Solana price (SOL) is trading bullish near $239, with momentum indicating possible tests of $244 and $264 resistance if bulls hold. Short-term support sits near $220; traders should watch weekly closes and volume signals for confirmation.

-

SOL up 5.57% today — momentum favors bulls for short-term upside.

-

Hourly and daily charts show no immediate reversal; weekly close above $219.97 would reinforce the trend.

-

Key resistances: $240, $244, $264; current price: $239.35 (press time).

Solana price update: SOL is trading near $239 with upside momentum — monitor weekly closes and volume for confirmation. Read actionable targets now.

By COINOTAG · Published: 2025-09-12 · Updated: 2025-09-12

What is the current Solana price outlook?

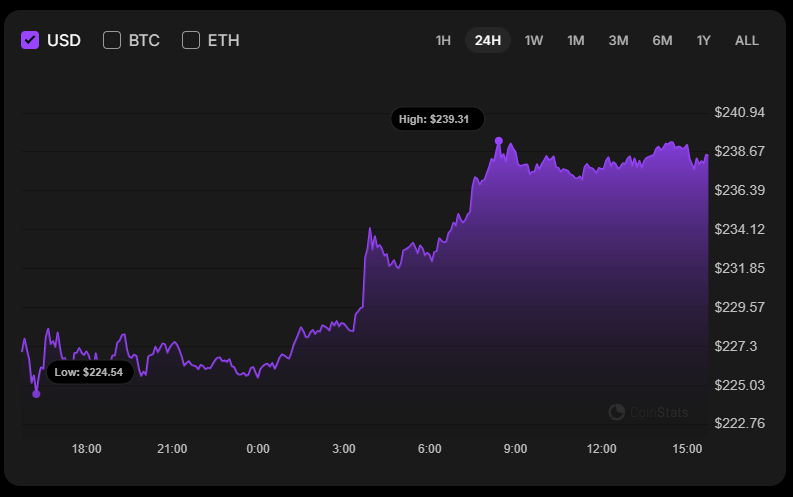

Solana price is showing bullish momentum today, trading near $239.35 and up 5.57% on the session. On short time frames the market favors continuation to immediate resistance levels if bulls keep closing candles near highs and volume supports the move.

The rates of most of the coins are in the green zone today, according to CoinStats.

SOL chart by CoinStats

How is SOL/USD performing on hourly and daily charts?

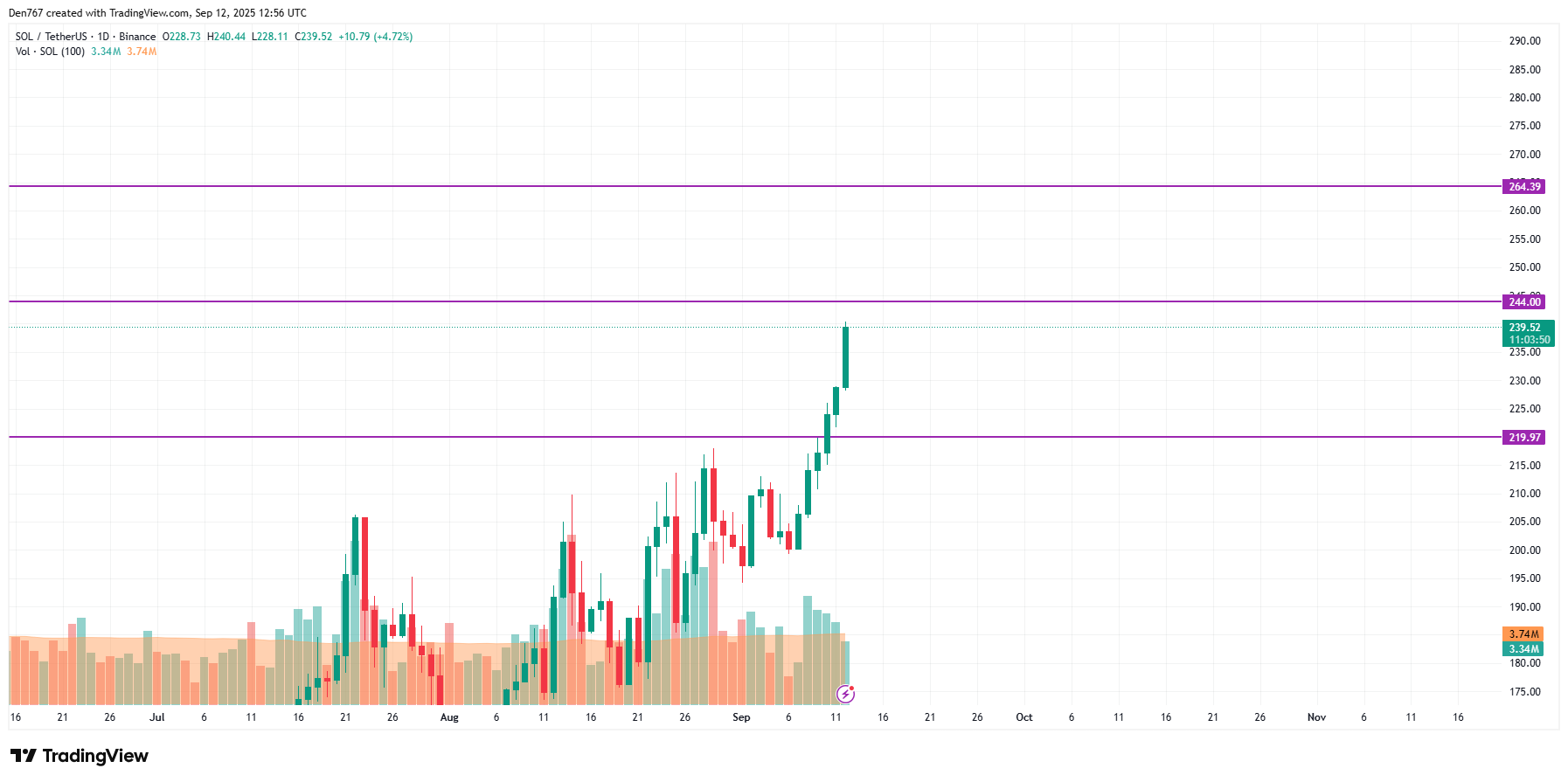

SOL/USD is one of the biggest gainers today, rising by 5.57%. The hourly chart looks bullish: if bulls hold the gained initiative and a candle closes near resistance, growth is likely to continue toward the $240 mark and above.

Image by TradingView

On the bigger time frame, there are no reversal signals so far. If the bar closes around the current prices with no long wick, there is a good chance to witness a test of the resistance at $244 by the end of the week.

Image by TradingView

From the midterm point of view, the picture is similar. If the weekly candle closes above the $219.97 level, traders may expect an ongoing upward move to the $264 resistance.

Image by TradingView

SOL is trading at $239.35 at press time.

Why does the current technical setup favor further upside?

Price structure shows higher highs on intraday charts and key resistances are within reach. Volume confirmation from CoinStats and pattern clarity on TradingView support continuation rather than immediate reversal. Watch weekly candle behavior for a decisive outlook.

Key comparative table

| Current price | $239.35 | Reference for short-term targets |

| 24h change | +5.57% | Momentum indicator |

| Immediate resistance | $240 / $244 | Targets if bullish strength continues |

| Midterm resistance | $264 | Next level if weekly close confirms |

| Key support | $219.97 | Weekly close above supports continuation |

How should traders manage risk with SOL now?

Use clearly defined stop levels below $219.97 for swing positions. Scale into positions on confirmed closes above resistance. Position sizing should reflect individual risk tolerance and volatility seen in the last 24 hours.

Frequently Asked Questions

Is Solana price expected to break $240 today?

Short-term momentum makes a $240 test likely if hourly candles close near highs. Confirmation requires follow-through volume and no bearish reversal wicks on key candles.

What resistance levels should traders watch for SOL?

Watch $240 and $244 for immediate resistance; $264 is the next midterm target if the weekly candle confirms bullish bias.

How can I interpret weekly closes for SOL?

A weekly close above $219.97 signals a sustained bullish bias. Conversely, a decisive weekly close below this level increases the risk of deeper pullbacks.

Key Takeaways

- Momentum: SOL is bullish on intraday charts; price near $239 indicates near-term upside.

- Resistance: $240–$244 immediate, $264 midterm — watch weekly closes for confirmation.

- Risk management: Use stop levels below $219.97 and confirm entries with volume.

Conclusion

Solana price is exhibiting bullish momentum with clear short-term targets at $240 and $244 and a midterm aim of $264 if weekly confirmation arrives. Traders should follow price action, volume signals, and weekly closes to manage risk and identify high-probability entries. Stay updated with on-chain and market data for evolving confirmations.

Author: COINOTAG — Financial markets team. Sources: CoinStats, TradingView (mentioned as plain text).