Solana TVL Hits $13 Billion All-Time High—Will SOL Follow With New Price Highs?

Solana’s SOL is surging on strong inflows, but the rally’s fate hinges on sustaining demand. Can it push past $270 or slip toward $219?

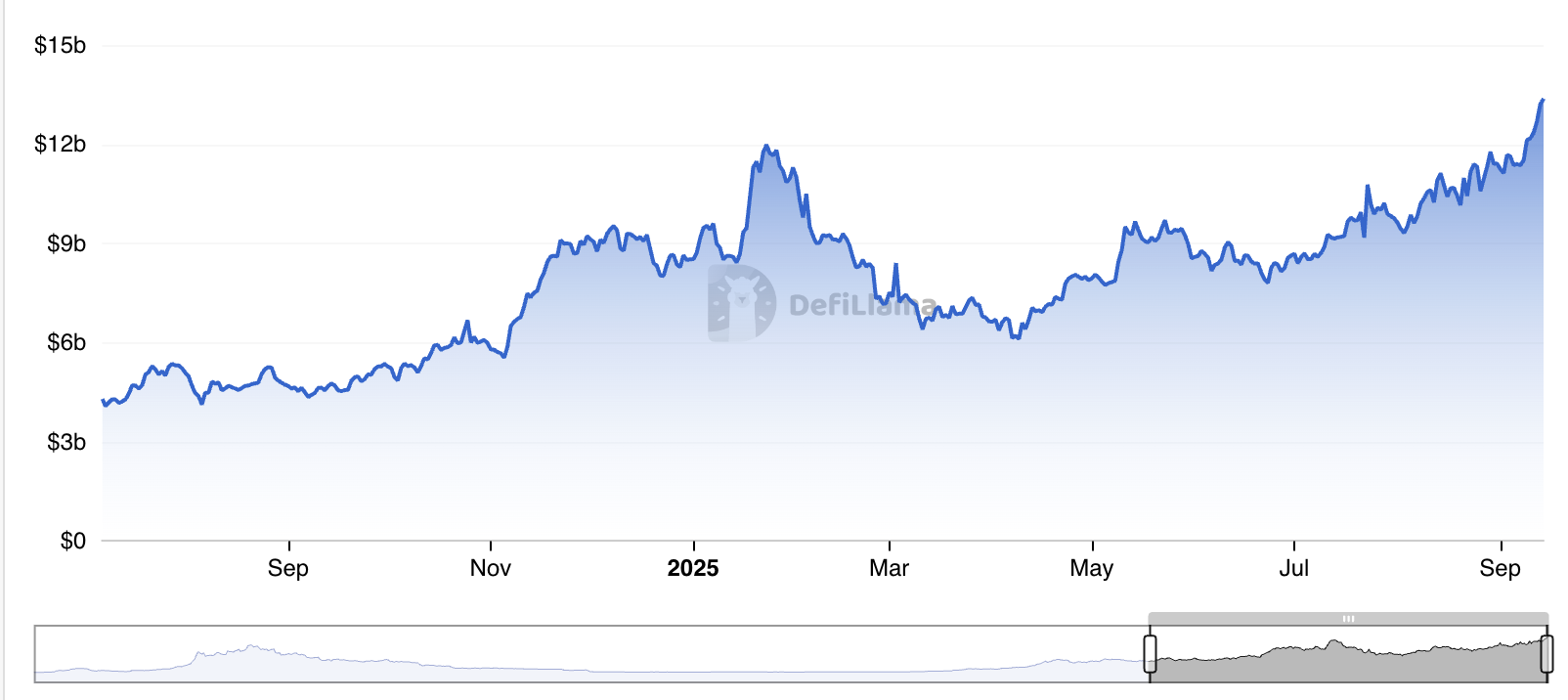

The Solana network has seen a surge in user demand and network inflows, pushing its decentralized finance (DeFi) total value locked (TVL) to an all-time high of over $13 billion.

As buying activity grows, SOL’s price has also surged nearly 25% in the past week. The question now is whether this wave of network growth will be enough to propel the altcoin back to record price levels.

Solana DeFi TVL Rockets to ATH as User Activity Surges

According to DefiLlama, Solana’s DeFi TVL is at an all-time high of $13.38 billion, having rocketed by 18% in the past week.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Solana TVL. Source:

DefiLlama

Solana TVL. Source:

DefiLlama

According to DeFiLlama, Solana’s DeFi TVL currently sits at an all-time high of $13.38 billion, rocketing by 18% in the past week. This surge is a clear marker of increased capital inflows into Solana’s DeFi protocols, a trend that can only be sustained when there is a rise in user demand and on-chain activity.

More Users, More Transactions: Solana’s Network Momentum Builds

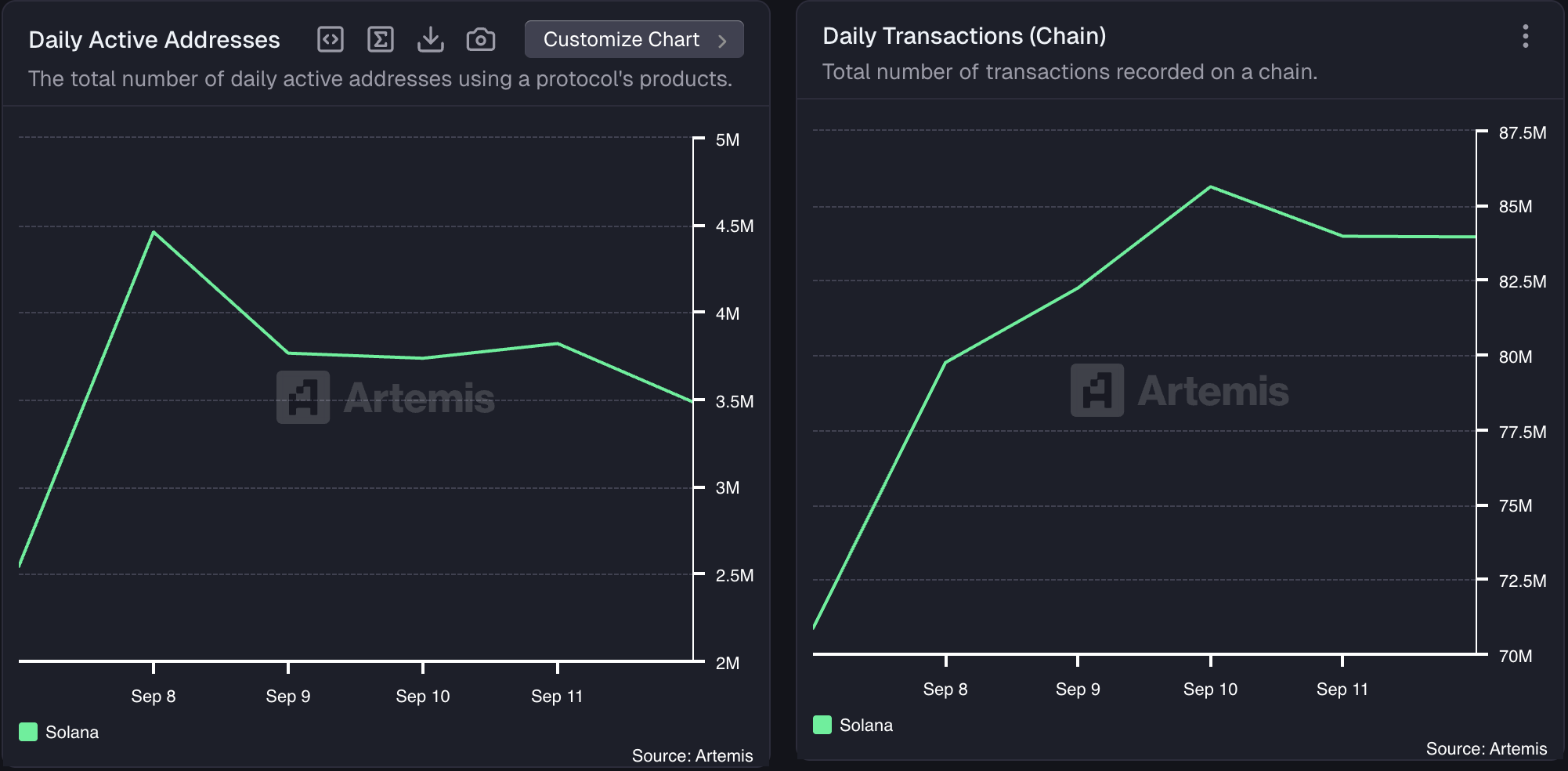

Data from Artemis confirms this trend, showing that Solana has experienced an uptick in daily active addresses and transactions. According to the on-chain data provider, in the past week, for example, the number of daily active addresses involved in at least one SOL transaction has increased by 37%.

The increase in users has directly translated to higher activity, as the daily transaction count on the network has climbed 17% over the same period.

Solana Network Activity. Source:

Artemis

Solana Network Activity. Source:

Artemis

When a network’s user demand increases this way, it signals stronger confidence in the ecosystem and deeper utility for its native asset.

With the Solana network showing strength, attention now shifts to how these gains are reflected in SOL’s market performance.

Can Solana Break Past $270 to Reclaim ATH?

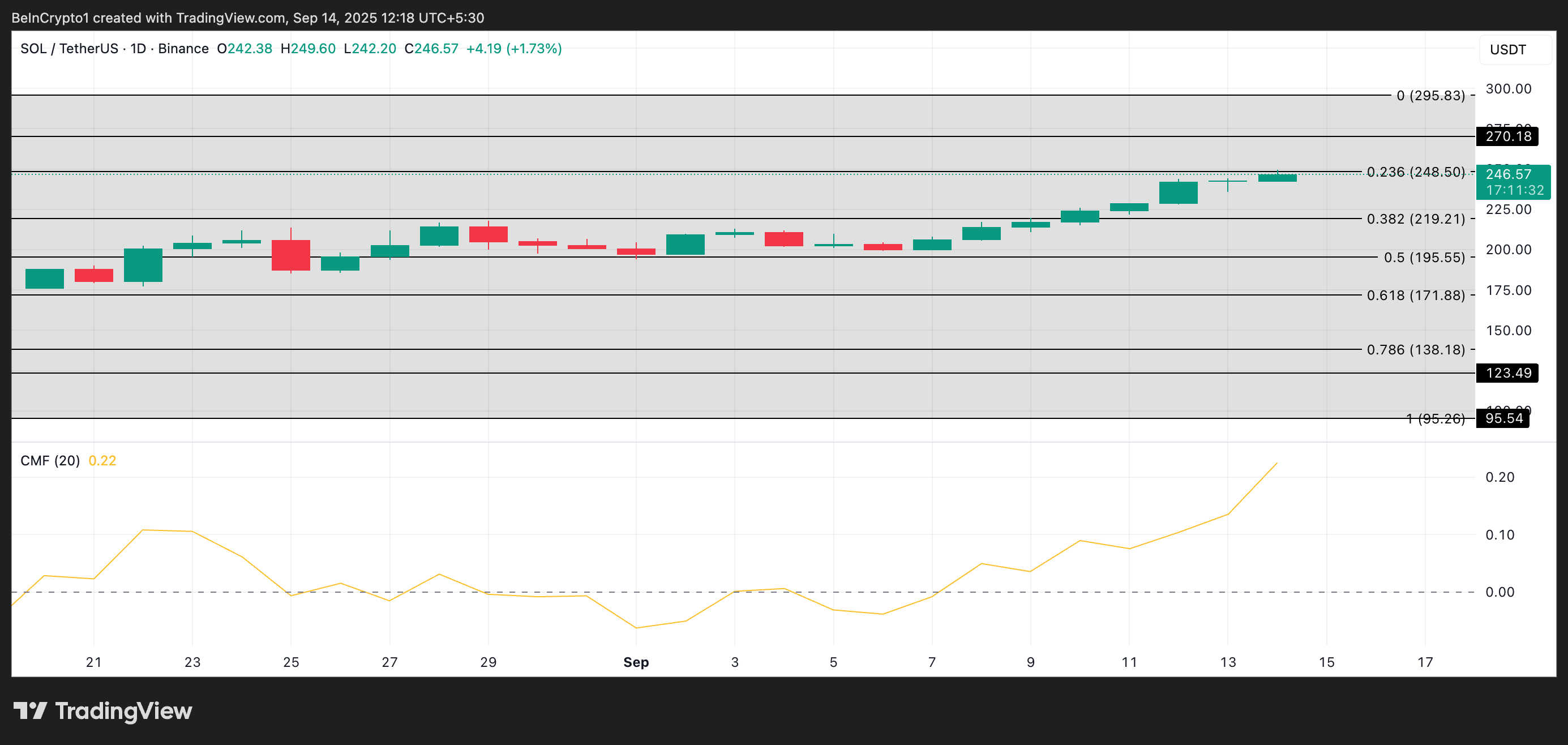

SOL is up 22% in the past week and currently trades at $246.91. Readings from its Chaikin Money Flow (CMF), which is in an uptrend, highlight the strong demand backing the rally. At press time, this momentum indicator is at 0.23.

The CMF indicator measures how money flows into and out of an asset. A positive CMF reading signals that buying pressure outweighs selling pressure, strengthening the bullish outlook.

SOL’s CMF at 0.22 shows that capital inflows remain firmly supportive of the rally. If momentum continues, the coin could extend its gains toward $270.18, and a successful break above that level would put it on course to reclaim its all-time high of $295.83.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

However, if demand weakens and inflows slow, SOL risks losing ground, with potential downside toward $219.21.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Respect the PUMP: Crypto’s emerging meme season

Crypto is shifting into risk-on mode — pump.fun dominates meme activity, while Lido leans on treasury maneuvers

Bittensor Hits Escape Velocity as Decentralized AI Adoption Accelerates

Mars Weekly | CARDS market cap surpasses $650 million, reaching a record high; probability of a 50 basis point Fed rate cut in September is 6.6%

Ethereum Foundation has released an end-to-end privacy roadmap, focusing on three main areas: privacy writing, reading, and proof, and plans to launch the experimental L2 PlasmaFold. CARDS market cap hits a record high, and pump.fun's live stream numbers have surpassed Rumble. The Shibarium cross-chain bridge suffered an attack, resulting in a loss of $2.4 million. Summary generated by Mars AI. The accuracy and completeness of this summary generated by the Mars AI model are still in the iterative update stage.