Tokenized ETFs are exchange-traded funds represented as blockchain tokens, enabling 24/7 trading, programmable settlement, and DeFi collateral use. BlackRock is exploring tokenized ETFs after spot Bitcoin ETF success, targeting real-world asset exposure while navigating regulatory and custody challenges.

-

Tokenized ETFs enable round-the-clock trading and programmable settlement.

-

They can serve as collateral in DeFi and increase market efficiency for real-world assets (RWA).

-

BlackRock’s BUIDL fund shows institutional scale: $2.2B in tokenized money market assets across multiple blockchains.

Tokenized ETFs: BlackRock explores tokenized ETFs after Bitcoin ETF success — learn implications, risks, and next steps for investors. Read more.

What are tokenized ETFs?

Tokenized ETFs are traditional exchange-traded funds issued or represented as blockchain tokens that allow fractional ownership, programmable settlement and extended trading hours. They combine ETF governance and regulatory wrappers with blockchain advantages such as automated transfers and on-chain custody options.

BlackRock, the world’s largest asset manager, is reportedly exploring ways to tokenize ETFs on the blockchain after the strong performance of its spot Bitcoin ETFs, according to reporting by Bloomberg (plain text source).

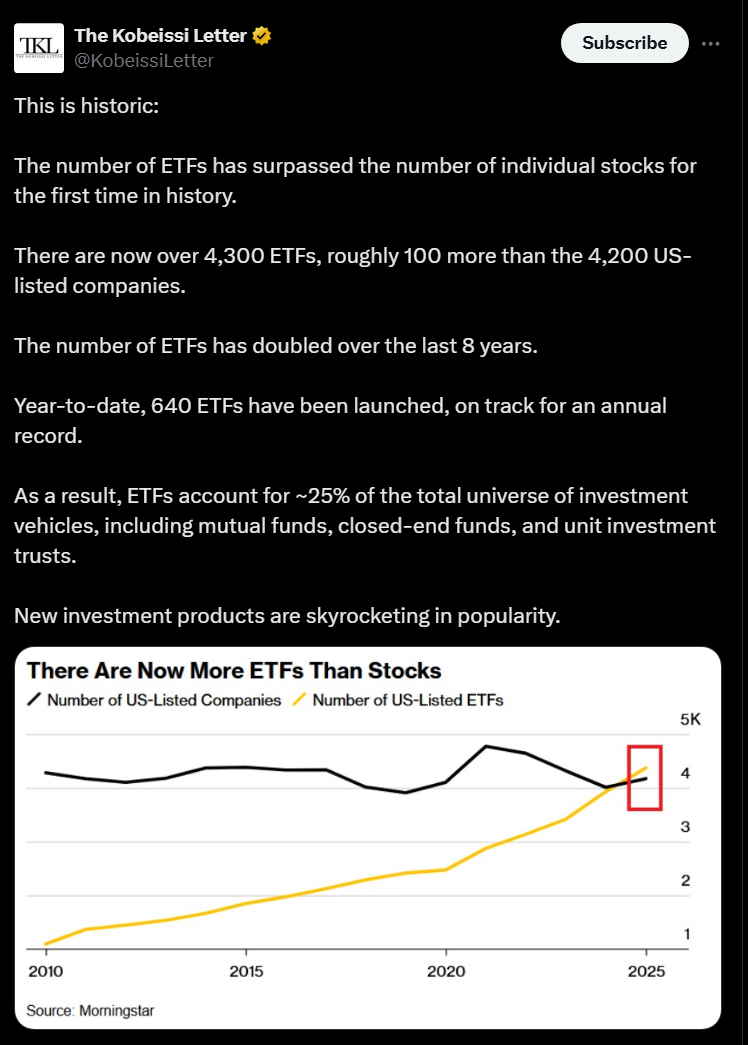

Source: The Kobeissi Letter

Source: The Kobeissi Letter

How could BlackRock tokenize ETFs and what would change?

BlackRock’s discussions reportedly target tokenizing funds with exposure to real-world assets (RWA). Tokenization could allow ETFs to trade beyond standard market hours and be used as collateral in decentralized finance (DeFi) applications, expanding market access and liquidity.

BlackRock already manages the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), a tokenized money market fund holding approximately $2.2 billion across Ethereum, Avalanche, Aptos, Polygon and other blockchains — demonstrating operational experience with tokenized fund structures.

Why does tokenization matter for TradFi and DeFi?

Tokenization bridges traditional finance and blockchain markets by converting securities into programmable tokens. Industry commentary from JPMorgan and other institutions calls tokenization a “significant leap” for money market and fund industries, helping funds act as collateral and retain yield while being more composable on-chain.

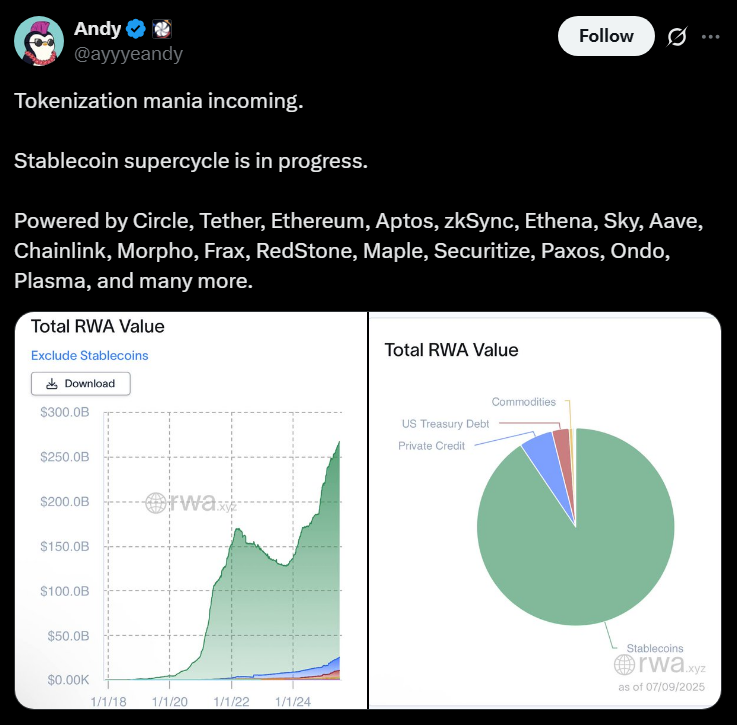

BUIDL market cap by network. Source: RWA.xyz

BUIDL market cap by network. Source: RWA.xyz

When could tokenized ETFs become widely available?

Adoption depends on regulatory clarity, custody solutions and market infrastructure. Regulators and banks are actively piloting tokenized money market initiatives; progress in legislation (e.g., stablecoin and custody frameworks) will accelerate product launches.

Morningstar data (plain text source) shows ETFs now outnumber publicly listed stocks, underlining why incumbents see tokenization as a way to modernize widely used investment vehicles.

Source: ayyyeandy

Source: ayyyeandy

How will tokenized ETFs affect investors and markets?

Tokenized ETFs could: (1) improve liquidity and settlement speed, (2) expand access via fractional ownership, and (3) enable new collateral workflows in DeFi. Risks include custody complexity, regulatory uncertainty and operational integration between centralized and decentralized systems.

| Trading hours | Market hours | Potential 24/7 on-chain trading |

| Settlement | T+1/T+2 | Near-instant on-chain settlement |

| Collateral use | Limited | Useable in DeFi as collateral |

Frequently Asked Questions

Will tokenized ETFs trade 24/7?

Potentially yes. Tokenized ETFs can be designed to trade on-chain outside standard market hours, subject to exchange and regulatory frameworks that govern primary issuance and market making.

Can tokenized ETFs be used as collateral in DeFi?

Yes. One core benefit is composability: tokenized ETF shares can be posted as collateral in smart contracts, enabling new liquidity and lending products while preserving fund yields.

Key Takeaways

- Tokenization accelerates access: Tokenized ETFs can broaden market access via fractional ownership and extended trading.

- Institutional momentum: BlackRock’s BUIDL and bank-led initiatives show growing TradFi support for tokenized funds.

- Regulation and custody matter: Widespread adoption hinges on clear rules, reliable custody and interoperable infrastructure.

Conclusion

BlackRock’s exploration of tokenized ETFs signals institutional commitment to tokenization as a practical evolution for ETFs and money market funds. While technical and regulatory hurdles remain, tokenized ETFs promise improved liquidity, programmable settlement and new DeFi use cases. Investors should monitor regulatory updates and product pilots from major institutions.