Shiba Inu Nears Monthly High, Yet Two On-Chain Red Flags Threaten a Dip

SHIB’s rally nears a monthly high, but two on-chain warning signs—rising exchange balances and whale exits—threaten a near-term dip.

Top meme coin Shiba Inu (SHIB) has surged over the past week, inching closer to its one-month high target of $0.00001408.

However, fresh on-chain signals suggest the momentum may not last, as market participants appear to be taking advantage of the surge to offload their holdings for quick gains.

SHIB Climbs, But On-Chain Data Points to Rising Sell Pressure

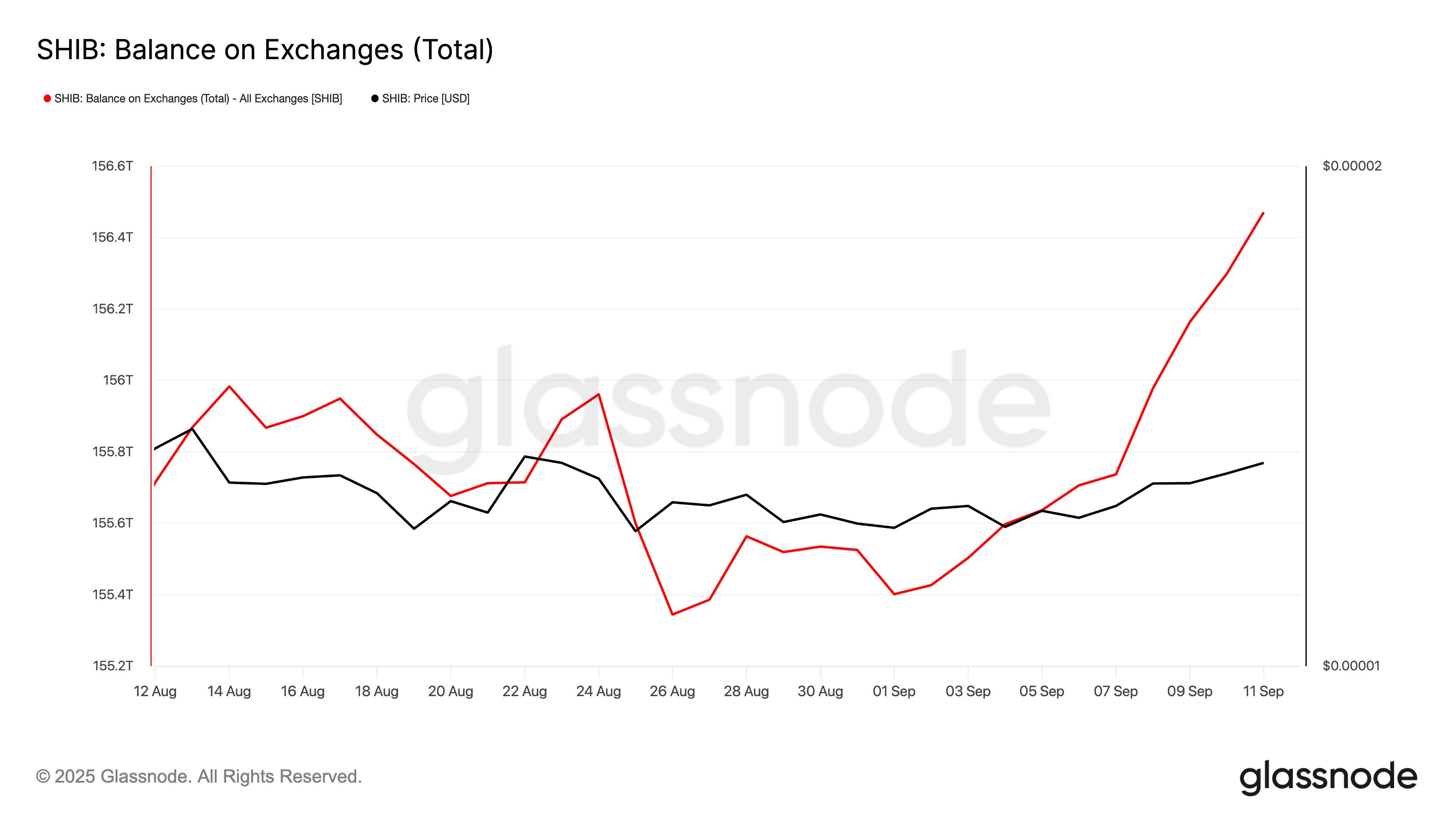

According to data from Glassnode, SHIB’s exchange balances have skyrocketed in the past week, hitting a 30-day high of 156.47 trillion on September 11.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

SHIB Balance on Exchanges. Source:

Glassnode

SHIB Balance on Exchanges. Source:

Glassnode

Exchange balance refers to the total number of tokens held in centralized trading platforms. When these balances spike during a price rally, it signals that holders are moving their tokens from private wallets to exchanges, intending to sell.

Therefore, SHIB’s sharp increase in exchange supply over the past few days suggests that traders are capitalizing on the recent upswing to lock in profits. The heightened selling pressure could prevent the meme coin from maintaining its rally and make a near-term pullback more likely.

Moreover, whale activity around SHIB has noticeably slowed, according to Nansen. Information from the on-chain data provider reveals that the balance of high-value wallets holding SHIB tokens worth more than $1 million has dropped by 6% in the past seven days.

SHIB Whale Activity. Source:

Nansen

SHIB Whale Activity. Source:

Nansen

A decline in whale holdings is interpreted as a bearish signal, as it suggests that deep-pocketed investors, who typically provide the strongest price support, are distributing rather than accumulating.

This trend could also trigger retail SHIB traders to sell, amplifying the downside pressure on the token.

SHIB Nears $0.00001408, But Sell Pressure Could Drag Price Lower

The rise in exchange balances and the drop in whale activity form two significant red flags for SHIB’s near-term outlook. If these continue, SHIB’s current rally could lose momentum, leading to a price decline toward $0.00001187.

SHIB Price Analysis. Source:

TradingView

SHIB Price Analysis. Source:

TradingView

However, if buy-side pressure strengthens, the meme coin could revisit its monthly high of $0.00001408.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.