Tether Unveils USAT under GENIUS Act, Appoints Bo Hines as CEO

- Tether launches USAT, a stablecoin built to meet the GENIUS Act’s regulatory standards.

- With Bo Hines as CEO, Tether signals a strategic shift toward regulatory alignment.

- USAT targets compliance-focused users and is set to compete with USDC and PayPal’s PYUSD.

Taking an innovative step, Tether has introduced USAT, a new U.S.-regulated stablecoin, designed to meet the regulatory standards of the GENIUS Act. It further announced the appointment of former White House crypto adviser Bo Hines as the CEO. These developments signal a strategic shift toward regulatory compliance and legitimacy in the United States. Reportedly, USAT aims to compete with established players like USDC and USDT by offering a stablecoin that prioritizes compliance with U.S. regulations.

The GENIUS Act, a legislative framework for stablecoins, introduces stricter reserve and compliance requirements, and USAT is one of the first stablecoins to align with its standards. Moreover, with this move, Tether showcases the increasing need for regulatory adherence in a rapidly evolving crypto market.

USAT Boosts Regulatory Compliance and USD Leadership

The GENIUS Act sets the rules for USAT as it requires stablecoins to be fully backed by reserves nd strictly regulated. This marks a major step toward stabilizing the U.S. stablecoin market as both lawmakers and investors push for clearer rules.

Paolo Ardoino, Tether’s CEO, emphasized that USAT is part of the company’s broader strategy to reinforce the dominance of the U.S. dollar in the digital economy. “USAT is our commitment to ensuring that the dollar not only remains dominant in the digital age, but thrives,” he said. This statement underlines Tether’s goal of adapting to growing regulatory scrutiny while preserving the dollar’s key role in global finance.

The launch of USAT coincides with an increased regulatory attention of US policymakers on stablecoins. According to a recent White House report, stablecoins have showcased significant growth in the U.S. economy, and by being compliant with the Act, USAT is positioned to thrive within the legal framework of the country.

USAT’s Competition with USDT and USDC

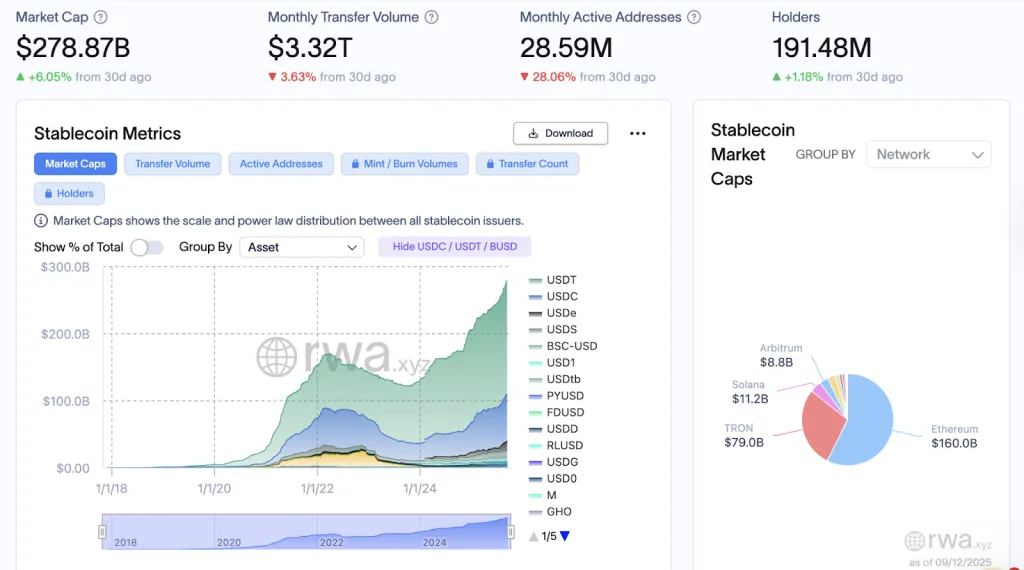

The U.S.-regulated dollar stablecoin is designed to complement USDT, which has a circulation of $169 billion. With the market experiencing immense growth, the overall market value has surged beyond $270 billion. Further, with the latest launch, Tether aims to align with regulatory demands and set a new standard for compliant stablecoins in the U.S., thus adapting to an evolving regulatory landscape.

Source:

Tether has also boosted its technological presence to support the stablecoin. The company announced on Aug. 28 a merger between USDT and the RGB protocol, which enables scalable, privately issued assets on Bitcoin. This connectivity could provide users with greater freedom in managing and transferring USDT, while maintaining Tether’s status.

Related: Tether Expands Stablecoin Integration with USD₮ on Bitcoin

Meanwhile, the environment of stablecoins turns competitive as USDC and PayPal’s PYUSD gain momentum. However, Tether has a stronger chance due to its focus on the regulatory benefits of the USAT. Further, with the government and financial agencies proposing stricter regulations, USAT could become the only option for compliance-seeking users.

Overall, with the introduction of USAT, stablecoins have become a substantial component of the U.S. financial system, and being highly compliant, they have subtly marked their shift from being just payment options to fully controlled financial tools.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will PayFi be the next narrative for RWA?

Can uncollateralized credit lending protocols work in the DeFi world?

Why are the new DAT setups by Multicoin, Jump, and Galaxy underestimated?

a16z's Latest Insight: Consumer AI Companies Will Redefine the Enterprise Software Market

The boundaries between the consumer market and the enterprise market are gradually becoming blurred to some extent.

Bitcoin all-time highs due in ‘2-3 weeks’ as price fills $117K futures gap