Nearly $4.3 Billion in Bitcoin and Ethereum Options Expire Today Ahead of Key Fed Decision

Bitcoin and Ethereum face $4.3 billion in expiring options, yet both trade above max pain levels. With implied volatility subdued, markets appear focused on next week’s Fed rate cut decision for the next major catalyst.

Today, nearly $4.3 billion in Bitcoin (BTC) and Ethereum (ETH) options contracts are set to expire, a development that could influence short-term price movements.

While smaller than last week’s expiry, such events often spark volatility. The timing coincides with growing optimism over a potential Federal Reserve rate cut next week.

Crypto Traders Eye $4.3 Billion Bitcoin and Ethereum Options Expiration

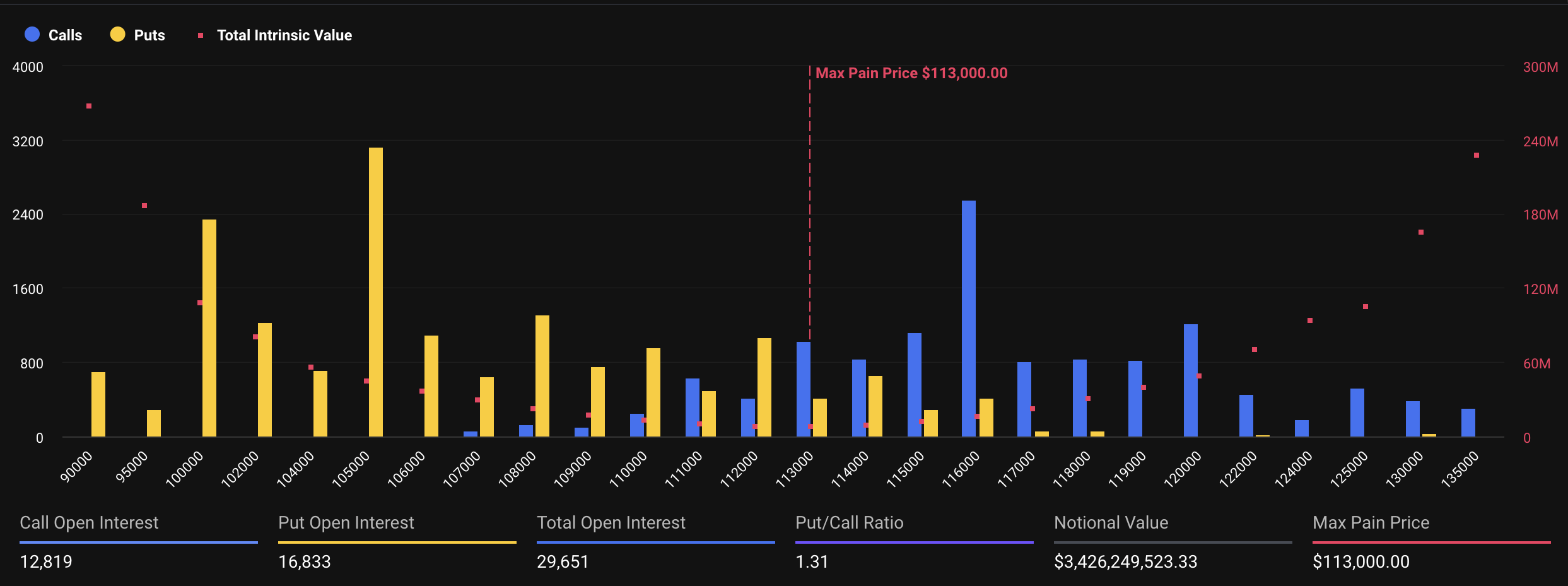

Deribit data showed that Bitcoin options expiring today have a notional value of $3.42 billion. The total open interest stands at 29,651 contracts, a slight drop from last week’s 30,447.

Of these, 12,819 are call contracts and 16,833 are put contracts. This creates a put-to-call ratio of 1.31, signaling more demand for downside protection. Such a skew often reflects caution among traders, as many are positioning for potential short-term weakness in Bitcoin’s price.

Bitcoin Expiring Options. Source:

Deribit

Bitcoin Expiring Options. Source:

Deribit

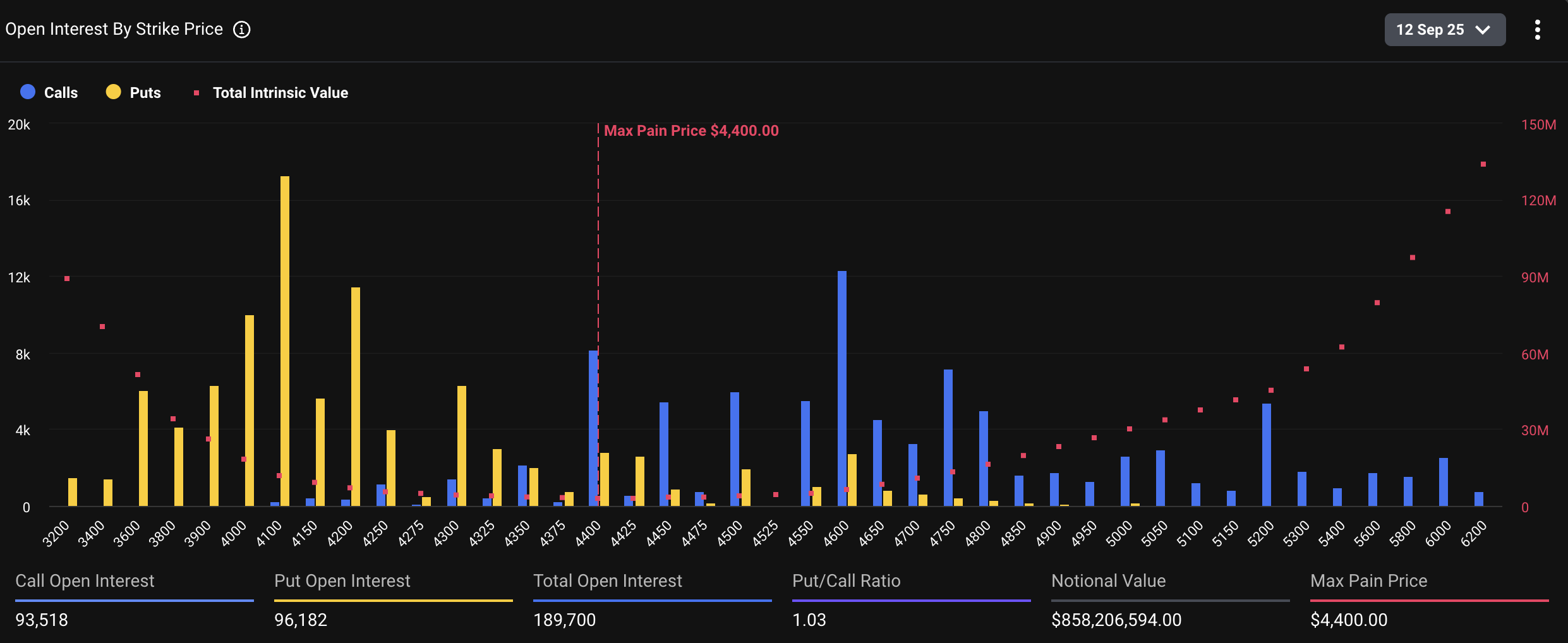

Meanwhile, Ethereum traders are showing slightly less bearish positioning compared to Bitcoin. For ETH, 93,518 call contracts versus 96,182 put contracts create a put-to-call ratio of 1.03.

The combined 189,700 contracts carry a notional value of $858.2 million, marking a significant decline from last week’s 299,744 contracts.

Expiring Ethereum Options. Source:

Deribit

Expiring Ethereum Options. Source:

Deribit

Both Bitcoin and Ethereum remain above their respective maximum pain levels. According to BeInCrypto Markets data, Bitcoin was trading at $115,617, above its maximum pain price of $113,000. Ethereum followed a similar pattern, trading at $4,553 against a maximum pain level of $4,400.

The maximum pain metric identifies the price point at which the largest number of options contracts expire worthless, creating the steepest losses for traders. Market watchers often pay close attention to this level.

Why? Because prices tend to drift toward it when options approach expiration, a phenomenon explained by the Max Pain theory.

Nonetheless, the spotlight now shifts to the Federal Reserve’s upcoming rate decision. Optimism has crept into the market, with forecasts of a potential rally if policymakers confirm expectations of an interest rate cut.

Analysts at Greeks.live pointed out that implied volatility remains calm, even edging slightly lower.

“The options market is pricing in relatively low future volatility, with a consensus that a 25-basis-point rate cut has already been factored in,” the analysts wrote.

Greeks.live noted a sharp rise in Block trade activity, which has accounted for more than half of daily volume over the past two weeks. Furthermore, their trade distribution analysis indicated that most of these transactions are concentrated in the current month, with buying and selling occurring at roughly equal levels.

“This indicates considerable market divergence regarding the latter half of this month, though expectations for volatility remain generally subdued,” the post added.

Lastly, the analysts suggested that market sentiment remains broadly favorable for the fourth quarter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Incentive Program: Win up to 1,100 USDT Per Week

CandyBomb x MET: Trade futures to share 20,000 MET!

CandyBomb x MET: Trade futures to share 20,000 MET!

CandyBomb x APR: Trade futures to share 88,888 APR!