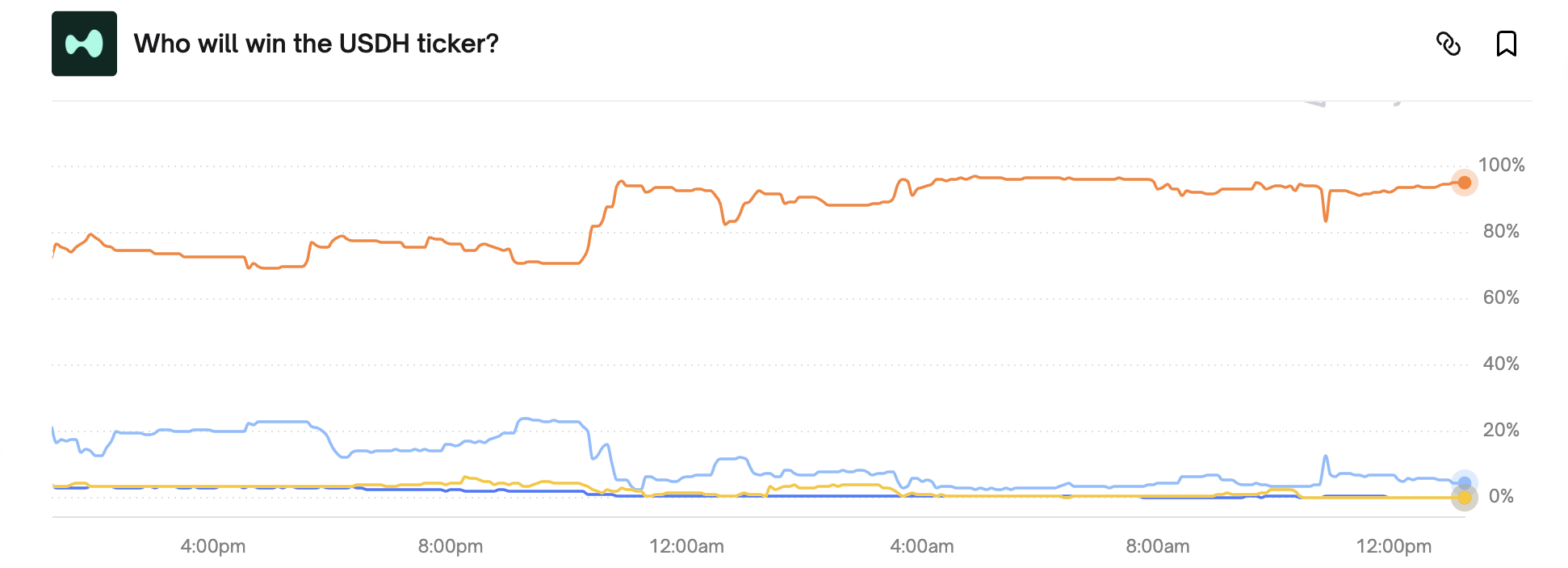

Observers initially speculated that this decision to make the governance proposal more democratic might open some unexpected possibilities. Native Markets has been the favorite to develop USDH with Hyperliquid, but its odds briefly dropped.

However, unverified rumors of a bribery scandal have apparently closed this window. Regardless of these social media claims’ veracity, Native Markets’ odds of success quickly returned to a commanding position.

Who Will Win the USDH Ticker? Source:

Who Will Win the USDH Ticker? Source:

The community governance proposal is live right now, and it will resolve on September 14. HYPE holders will stake their tokens to one Hyperliquid validator, each of whom has taken a public stance on the USDH issue. These token validations will thus serve as the mechanism for democratic governance.

Between Hyperliquid’s ETF ambitions and this USDH governance protocol, the company is liable to maintain heightened community interest for the immediate future. Based on today’s price actions, that won’t necessarily translate to an immediate valuation boost for HYPE, but this organic visibility is crucially important.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!