Solana price breakout propelled SOL above $240 after a confirmed double bottom; strong on-chain metrics—$17B TVL and $1.65B institutional inflows—plus ETF anticipation have intensified buying pressure and raised short-term upside toward resistance near $245.

-

Double bottom breakout confirmed above $210; buyers testing resistance near $245.

-

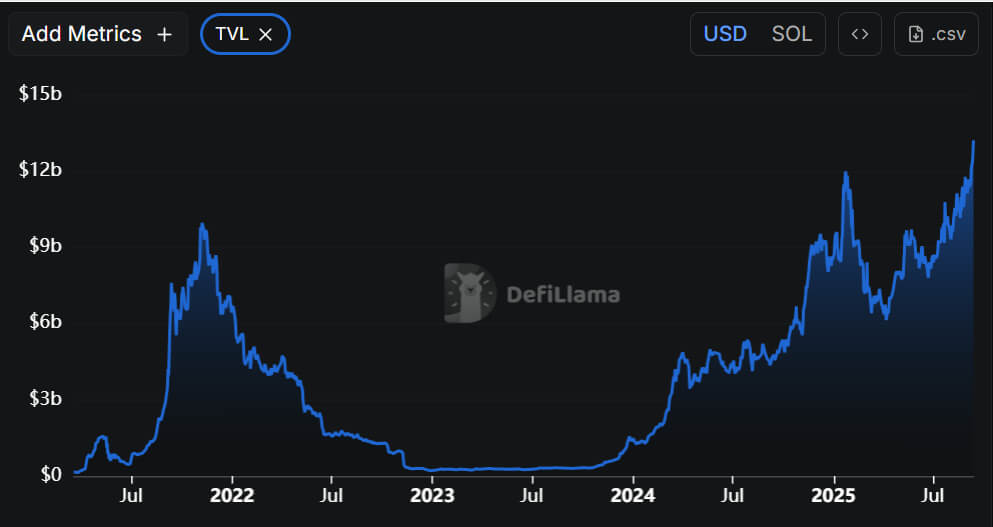

On-chain growth: TVL at $17B with record DEX and stablecoin activity.

-

Institutional inflows of $1.65B and pending ETF decisions are supporting bullish momentum.

Solana price breakout lifts SOL above $240 with $17B TVL and $1.65B inflows; read technical and on-chain analysis now.

What is the Solana price breakout and why does it matter?

Solana price breakout refers to SOL moving decisively above the $210–$230 resistance band after a double bottom formation, signaling renewed bullish momentum. The breakout matters because it aligns technical strength with on-chain metrics—$17B TVL and substantial institutional inflows—indicating a potential trend continuation toward $245 and beyond.

How did the double bottom form and what does the technical setup show?

The chart shows a clear double bottom near $210, with the second low holding above the first, confirming support. After consolidation, SOL climbed ~20.24% then an additional ~11.93%, producing a breakout above $230. Volume patterns indicate accumulation during the pullback, and buyers are now testing resistance around $245 for a possible continuation.

$SOL has surged to around $232.87, powered by a strong double bottom breakout after consolidating near the $210 support zone. Momentum is carrying the price higher as buyers push past resistance. With this continuation, $SOL is signaling strong bullish energy …. pic.twitter.com/fOYy8CFfbB — BitGuru 🔶 (@bitgu_ru) September 12, 2025

The double bottom established a robust support base above the $200 psychological level, stabilizing near $210 before the upward move. The sequence of higher lows and higher highs remains intact, pointing to sustained momentum as trading activity increases.

Source: BrokeDoomer(X)

Source: BrokeDoomer(X)

How strong are Solana’s on-chain and institutional drivers?

Solana’s ecosystem growth provides a fundamental backdrop to price action. Total Value Locked (TVL) reached $17 billion, while stablecoin capitalization and 24-hour DEX volume posted material increases. Institutional allocation—reported at $1.65 billion into a Solana treasury—corresponded with a 27% jump in trading volume, lifting market capitalization above $126 billion.

Source: DeFiLlama

Source: DeFiLlama

Market catalysts remain in focus: a potential spot Solana ETF approval and the Alpenglow network upgrade (moving to proof-of-stake improvements and faster transactions). Analysts note that these catalysts, combined with visible capital flows, could support further upside if on-chain participation remains elevated.

Key Takeaways

- Technical breakout: Double bottom confirmed; SOL trading above $240 and testing $245 resistance.

- On-chain strength: TVL at $17B with record DEX and stablecoin activity supporting price action.

- Institutional support: $1.65B inflows and ETF anticipation can sustain momentum; monitor volume and resistance zones.

Frequently Asked Questions

Will Solana keep rising after the double bottom breakout?

Short-term continuation is likely if buyers hold above the $230 zone and volume stays elevated. Watch resistance near $245 and on-chain flows; failure to hold $230 could signal a retest of $210 support.

How do institutional inflows affect SOL price?

Large institutional allocations increase liquidity and trading volume, reducing downside volatility and often supporting higher prices as treasury purchases and on-chain demand concentrate supply.

Conclusion

The Solana price breakout combines technical confirmation with robust on-chain metrics and institutional interest, forming a cohesive bullish case. Traders should monitor resistance near $245 and key on-chain indicators: TVL, DEX volume, and net inflows. For investors, upcoming ETF decisions and the Alpenglow upgrade are pivotal catalysts; stay updated and manage risk accordingly.