Dogecoin ETF: The REX‑Osprey DOGE ETF is approaching launch, offering direct institutional exposure to Dogecoin (DOGE). This listing reflects how narrative, liquidity and large-scale demand—not fundamentals—are driving institutional products into memecoins.

-

Dogecoin ETF nearing launch — institutions package memecoin exposure

-

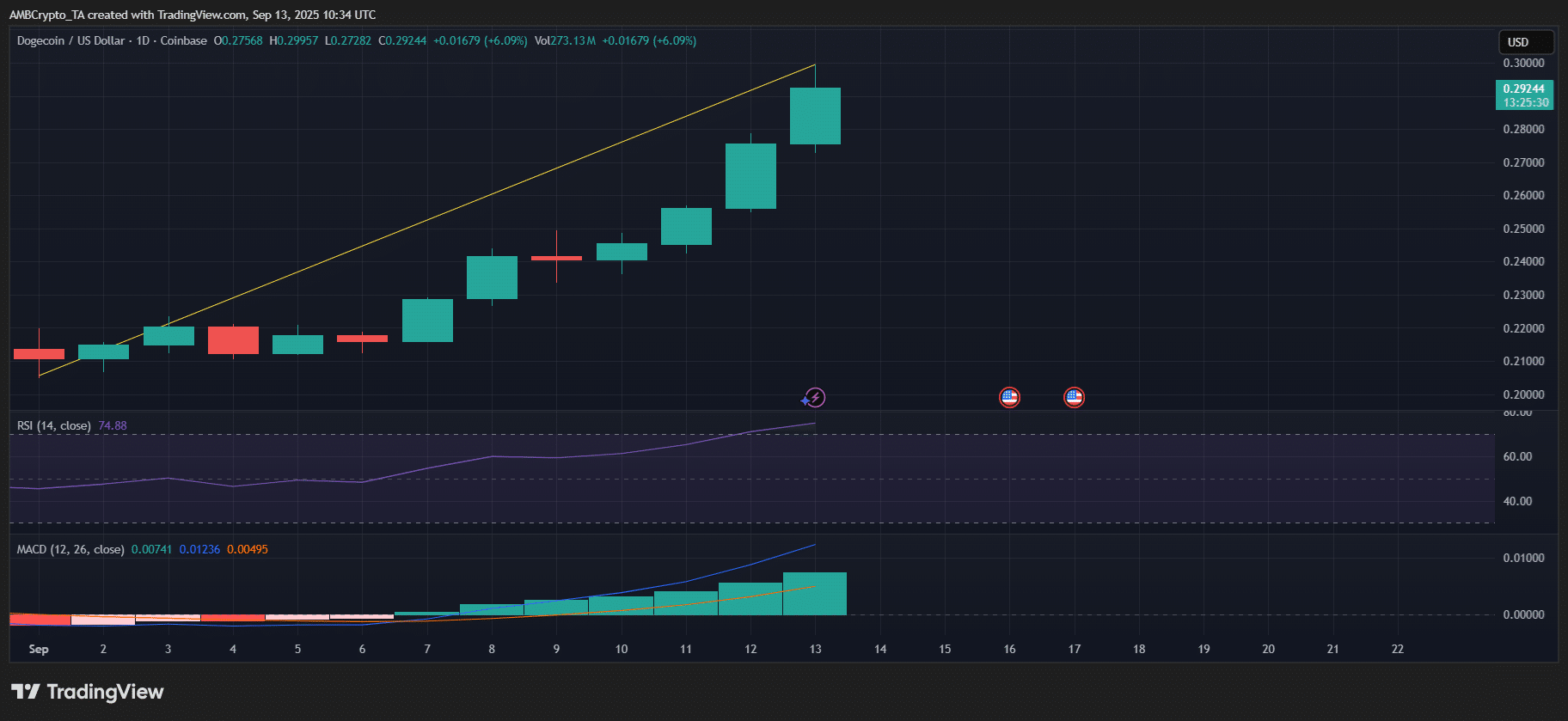

DOGE rallied ~36% over the past week amid ETF news; momentum indicators show strong short-term buying pressure.

-

Market implications: increased liquidity, higher volatility, and concentration risks as a few wallets still hold large DOGE supplies.

Meta description: Dogecoin ETF: REX‑Osprey DOGE ETF nears launch as institutional demand and liquidity lift DOGE. Read concise analysis, risks, and trading considerations now.

What is the Dogecoin ETF and why does it matter?

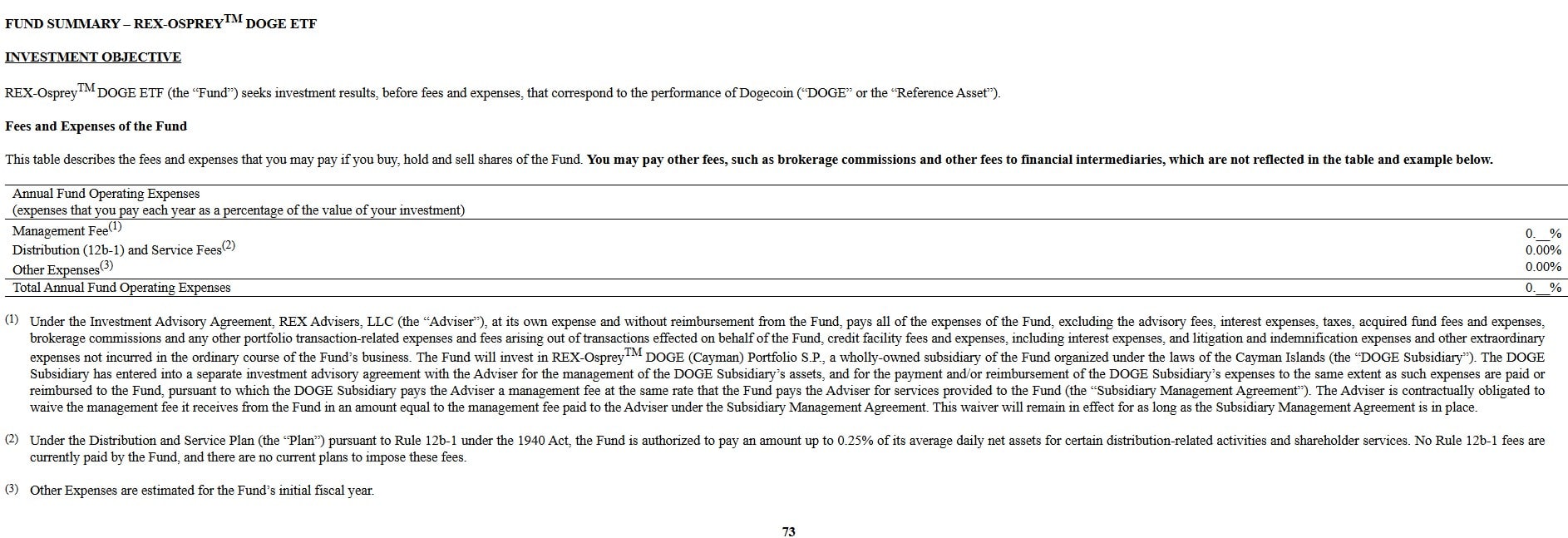

Dogecoin ETF is a regulated exchange‑traded fund designed to give investors direct exposure to Dogecoin (DOGE) without holding the token directly. It matters because an ETF can broaden access, add institutional liquidity, and change market dynamics for DOGE—potentially increasing volatility and retail participation.

How could the REX‑Osprey DOGE ETF affect DOGE price and market structure?

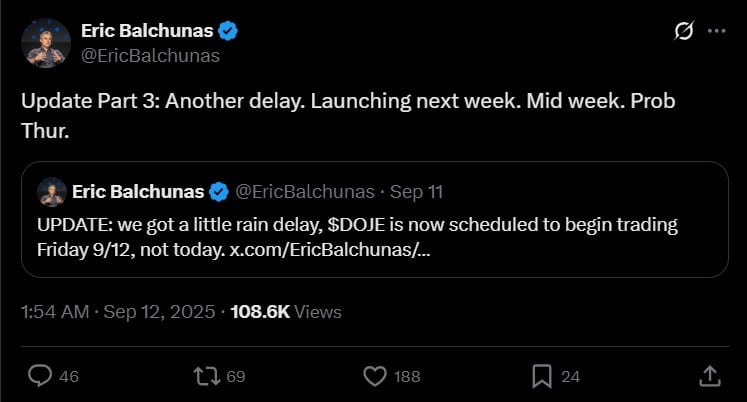

The REX‑Osprey DOGE ETF could amplify demand by creating buy flows from ETF issuers and institutions. DOGE rallied roughly 36% over a recent week, moving from $0.21 to near $0.30, with on‑chain concentration and technical indicators (RSI overbought, MACD bullish crossover) signaling heightened short‑term risk. Source: SEC filing, Bloomberg reporting, TradingView charts.

Frequently Asked Questions

Is the Dogecoin ETF a sign that memecoins are institutionalized?

Yes and no. The ETF signals institutional appetite to package culturally relevant assets for investors. It institutionalizes access, not necessarily the underlying project’s fundamentals. Expect financial products to reflect market demand more than technical roadmap maturity.

Market snapshot and technicals

Short‑term momentum: DOGE rallied ~36% in the past seven days, moving from $0.21 to near $0.30. Daily volume and a bullish MACD crossover support momentum while RSI readings moved into overbought territory. Source: TradingView.

Smoke or substance: what investors should know

Dogecoin’s institutional packaging reveals market realities: narrative and liquidity can create products even when development activity is limited. DOGE development remains modest and supply concentration remains a structural risk.

Institutional entrants may increase market depth but also introduce larger, faster flows that can magnify price swings for retail holders.

Source: sec.gov

Source: X

Source: TradingView

Key Takeaways

- Institutional access: The REX‑Osprey DOGE ETF will make DOGE available to investors via a regulated ETF wrapper.

- Market dynamic: Narrative and liquidity—not fundamentals—are driving institutionalization of memecoins.

- Risk management: Expect increased volume and volatility; monitor supply concentration and set clear position limits.

Conclusion

Dogecoin’s ETF moment underlines a structural shift: culture and narrative now intersect with finance, enabling memecoins like DOGE to enter institutional products. Investors should balance the potential for significant inflows with the persistent risks of volatility and concentrated holdings. For actionable clarity, monitor official ETF filings and on‑chain metrics and adjust risk controls accordingly.