Tron’s fee reduction cut average gas costs by ~60% and slashed daily Super Representative revenue from $13.9M to $5M within days; despite the drop, Tron still led layer‑1 revenue, capturing roughly 92.8% of L1 fees over the past week, per onchain and market-data reports.

-

Fee change: Proposal #789 lowered the energy unit price from 210 sun to 100 sun, reducing average gas fees by ~60%.

-

Daily revenue for Tron Super Representatives fell to $5M on Sept. 7, a 64% decline in 10 days after implementation.

-

Over 90 days Tron generated $1.1B in fees and captured ~92.8% of layer‑1 revenue, per Token Terminal and onchain data.

Tron fee reduction cuts gas costs ~60%, slashes SR revenue — read details, stats, and next steps for users and validators. Source: CryptoQuant, Token Terminal. (COINOTAG)

What is the Tron fee reduction and why was it implemented?

Tron fee reduction refers to Proposal #789, which lowered the energy unit price from 210 sun to 100 sun to reduce transaction costs and encourage more transfers. The change aimed to improve network accessibility and long‑term ecosystem growth while accepting a short‑term drop in validator revenue.

Proposal #789 passed via Super Representative voting and went live on Aug. 29. Community proponents, including the proposal author GrothenDI, argued lower fees would spur activity and increase total transfer volume over time.

How much did Tron transaction fees and validator revenue change?

After implementation, average gas fees on Tron fell by approximately 60%. On Sept. 7, onchain data reported daily fees for Super Representatives at roughly $5 million — down from $13.9 million the day before the fee reduction took effect.

That represents a ~64% decline in short‑term revenue for block producers. CryptoQuant and onchain metrics were cited in public reports documenting the immediate financial impact.

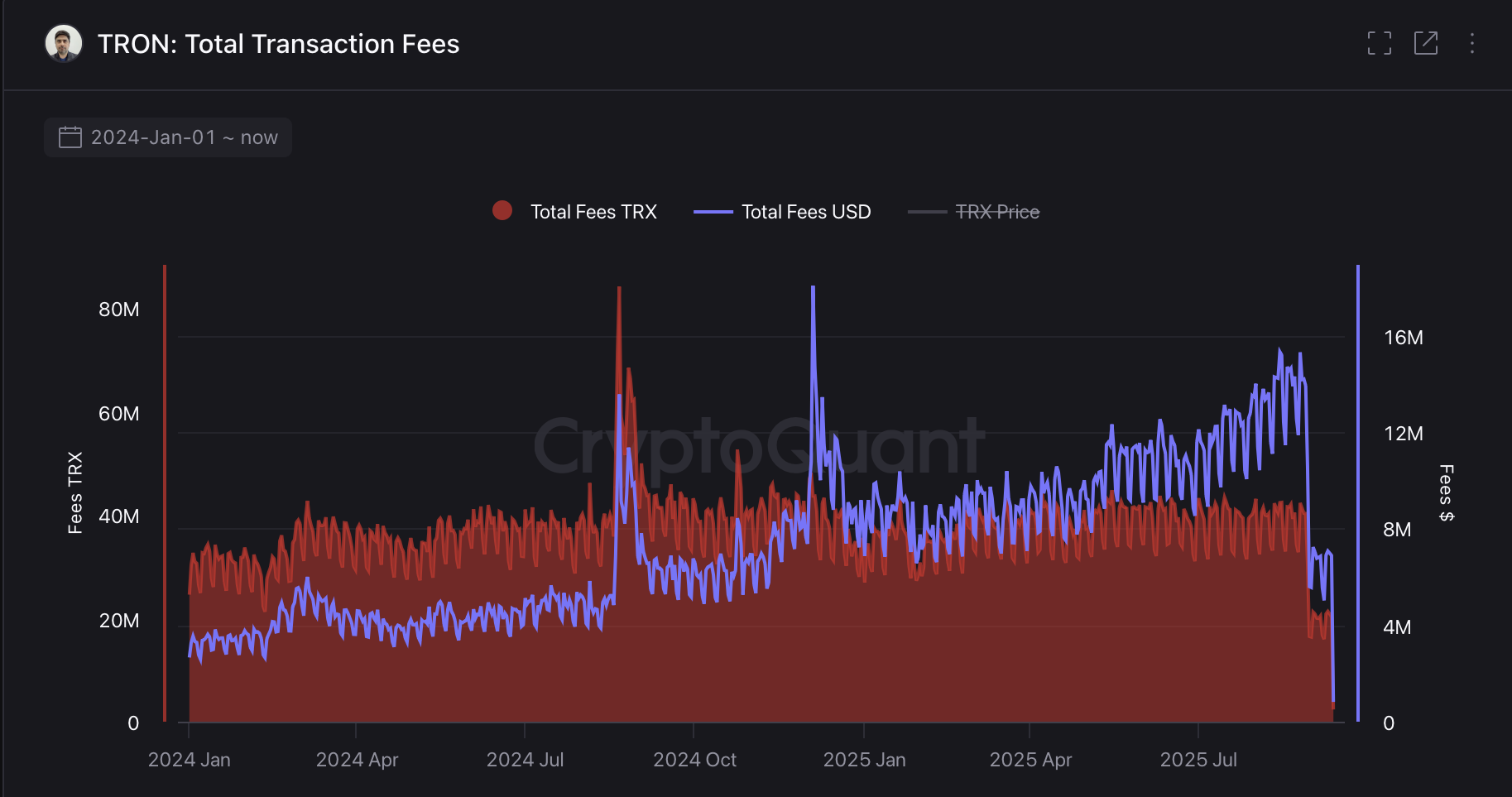

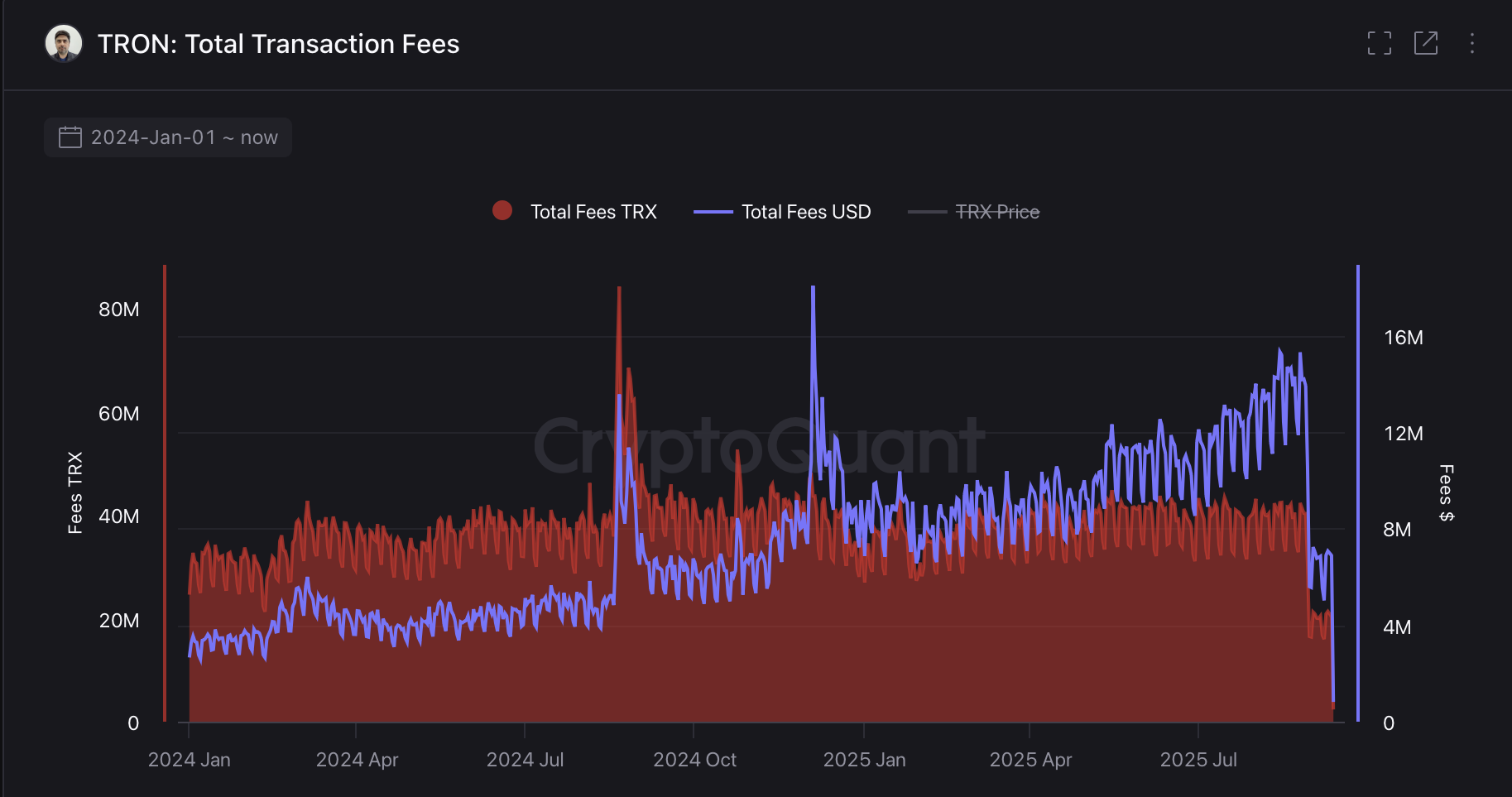

Tron transaction fees since January 2024. Source: CryptoQuant

How does this change affect users and ecosystem growth?

Lower fees reduce per‑transaction cost and can make micro‑transfers and smaller transactions economically viable. GrothenDI estimated the fee cut could enable an additional 12 million potential transfers by removing cost barriers.

For regular users, this means cheaper transfers measured in sun (1 TRX = 1,000,000 sun). For developers and dApp operators, reduced friction may improve onboarding and daily active use.

Did Tron remain the top revenue‑generating layer‑1 after the cut?

Yes. Despite the fee cut, Token Terminal data show Tron captured about 92.8% of total revenue among layer‑1 networks over the past seven days. Over the last 90 days, Tron generated roughly $1.1 billion in fees.

By contrast, Ethereum has historically led long‑term revenue, with cumulative revenue near $13 billion over five years compared to Tron’s $6.3 billion, per market data aggregators and historical summaries.

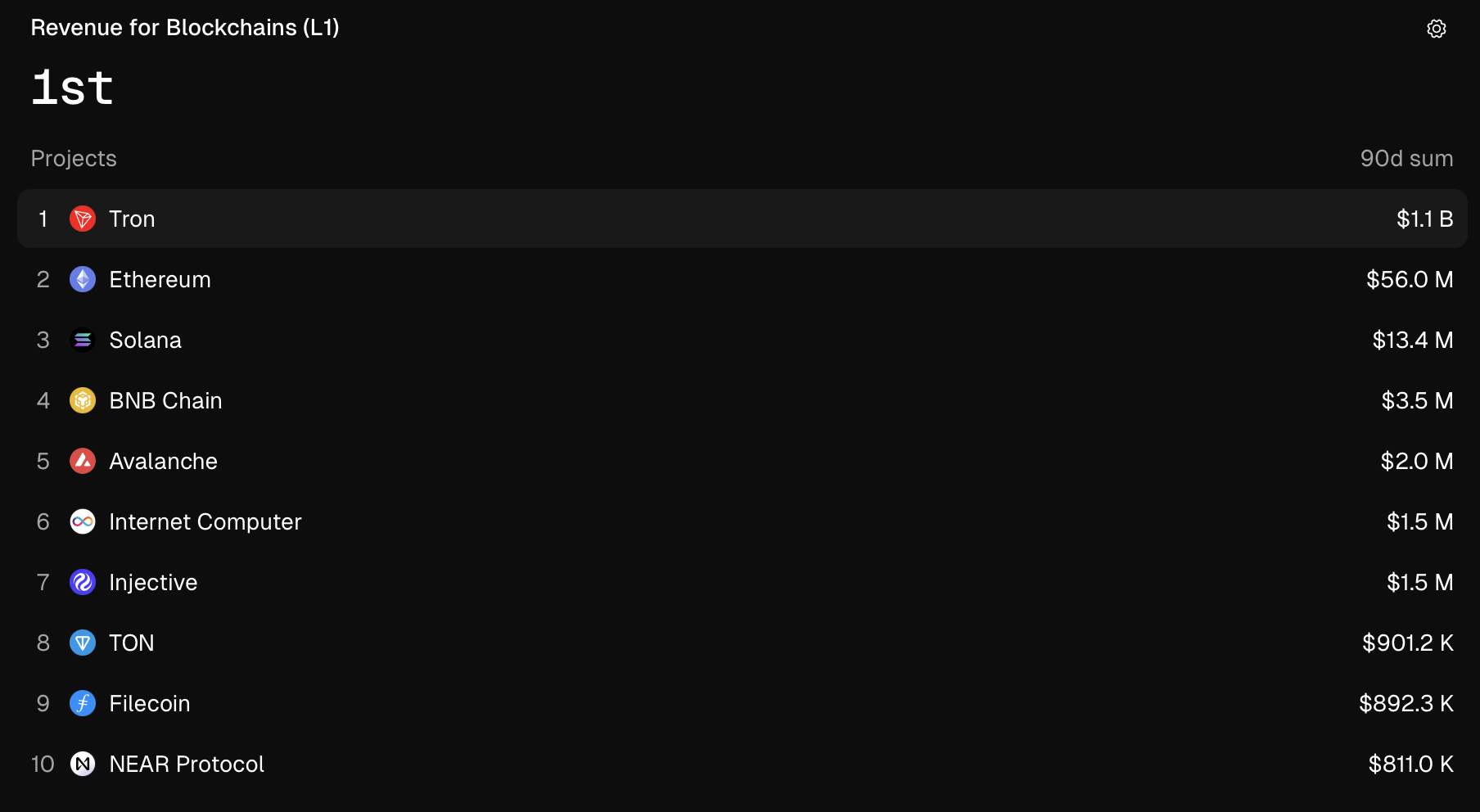

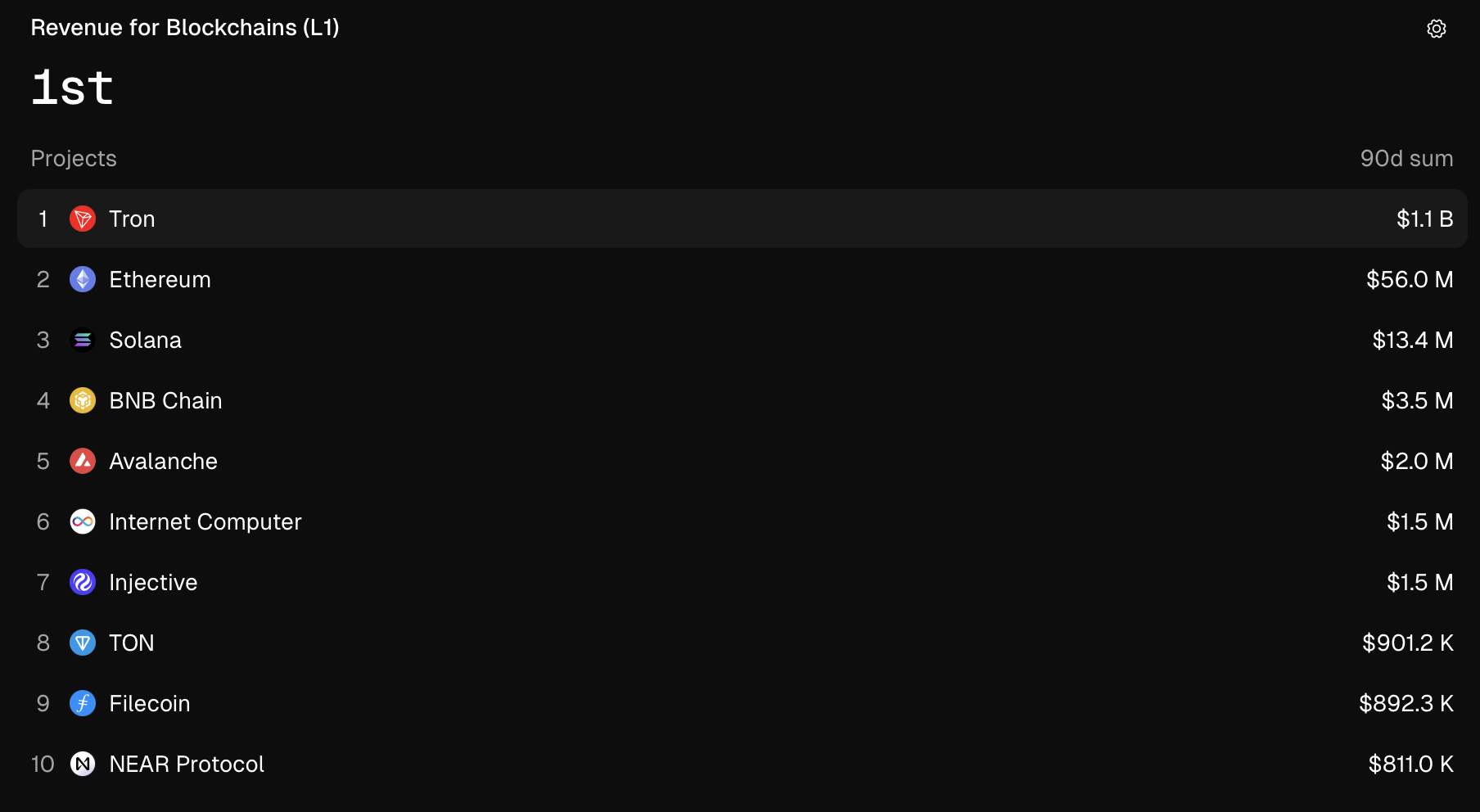

Revenue generated by layer-1 blockchains over past 90 days. Source: Token Terminal

Frequently Asked Questions

How quickly did revenue fall after the fee change?

Revenue dropped within days: daily Super Representative fees fell from $13.9M to about $5M on Sept. 7, marking a 64% reduction roughly ten days after lower fees were implemented.

Who proposed the fee cut and what was the rationale?

Community member GrothenDI proposed Proposal #789 in August, arguing lower transaction fees would foster sustainable network growth and increase the number of potential transfers by reducing costs for users.

Will lower fees increase total transaction volume?

Lower fees typically reduce friction and can increase transfers; GrothenDI estimated an additional 12 million potential transfers. The net effect depends on user adoption and dApp activity over subsequent weeks and months.

Key Takeaways

- Immediate impact: Super Representative daily revenue fell ~64% to $5M after the fee cut.

- Fee reduction: Energy unit price lowered from 210 sun to 100 sun, reducing average gas fees by ~60%.

- Longer‑term outlook: Tron still leads recent L1 revenue share; reduced fees aim to boost transaction volume and ecosystem growth.

Conclusion

Tron’s Proposal #789 significantly lowered gas fees and reduced short‑term block producer income while maintaining the network’s top position in recent layer‑1 revenue metrics. Stakeholders should monitor onchain metrics, Super Representative receipts, and user activity to evaluate whether lower fees translate into sustained growth and higher aggregate revenue over time. COINOTAG will continue tracking updates and data from CryptoQuant and Token Terminal as the ecosystem responds.

Even after the change, Tron still holds a significant lead in revenue among layer-1 blockchains, including Ethereum, Solana and BNB Chain.

Tron’s recent fee reduction has significantly cut into the revenue earned by its block producers, according to a new report from CryptoQuant.

The total daily network fees for Tron’s block producers, known as Super Representatives, dropped to $5 million on Sept. 7, the lowest level in over a year. That’s a 64% revenue decline in 10 days, down from $13.9 million the day before lower fees were implemented.

Onchain data shows that average gas fees on Tron have decreased by 60% after the network implemented a proposal slashing the energy unit price from 210 sun to 100 sun. Gas fees are transaction costs paid on the Tron network, measured in its smallest unit, called sun.

Tron Proposal #789, labeled “Decrease the transaction fees,” went live on Aug. 29 after a vote from the Super Representative community.

Tron transaction fees since January 2024. Source: CryptoQuant

Community member GrothenDI issued the proposal in August, arguing that lower transaction fees would “ensure the sustainable and healthy development of the Tron ecosystem.”

GrothenDI estimated that cutting the gas fees to 100 sun from 210 sun could result in an additional 12 million potential transfers from users. One TRON (TRX) equals 1 million sun, the lowest divisible part of TRX.

Related: Tron Inc. adds $110M in TRX to treasury, total holdings now top $220M

Tron dominates blockchain revenue among L1s

Although Proposal #789 reduced gas fees on Tron, the blockchain still leads other layer-1 chains in revenue, according to data from Token Terminal.

Over the past seven days, Tron captured 92.8% of total revenue among layer-1 networks, ahead of Ethereum, Solana, BNB Chain and Avalanche. Fees generated from transactions on Tron amounted to $1.1 billion over the past 90 days.

Revenue generated by layer-1 blockchains over past 90 days. Source: Token Terminal

Ethereum has led revenue generation over the past five years with $13 billion, compared to Tron’s $6.3 billion.

Magazine: Ethereum L2s will be interoperable ‘within months’ — Complete guide