Key Notes

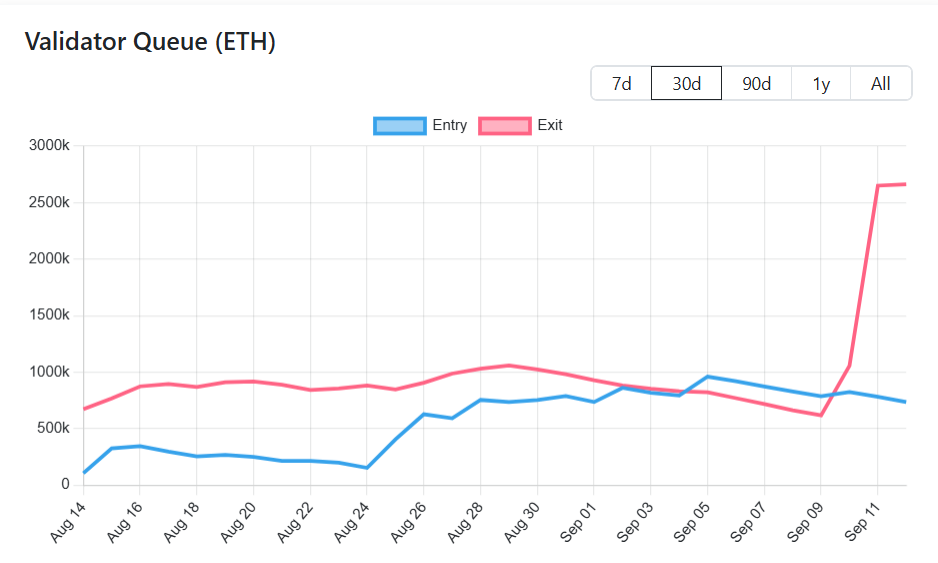

- A record number of validators are exiting, stretching the Ether staking exit queue to record high.

- ETH reclaimed $4,500, but failure to hold could lead to $4,000 retest, analyst says.

- Over $7.5 billion worth of ETH has been accumulated near $4,300.

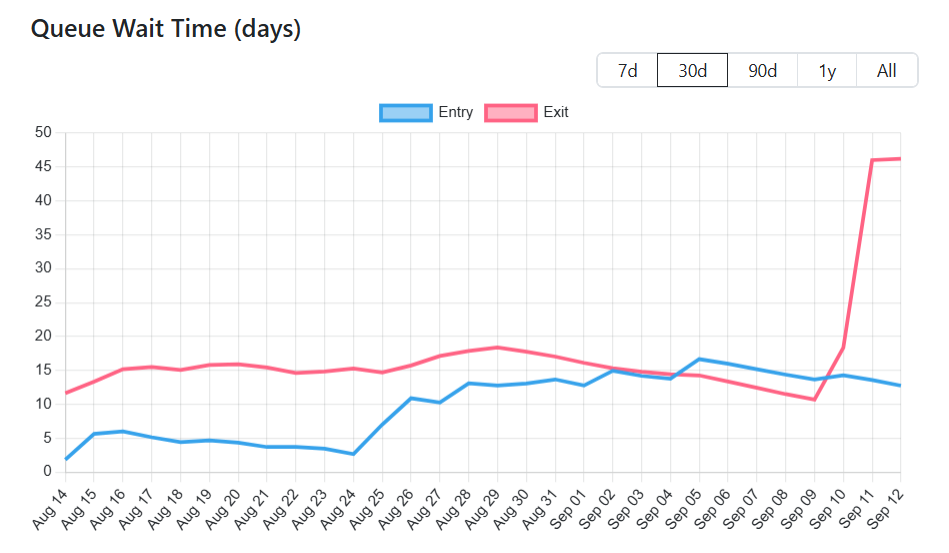

Ethereum’s staking system is seeing a surge in validator exits, with the queue now stretched to nearly 45 days, an all-time high. While this doesn’t directly trigger a sell-off, it increases the risks tied to liquid staking tokens (LSTs) and lending-related tokens (LRTs).

During such a rise in validator exits, redeeming staked ETH ETH $4 542 24h volatility: 2.7% Market cap: $547.26 B Vol. 24h: $29.19 B becomes slower and riskier, reducing its appeal as collateral. As the time passes, collateral quality worsens, raising composability risks like depegging.

Ether staking validator queue | Source: validatorqueue

Experts warn that while the exit queue’s large size doesn’t directly cause mass selling, it amplifies risks, especially during high market volatility or sudden liquidity demand by institutions.

Without liquidity buffers, arbitrage stress could spread quickly, adding volatility to an otherwise bullish outlook.

Ether staking validator queue wait time (in days) | Source: validatorqueue

Rising Risk of ETH Price Correction

Ether has recently reclaimed the critical $4,500 level, with the next resistance zone around $4,700. Popular trader Ted cautioned that if ETH fails to hold $4,500, it could retest the $4,000–$4,100 range.

$ETH has reclaimed the $4,500 level now.

The next resistance zone for Ethereum is around $4,700 before a new ATH.

In case ETH doesn't hold the $4,500 level, there's a chance of $4,000-$4,100 level retest. pic.twitter.com/Icbxivjv3W

— Ted (@TedPillows) September 12, 2025

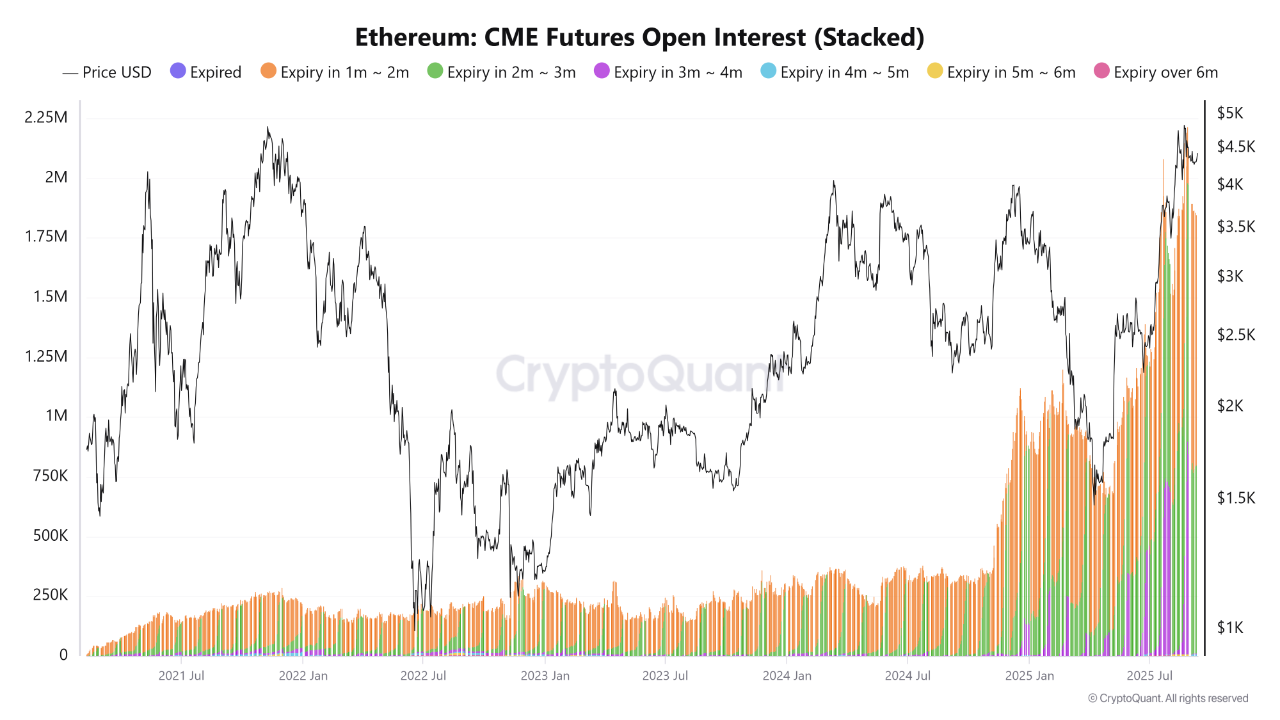

This comes amid record-high open interest (OI) in CME Futures, particularly in short-term maturities spanning one to three months. Such aggressive participation generally signals strong institutional demand .

Ether CME Futures OI | Source: CryptoQuant

However, it also increases liquidation risks during contract expirations, where sharp corrections are more likely.

Long-term OI growth suggests that despite short-term volatility, ETH’s outlook remains bullish. But, crowded leveraged positions could result in sudden price swings.

Massive Accumulation Around $4,300

At the time of writing, ETH is trading around $4,518, up by 2.2% in the past day. Despite the cryptocurrency’s sideways trading between $4,200 and $4,500 this month, CryptoQuant data suggests a growing accumulation trend.

Around 1.7 million ETH, worth about $7.5 billion, has been accumulated near the $4,300–$4,400 zone . Moreover, many withdrawals from centralized exchanges are happening at this level, making it a strong support zone if ETH faces another dip.

Such exchange exits also suggest that investors are repositioning for longer-term holds rather than short-term trading.