Key Notes

- BTC is consolidating near $116K, with resistance at $116.2K and support at $108.5K.

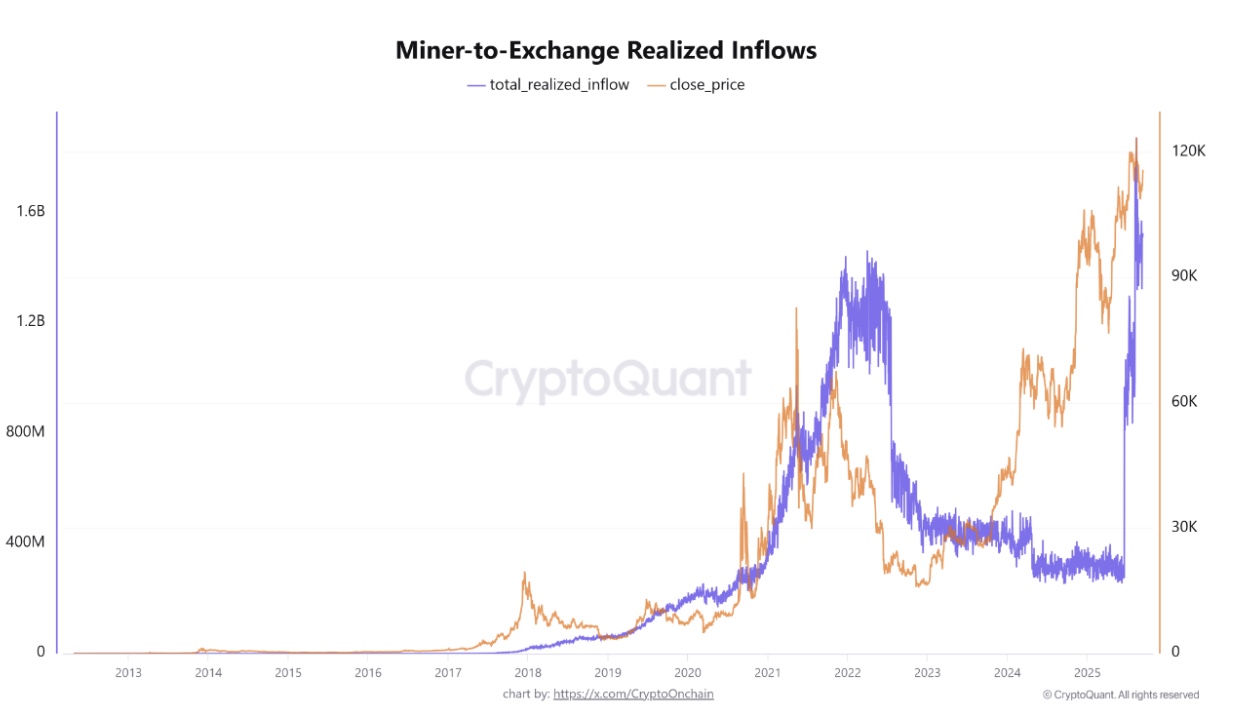

- Miner inflows to exchanges have hit a record $1.87 billion, raising supply-side risks.

- BTC network hash rate and difficulty reached new all-time highs, showing resilience.

Bitcoin (BTC) trades in a narrowing range priced at $115,866, up nearly 5% in the past week. The asset is holding well above the 20-day and 50-day EMAs at $113,000 and $133,200, respectively.

Analysts at Bitcoin Vector note that the market is compressing, with support at $108,500 and resistance at $116,200. After reclaiming the $114,000 level, holding above it will determine BTC’s future trajectory .

A sustained breakout above $116,200 is required to confirm the next leg higher. Until then, Bitcoin is likely to consolidate within its narrowing structure.

Miner Inflows Hit Record Levels

On-chain data from CryptoQuant shows miners are sending Bitcoin to exchanges at record realized values. The “Realized Miner Inflow to Exchanges” metric surged from $254 million on June 24 to an all-time high of $1.87 billion on August 13.

The current level remains elevated at $1.54 billion, marking the largest miner transfer of value to exchanges in Bitcoin’s history.

Miner-to-exchange realized inflows | Source: CryptoQuant

This surge suggests two possibilities i.e., the miners may be under pressure from rising costs and network difficulty, leading to capitulation, or they may be strategically realizing profits at elevated price levels.

Either way, the scale of miner inflows raises the risk of supply-side resistance and potential volatility ahead.

Network Strength at New Highs

Despite miners moving coins to exchanges, the Bitcoin network itself is displaying unprecedented strength . The hash rate climbed to a record 1.12 billion TH/s on September 12, while the mining difficulty reached an all-time high of 136.04T.

Projections for the next adjustment on September 18 indicate another 6.38% increase to 144.72T. As a result, BTC remains one of the best crypto to buy and hold for the long term.

ETF Inflows Fuel Institutional Demand

Moreover, US spot Bitcoin ETFs have seen a resurgence in inflows , which reached $642.35 million on Friday alone, pushing cumulative net inflows to $56.83 billion. Total net assets now stand at $153.18 billion, or about 6.6% of Bitcoin’s market cap.

Fidelity’s FBTC led with $315.18 million in inflows, followed by BlackRock’s IBIT with $264.71 million. Trading volumes across all spot Bitcoin ETFs topped $3.89 billion.

next