WisdomTree Launches Tokenized Fund on Ethereum & Stellar: $25 Minimum

WisdomTree launched its $25 CRDT fund on Ethereum and Stellar, opening private credit to retail and crypto-native investors. The tokenized product brings liquidity, transparency, and regulatory compliance to a $1 trillion alternative asset market.

WisdomTree launched its Private Credit and Alternative Income Digital Fund (CRDT), a blockchain-based product offering retail and institutional investors direct exposure to private credit.

The launch aligns with a broader industry trend of tokenizing real-world assets (RWAs) to enhance accessibility and transparency. It also makes the traditionally inaccessible private credit market available to a broader audience, including retail and crypto-native investors.

WisdomTree Expands Access to Private Credit

WisdomTree, a global asset manager, launched its Private Credit and Alternative Income Digital Fund (CRDT) on Friday, making private credit investments more accessible. The new fund, which tracks the Gapstow Liquid Alternative Credit Index (GLACI), operates on the Ethereum and Stellar blockchains.

It targets retail and institutional investors, with a minimum investment of just $25. WisdomTree offers the fund via its WisdomTree Prime and WisdomTree Connect platforms.

Private credit has grown into a $1 trillion asset class as companies increasingly rely on nonbank financing. Yet it has traditionally been challenging to access. Significant minimum commitments, strict accreditation requirements, and long lock-up periods limited liquidity, effectively reserving the market for institutions and ultra-wealthy individuals. But, CRDT lowers this threshold significantly by introducing tokenization and daily liquidity, opening the market to a broader range of investors.

Global Chief Investment Officer Jeremy Schwartz at WisdomTree commented on the development.

“Private credit has become one of the most talked-about opportunities in today’s market. For four years, we’ve been proud to make this space more accessible to the individual investor through our ETF, and now CRDT is able to deliver yield potential in a modern, tokenized fund.”

Tokenized Credit Market Surges Past $30B

WisdomTree is expanding its suite of tokenized products to attract digital-first investors who want access to alternative assets. Will Peck, Head of Digital Assets at WisdomTree, said CRDT provides “access to one of the most coveted asset classes – alternatives – directly on-chain.” He emphasized that the initiative helps investors diversify with institutional-grade assets in a compliant digital environment.

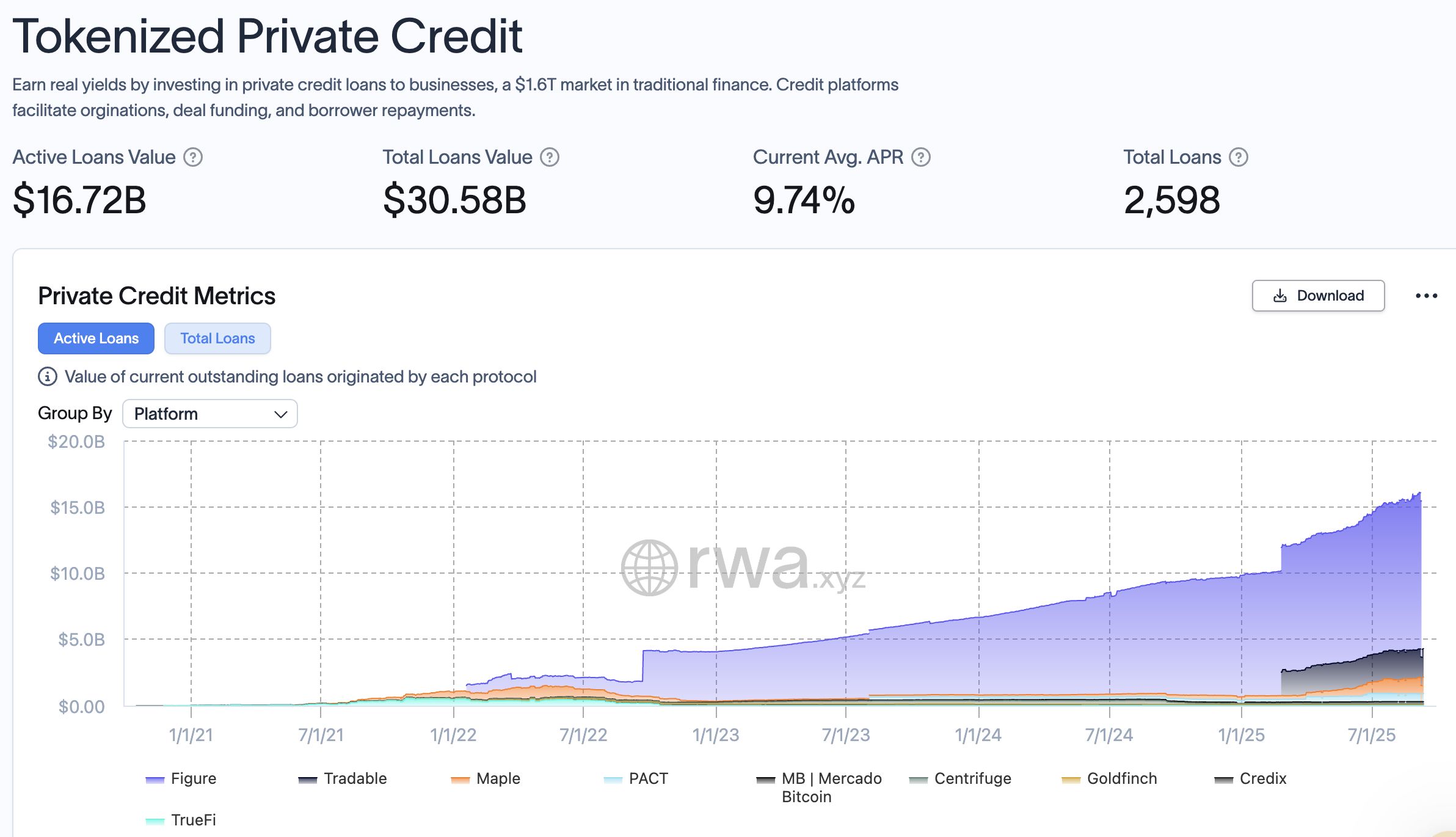

According to RWA.xyz, the tokenized private credit market has reached a cumulative loan value of $30.58 billion, with $16.72 billion currently active. Average annual percentage rates (APR) stand at 9.74%, highlighting the sector’s appeal to investors seeking yield in a high-rate environment.

The tokenized private credit market performance Source: RWA.XYZ

The tokenized private credit market performance Source: RWA.XYZ

Private credit is increasingly migrating to on-chain. Protocols like Figure dominate the landscape, accounting for most outstanding loans, while newer entrants such as Credix and Goldfinch are also expanding. The number of originated loans has climbed to 2,598, signaling growing adoption of blockchain-based financing.

Private Credit Platform / Source:rwa.wyz

Private Credit Platform / Source:rwa.wyz

The data shows accelerated growth since early 2023, with outstanding loans nearly doubling over the past 18 months. This momentum reflects broader demand for tokenized real-world assets.

Still, these funds remain subject to traditional financial risks, including exposure to closed-end funds, business development companies, and REITs. Investors should also note blockchain-related risks such as cybersecurity threats, network congestion, and regulatory changes that may impact tokenized assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US-China Trade Deal’s Impact on Crypto Markets

Borrowing the Fake to Achieve the Real: A Web3 Builder's Self-Reflection

Honeypot Finance’s AMM Perp DEX addresses the pain points of traditional AMMs through structural upgrades, including issues such as zero-sum games, arbitrage loopholes, and capital mixing problems. These upgrades achieve a sustainable structure, layered risk control, and a fair liquidation process.

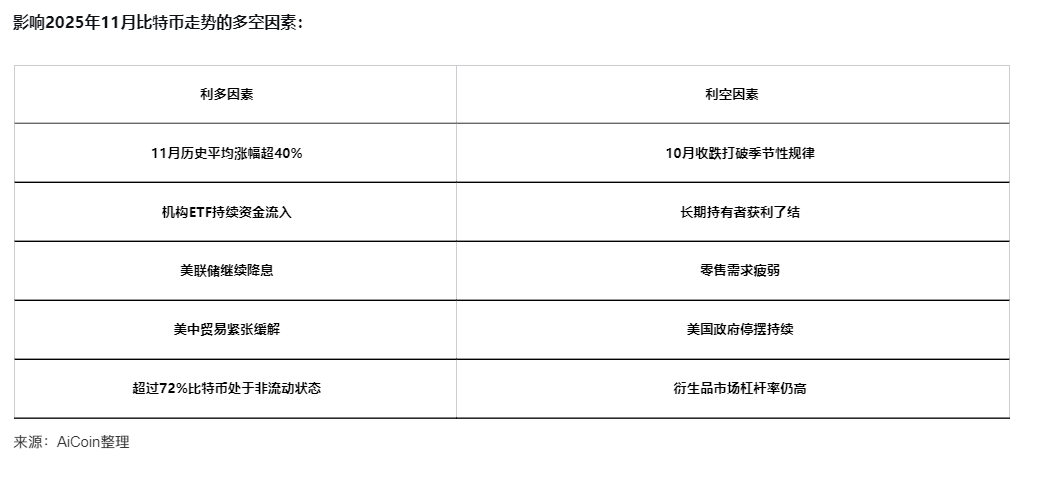

Bitcoin closed lower in October—can November bring a turnaround?

Trump’s Crypto Magic: From “Don’t Know” to a $2 Billion Pardon Spectacle