Did “Sharks” Push Bitcoin Above $115K in Two Weeks?

Large 'shark' investors just bought a massive 65,000 BTC in a single week, bringing their total holdings to a record high and signaling a major supply crunch.

A group of large investors, often called ‘sharks,’ purchased a massive 65,000 BTC in just one week. Bitcoin’s price recovered to $115,000 in two weeks.

Typically, shark wallets hold between 100 and 1,000 BTC. This group previously gained attention for a large-scale buying spree when Bitcoin was consolidating around the $112,000 level.

Sharks Accumulate 65,000 BTC in One Week

According to CryptoQuant analyst ‘XWIN Research Japan’, the behavior of Bitcoin’s short-term traders is currently showing clear signs of divergence.

In the past week alone, shark wallets added 65,000 BTC, pushing their total holdings to an all-time high of 3.65 million BTC. The analyst noted that while the market is volatile, swinging up and down, a Bitcoin supply crunch is simultaneously taking hold.

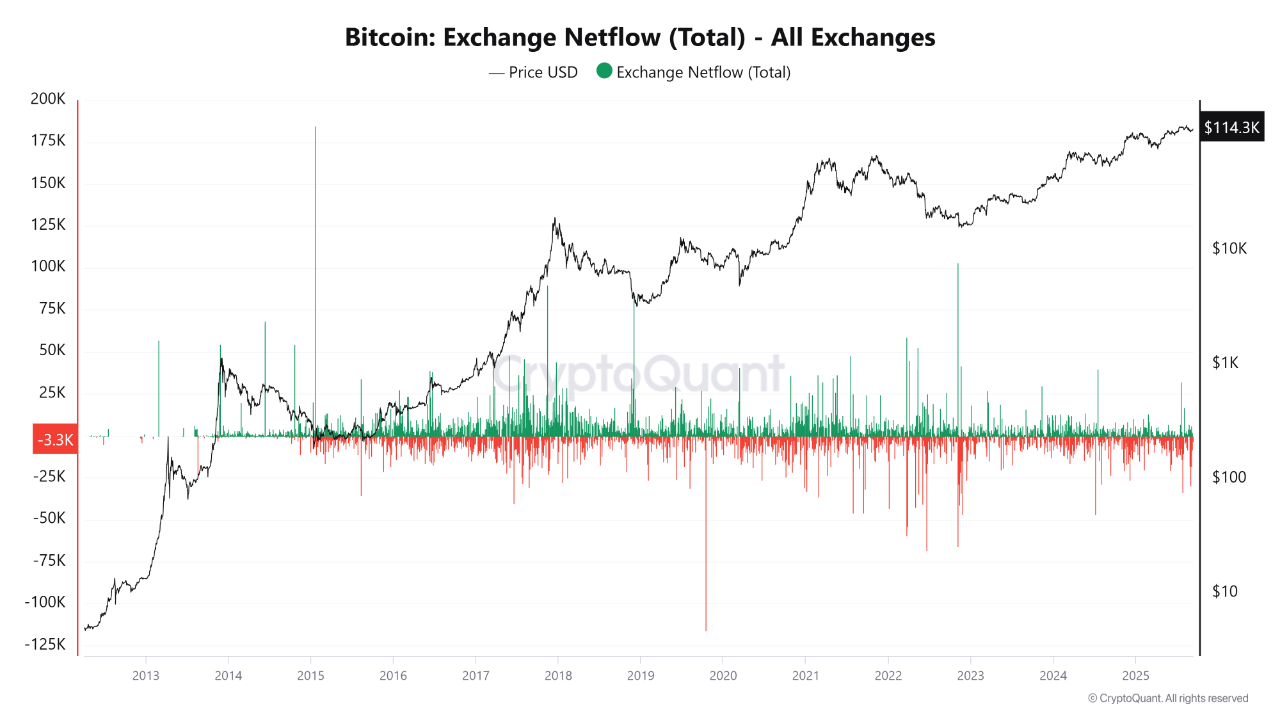

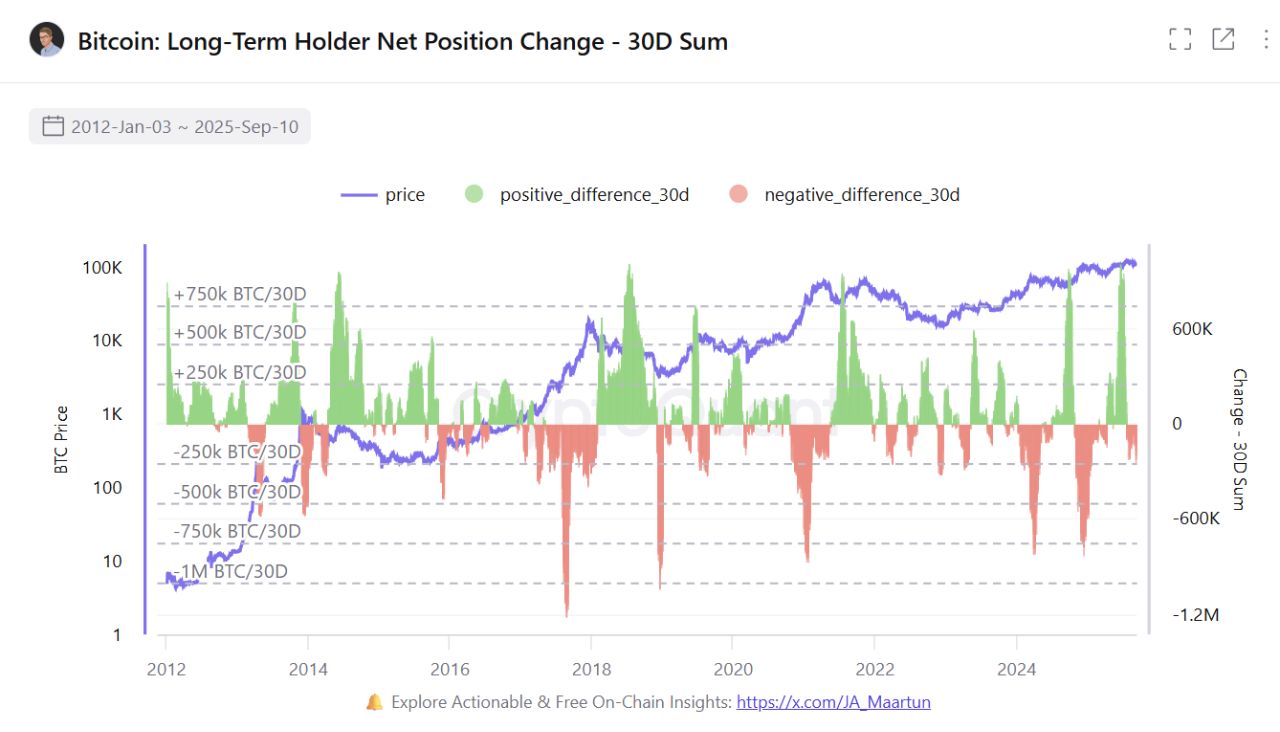

Two key on-chain datasets confirm this trend: Long-Term Holder (LTH) Net Position Change and Exchange Netflow.

Bitcoin: Exchange Netflow. Source: CryptoQuant

Bitcoin: Exchange Netflow. Source: CryptoQuant

A Supply Squeeze Beneath the Volatility

XWIN Research Japan explained that long-term holders have also accumulated coins, a signal that has historically preceded strong bull runs. The 30-day change in long-term holder (LTH) net position, a metric tracking these movements, has turned positive.

Bitcoin: Long-Term Holder Net Position Change. Source: CryptoQuant

Bitcoin: Long-Term Holder Net Position Change. Source: CryptoQuant

The analyst said the recent trend of continuous net outflows from exchanges supports this theory. He suggested that investors are withdrawing BTC from exchanges and moving it into cold storage, indicating that the shark investors are not engaging in speculative short-term trading but are actively removing supply from the market.

XWIN Research Japan advised that a short-term correction is still possible if derivatives leverage becomes overheated. However, he concluded that the foundation for Bitcoin’s next major rally is being laid beneath the surface volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Berachain Secures User Funds After Major Security Breach

In Brief Berachain network halted to protect user assets after a Balancer V2 breach. Developers launched a hard fork to recover funds and eliminate vulnerabilities. BERA and BAL coins saw decrease in value post-security incident.

Bitcoin: 5 alarming signals between retail retreat and institutional pressure

Internet Computer (ICP) To Soar Higher? Key Pattern Formation Suggests Potential Upside Move

Ethereum (ETH) To Make Bullish Reversal? This Emerging Fractal Setup Suggest So!