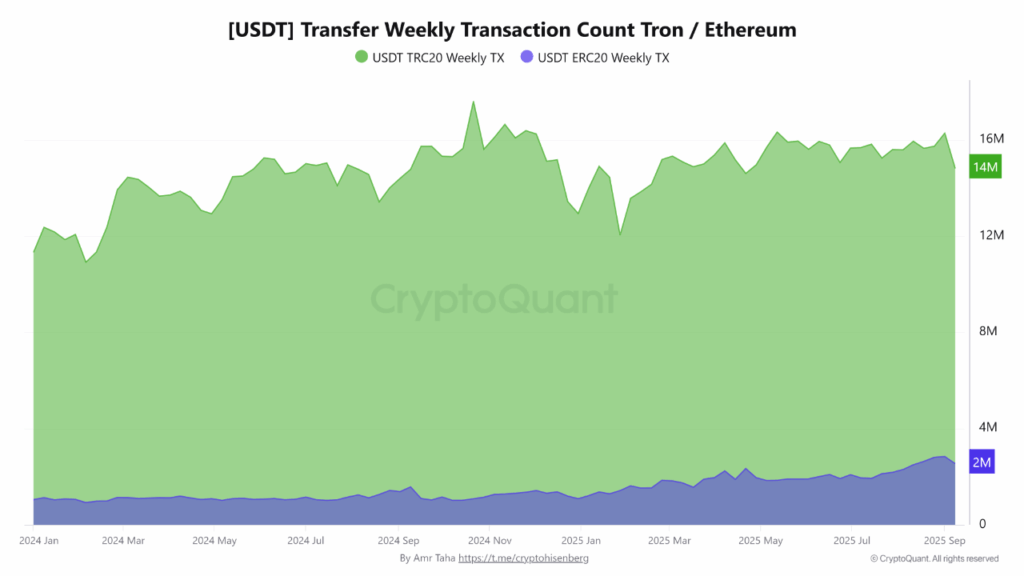

Tron USDT transfers surged to about 14.8 million weekly TRC20 transactions after a 60% fee cut, roughly six times Ethereum’s ~2.5 million ERC20 transfers; the fee reduction lowered weekly TRX revenue but sustained high stablecoin volume, reinforcing Tron’s lead in USDT activity.

-

Tron processed ~14.8M weekly USDT transfers vs. Ethereum’s ~2.5M, a 6x gap.

-

Fee reduction of 60% cut weekly TRX revenue from ~272M to ~123.8M while keeping volumes steady.

-

High throughput and lower costs strengthened Tron’s position for stablecoin transfers, per on-chain charts and CryptoQuant data.

Tron USDT transfers spike to 14.8M weekly after 60% fee cut — read how fee policy drove volume and what it means for stablecoin networks. Stay informed with COINOTAG.

What are Tron USDT transfers and why did volume spike?

Tron USDT transfers are stablecoin transactions on the TRC20 standard; they spiked after the network cut transaction fees by about 60%, which kept weekly transfer counts near 14.8 million. Lower costs improved transfer economics and sustained user activity even as weekly fee revenue declined.

How does the fee reduction affect TRC20 transaction economics?

Tron’s fee cut reduced weekly fee revenue from roughly 272 million TRX to 123.8 million TRX. Despite lower revenue, transaction counts remained around 14 million per week, suggesting demand elasticity favored the cheaper network for stablecoin transfers. Data sources referenced: CryptoQuant and on-chain metrics.

Tron dominates USDT transfers, recording 14.8M weekly transactions, six times Ethereum’s count, after cutting transaction fees by 60%.

- Tron processed 14.8 million USDT transactions in one week, nearly six times Ethereum’s 2.5 million, reflecting dominant stablecoin activity.

- A 60% reduction in transaction fees lowered weekly revenue but kept volumes steady near 14 million, proving effective long-term adoption strategy.

- With high adoption, lower costs, and steady usage, Tron strengthens its position as a leading stablecoin network, widening the gap over Ethereum.

Tron dominates USDT transfers after implementing a strategic fee reduction, widening the performance gap with Ethereum. Data from recent weeks shows Tron processing substantially higher transactions while maintaining strong activity levels despite lower fees.

What does expanding transaction activity tell us about stablecoin demand?

Over the past two weeks, Tron’s TRC20 network processed an estimated 14.8 million weekly transactions. Ethereum’s ERC20 network managed approximately 2.5 million in the same period. The disparity indicates user preference for lower-cost, higher-throughput stablecoin transfers.

Source: CryptoQuant

Source: CryptoQuant

How did the fee change influence user behavior?

The 60% fee cut improved transaction economics for users who move USDT frequently. Lower per-transfer cost reduces friction for remittances, trading settlements, and dApp transfers. On-chain analytics showed sustained weekly volumes near 14 million, indicating that reduced fees supported continued usage rather than cannibalizing activity.

Why might Tron prioritize volume over immediate fee revenue?

Tron’s strategy appears focused on long-term network effects. High transaction throughput attracts liquidity, developers, and decentralized applications. As adoption increases, the network can monetize via ancillary services, token utility, and higher on-chain activity, offsetting initial fee revenue declines.

What role do network effects play in stablecoin ecosystems?

Network effects are crucial: more transfers mean deeper liquidity and faster settlement for dApps and exchanges. Lower operational barriers encourage migration from costlier networks. For Tron, sustained volume growth signals improved market positioning for stablecoin use cases.

Frequently Asked Questions

How many USDT transfers did Tron process weekly?

Tron processed approximately 14.8 million USDT transfers in the observed week, compared with about 2.5 million on Ethereum’s ERC20, highlighting a significant volume advantage.

Did the fee cut hurt Tron’s weekly revenue?

Yes. Weekly fee revenue fell from around 272 million TRX before the cut to roughly 123.8 million TRX after the reduction, while transaction counts stayed high.

Key Takeaways

- Volume leadership: Tron handled ~14.8M weekly USDT transfers vs. Ethereum’s ~2.5M.

- Revenue trade-off: A 60% fee cut reduced weekly TRX revenue but preserved high transaction throughput.

- Strategic positioning: Lower fees improved adoption, strengthening Tron’s stablecoin ecosystem and market competitiveness.

Conclusion

Tron’s fee reduction strategy drove a significant increase in Tron USDT transfers, sustaining about 14.8 million weekly transactions and widening the gap with Ethereum. While weekly fee revenue dropped, the move reinforced network effects, suggesting a deliberate shift toward long-term adoption and liquidity growth. Monitor on-chain analytics and CryptoQuant data for updated trends.

Published: 2025-09-14 Updated: 2025-09-14

Author: COINOTAG

Sources (no external links): CryptoQuant on-chain charts, on-chain transaction data, Alpha Crypto Signal (social mention).