SBI Ends Joint Venture with Zodia Custody

SBI ends its Zodia crypto-custody venture while starting a global tech fund, reallocating resources toward diversified technology investments and balancing regulatory risks with innovation opportunities.

SBI Holdings is overhauling its digital and technology initiatives. It is ending a crypto-custody venture with Zodia Custody and launching a global equity fund targeting Web3, AI, and other transformative sectors.

The dual move reflects a strategic pivot toward scalable technology-driven opportunities under Japan’s evolving regulatory environment.

SBI Ends Crypto-Custody Venture with Zodia

SBI Holdings and London-based Zodia Custody have agreed to dissolve their joint venture in Japan about two years after its creation. The decision follows internal reviews of priorities by both parties. Zodia Custody, backed by Standard Chartered, had been preparing an application with Japan’s Financial Services Agency but never proceeded.

Japan remains challenging for foreign crypto firms, given strict oversight shaped by past incidents such as the 2024 DMM Bitcoin breach exceeding approximately $2.04 billion and the earlier Mt. Gox collapse.

According to Bloomberg, SBI spokesperson Kosuke Kitamura stated that the decision does not indicate a withdrawal from digital asset services or Asia. Instead, it aims to accelerate group-wide digital strategies. Zodia Custody continues to expand in other markets, including a recent acquisition of Tungsten Custody Solutions in the United Arab Emirates.

Launch of Next-Generation Technology Strategy Fund

SBI Asset Management will begin operating the SBI Next-Generation Technology Strategy Fund on September 17. The fund invests in global equities across emerging sectors, including Web3, blockchain, decentralized finance, artificial intelligence, quantum computing, and nuclear-fusion energy. Initially focusing on these themes, the portfolio will adjust as technologies and market conditions evolve.

Offered through SBI Securities, the fund carries an annual trust fee of 0.99%, which ranks among the lowest for comparable actively managed technology funds in Japan. By targeting industries that may reshape global markets, the fund seeks to provide investors with diversified exposure and medium—to long-term capital growth.

Strategic Implications

These simultaneous actions highlight a broader shift among Japanese financial institutions seeking to balance digital asset risk with opportunities in advanced technology. SBI’s exit from a crypto-specific joint venture and its launch of a forward-looking investment vehicle show a calculated strategy to capture technological innovation while operating within a regulated framework.

The two developments are connected by SBI’s broader goal of reallocating resources away from direct crypto custody’s high regulatory and security risks toward diversified technology investments that still encompass blockchain and Web3 potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

First Solana ETFs approved: bulls regain control with eyes on $230

Hedera price forecast: HBAR eyes $0.23 amid ETF listing

Nasdaq-listed AgriFORCE eyes $700M Avalanche treasury bet; AVAX price outlook

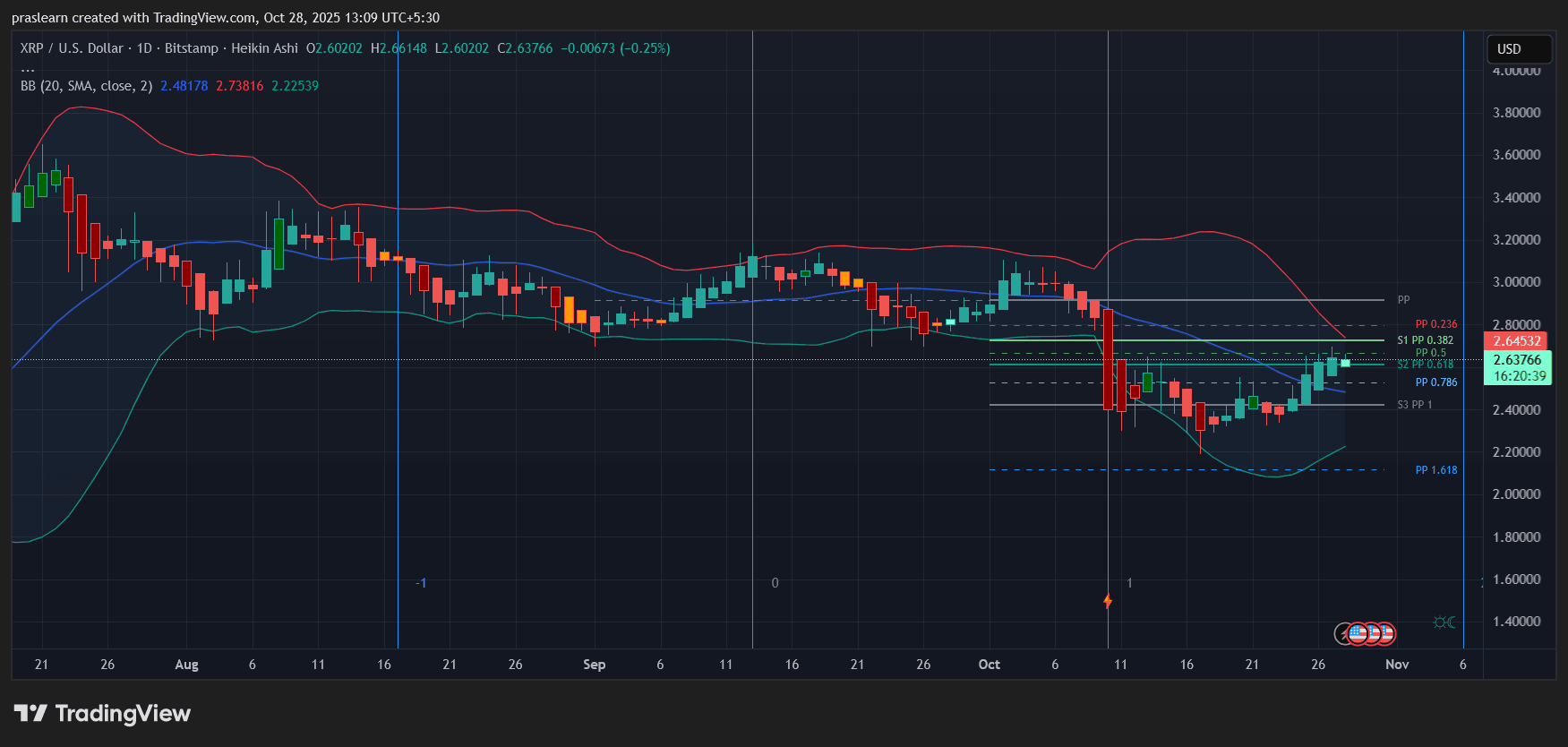

Is XRP About to Rally on US–China Trade Peace Talks?