XRP’s Near-Term Outlook Turns Bullish as Short-Term Holder Activity Jumps 38%

XRP is rallying as short-term holders expand their positions, fueling confidence in sustained momentum. Technicals suggest more upside ahead.

Ripple’s XRP has gained 10% in the past week, signaling renewed market strength. Amid the broader crypto market uptick, data suggests that this rally is backed by aggressive accumulation from short-term holders (STHs).

This reflects growing confidence among traders who often play a decisive role in shaping the token’s near-term price action.

XRP Rallies as Short-Term Holders Boost Supply

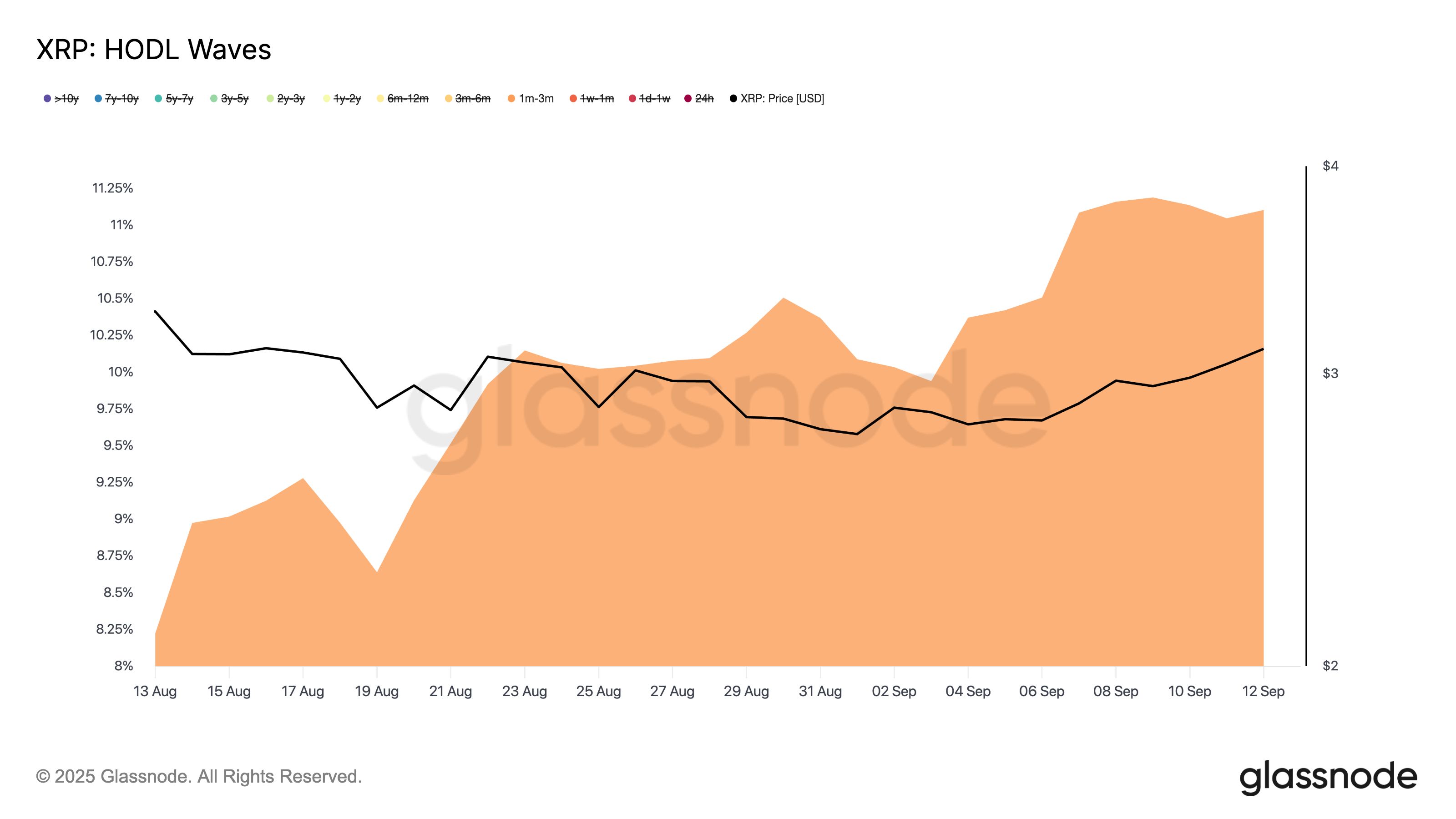

According to Glassnode, XRP STHs (those in the 1–3 month bracket) have steadily increased their supply over the past month, a trend that has culminated in the token’s double-digit rally over the past week.

On-chain analysis of XRP’s HODL Waves shows that this cohort has expanded its holdings by 38% in the last 30 days.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP HODL Waves. Source:

Glassnode

XRP HODL Waves. Source:

Glassnode

The HODL Waves metric tracks how long coins are held across different investor groups, offering insight into market holding patterns.

The increase in XRP’s STH supply is significant because this group often controls a sizable portion of circulating tokens and is typically quick to react to market conditions. This makes their accumulation or distribution patterns noteworthy as they frequently influence near-term price movements.

The gradual buildup of XRP holdings by its STHs strengthens the case for sustained momentum. This suggests market confidence is rising and potential upside remains possible if broader conditions hold steady.

Further, readings from XRP’s Relative Strength Index (RSI) on the daily chart support this bullish outlook. As of this writing, the momentum indicator is 59.65 and trending upward, highlighting the bullish tilt in market sentiment.

XRP RSI. Source:

TradingView

XRP RSI. Source:

TradingView

The RSI measures whether an asset is overbought or oversold on a scale of 0 to 100. Readings above 70 point to overbought conditions and potential price declines, while readings below 30 signal oversold levels and possible rebounds.

Therefore, XRP’s RSI of 59.65 indicates strong demand for the cryptocurrency, with room for further upside before facing significant selling pressure.

XRP Could Surge Toward $3.66—Or Slip Back to $2.87

A sustained buy-side pressure could cause XRP to attempt to breach the resistance at $3.22. If successful, the token could extend its gains toward $3.66, a high last recorded on July 18.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

On the other hand, if demand plunges, the XRP price could retrace and fall to $2.87.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Technical Analysis: Balancer hacked for $120 millions, where was the vulnerability?

The key issue in this attack lies in the protocol’s logic for handling small transactions.

The Butterfly Effect of the Balancer Hack: Why Did XUSD Depeg?

Long-standing issues surrounding leverage, oracle infrastructure, and PoR transparency have resurfaced.

Why does Naval say: ZCash is insurance for bitcoin privacy?

Investors speculate that, with the "suspense" of high inflation gone, ZEC may follow a trajectory similar to early Bitcoin.

Is the reason for bitcoin's recent decline that Strategy is no longer "aggressively buying"?

Spot bitcoin ETFs, which have long been regarded as "automatic absorbers of new supply," are also showing similar signs of weakness.