The USDH stablecoin vote will choose which issuer mints Hyperliquid’s native dollar peg; validators vote onchain Sunday 10:00–11:00 UTC, needing a two‑thirds supermajority to pass, with major bids from Native Markets, Paxos, Sky, Frax and Agora.

-

Validators vote onchain Sunday 10:00–11:00 UTC; a two‑thirds stake is required to select USDH’s issuer.

-

Native Markets, Paxos, Sky, Frax, Agora, Curve, OpenEden and Bitgo remain as bidders; Ethena withdrew and endorsed Native Markets.

-

Hyperliquid processed $330B in July; HYPE hit an all‑time high of $57.30 per CoinGecko ahead of the vote.

USDH stablecoin vote: Hyperliquid’s validator vote picks the issuer Sunday—read concise bids, vote mechanics, and key implications for traders and the HYPE ecosystem.

What is the USDH vote and why does it matter?

USDH stablecoin is the name of Hyperliquid’s proposed native dollar‑pegged asset, and the vote will decide which issuer controls the canonical USDH, influencing liquidity, reserve management and billions in stablecoin flows within Hyperliquid’s Layer‑1 ecosystem.

Who are the main bidders for USDH?

Leading proposals come from Native Markets, Paxos, Sky, Frax Finance and Agora, with later submissions by Curve, OpenEden and BitGo. Ethena formally withdrew and publicly endorsed Native Markets. Polymarket betting odds currently show Native Markets as the frontrunner, followed by Paxos.

How will the USDH vote work?

Voting is fully onchain between 10:00 and 11:00 UTC on Sunday. Validator power equals staked HYPE; delegators may change support before and during the window. A proposal requires two‑thirds of total stake to pass. The Hyperliquid Foundation and staking provider Kinetiq, controlling roughly 63% of tokens, have pledged to abstain.

What are each bidder’s key proposals?

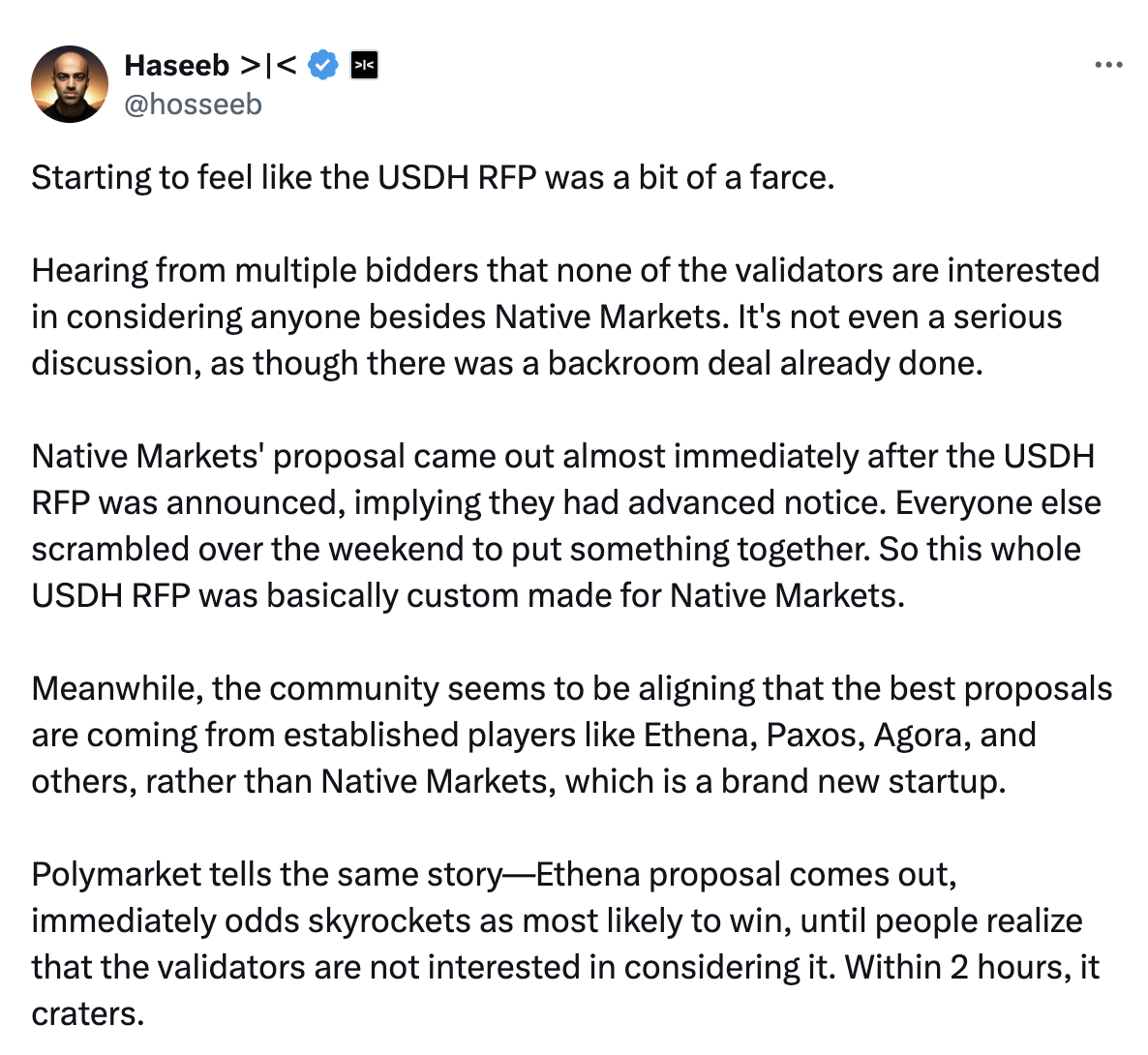

Native Markets: Proposed to mint USDH natively on HyperEVM and split reserve yield between HYPE buybacks and ecosystem growth. The team intends to use Stripe’s Bridge for reserve tokenization; that choice drew pushback over possible conflicts. Native Markets names include Max Fiege, MC Lader and Anish Agnihotri.

Source: Haseeb Qureshi

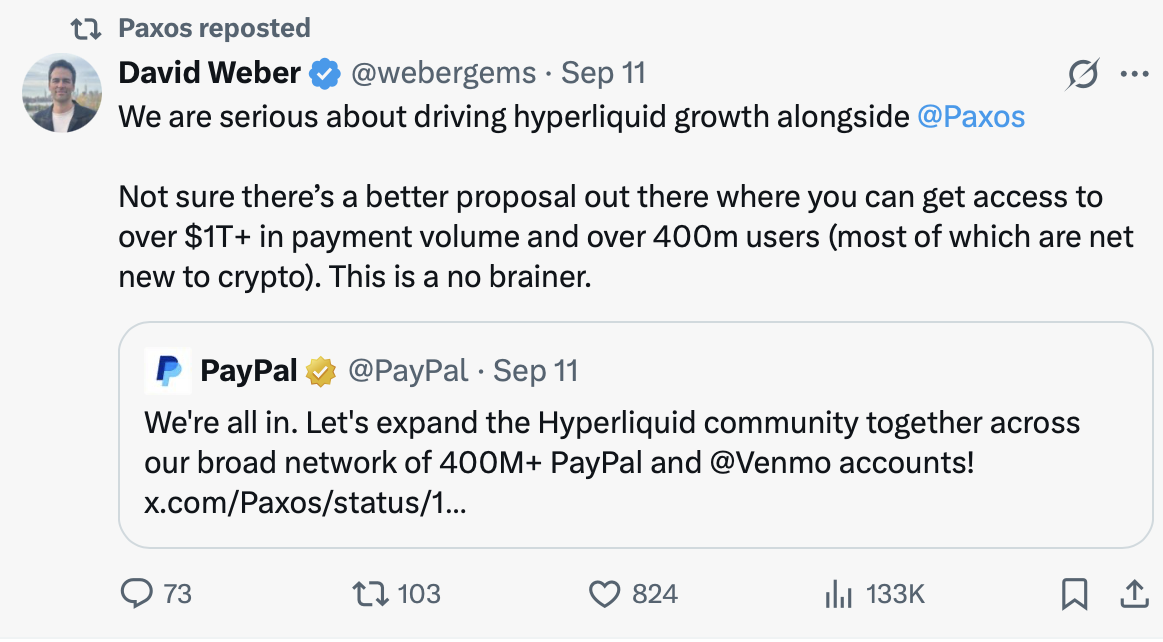

Paxos: Submitted a compliance‑focused proposal aligned with the US Stablecoins Act and EU MiCA, allocating 95% of interest from reserves to HYPE buybacks and redistribution. Paxos highlights prior regulated stablecoin launches, and proposed brokerage integration for USDH.

Source: David Weber

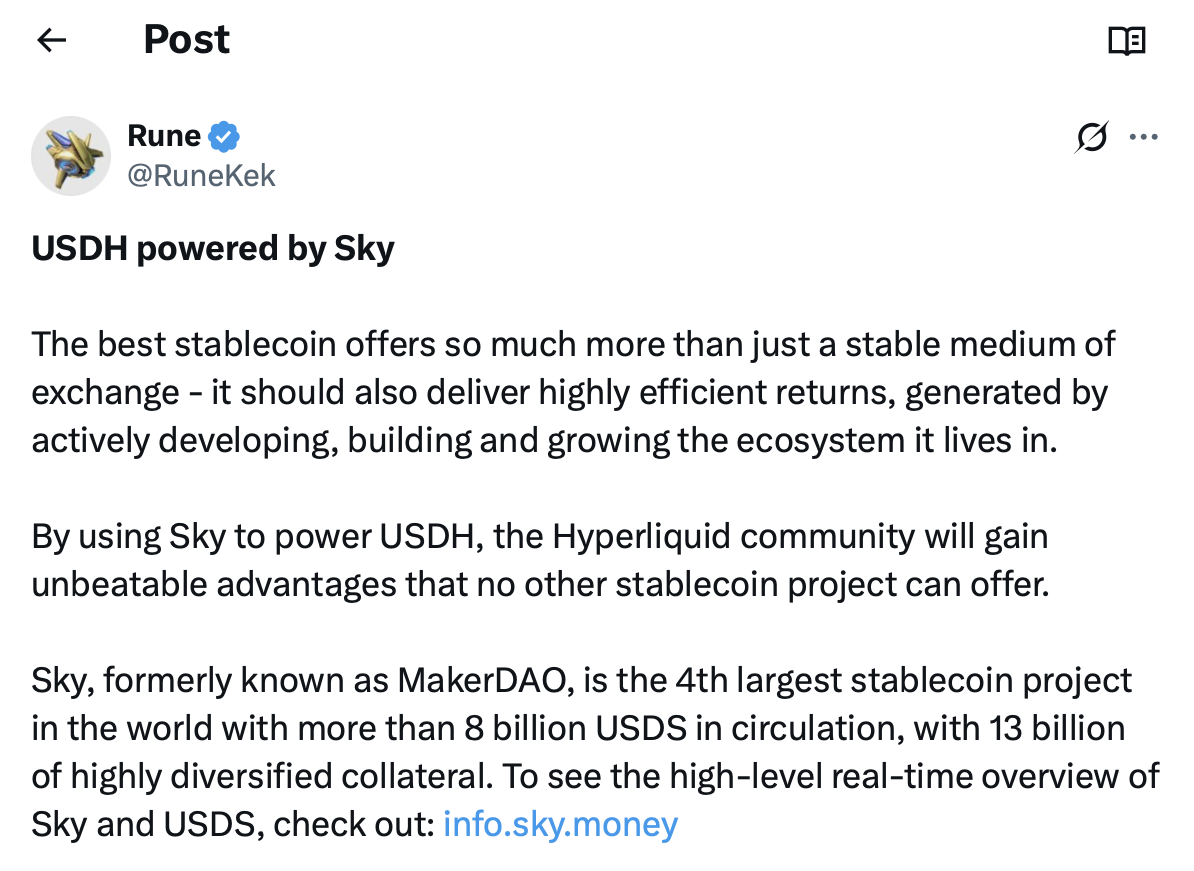

Sky: Pledged native multichain support via LayerZero, a portion of its balance sheet deployed into Hyperliquid with a 4.85% return on USDH, and direct profits toward HYPE buybacks and the Assistance Fund.

Source: Rune Christensen

Frax Finance: Proposed one‑for‑one backing with tokenized US Treasurys via a federally regulated U.S. bank partner (unnamed) and recycling treasury yield fully into the Hyperliquid ecosystem.

Source: Frax Finance

Agora: Offered a VanEck‑managed asset approach, committing 100% of net reserve revenue to HYPE buybacks or the Assistance Fund and raising concerns about Stripe/Bridge conflicts if chosen.

When will results be known and what are the immediate implications?

Voting concludes at 11:00 UTC the same Sunday; a passing proposal requires a two‑thirds supermajority. The winning issuer will control USDH minting and reserve policies, shaping liquidity, collateral availability for perpetual futures and reserve yield allocation into the HYPE economy.

What market signals to watch during and after the vote?

Watch HYPE price action, onchain staking shifts, reserve disclosures from the winning issuer and integration announcements. HYPE traded to a new high of $57.30 ahead of the vote, and Hyperliquid reported $330 billion in July trading volume—both indicators of market interest and potential economic impact.

Frequently Asked Questions

How long is the USDH vote window?

The vote runs for one hour on Sunday, from 10:00 to 11:00 UTC. Results depend on onchain tallies and are final once the two‑thirds threshold is checked.

Can delegators change their vote during the window?

Yes. Delegators can shift support among validators and proposals up to and during the voting hour, altering the distribution of voting power in real time.

Key Takeaways

- Governance milestone: This is Hyperliquid’s first major non‑delisting governance decision and will set USDH’s issuer and reserve policy.

- High stakes: The winner gains access to substantial stablecoin flow within a network that recorded $330B in July trading volume.

- Watch onchain signals: Monitor HYPE staking shifts, reserve disclosures and integration announcements post‑vote.

Conclusion

The USDH stablecoin vote is a pivotal moment for Hyperliquid and its HYPE economy. Validators will decide Sunday which issuer governs USDH and reserve strategy, shaping liquidity, collateral and yield allocation across the platform. Stakeholders should track onchain votes and issuer disclosures closely; the outcome will influence trading and protocol incentives in the months ahead.