The ETH/BTC ratio shows Ether’s strength versus Bitcoin; currently around 0.039, it has failed to reclaim 0.05 since July 2024. A falling ratio signals relative weakness in ETH versus BTC despite Ether’s strong price rally and growing institutional adoption.

-

ETH/BTC ratio is ~0.039 as of September 2025

-

Ether rallied to an ATH in August but the ratio remains below 0.05.

-

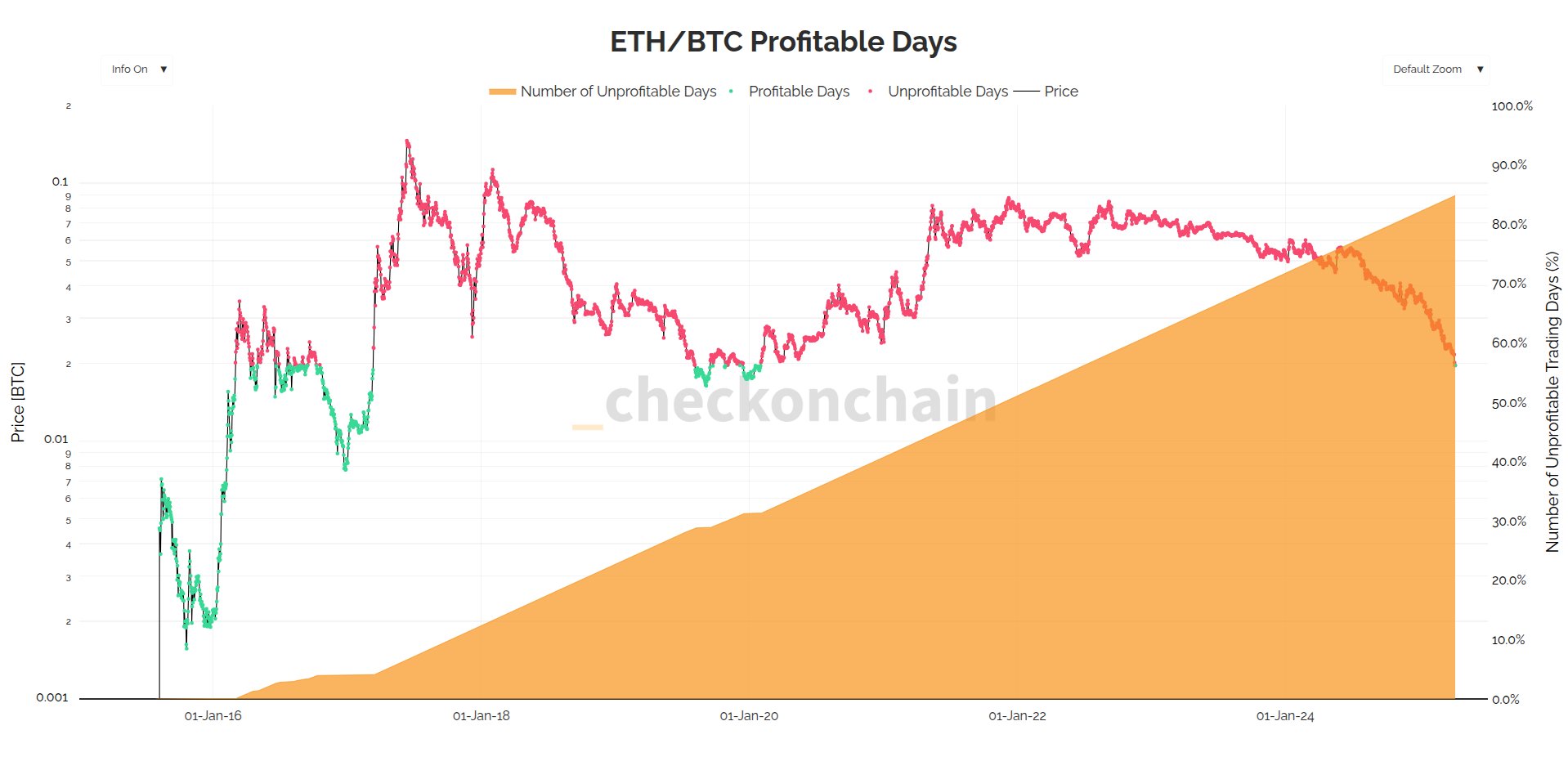

ETH outperformed BTC only ~15% of the time since 2015, per market analysis.

ETH/BTC ratio analysis: Current ratio ~0.039; read key drivers, expert views, and what to watch next — actionable insights and next steps.

The ratio compares the price of ETH to BTC; a higher ratio indicates ETH is gaining strength against BTC, while a lower ratio signals weak ETH.

What is the ETH/BTC ratio and why does it matter?

The ETH/BTC ratio measures Ether’s price against Bitcoin’s price to show relative strength between the two largest crypto assets. Traders and portfolio managers use the ratio to time rotation between ETH and BTC, evaluate sector leadership, and assess capital flows within crypto markets.

The Ether–Bitcoin (ETH/BTC) ratio has failed to reclaim 0.05 since July 2024 despite institutional adoption and Ether’s price rally in July and August that set new local highs. The ratio currently sits near 0.039, below August’s 0.04 peak.

The ETH/BTC ratio from July 2022 to July 2025. Source: TradingView

The ETH/BTC ratio from July 2022 to July 2025. Source: TradingView

How has the ETH/BTC ratio moved since 2015?

Historically, the ratio peaked at 0.14 in June 2017, according to CoinGecko data, and fell as low as 0.02 in March 2020 amid macro uncertainty. Since 2015, Ether has outperformed Bitcoin roughly 15% of the time, based on a price-history analysis by market analyst James Check.

After the March decline, markets recovered and Ether recorded strong gains in mid‑2025. Ether reached a nominal all-time high of $4,957 on August 24, 2025, before a modest pullback of about 6.7% to current levels.

ETH experiences a price rally in July and August, climbing to new all-time highs. Source: TradingView

ETH experiences a price rally in July and August, climbing to new all-time highs. Source: TradingView

Why did ETH rally while the ratio stayed low?

Ether’s price appreciation (about +155% since July) was driven by institutional interest, ETF inflows, and increased treasury allocations by corporations. Yet BTC’s simultaneous strength and capital rotation into BTC kept the ETH/BTC ratio depressed.

What are the main drivers that keep the ratio below 0.05?

- BTC dominance and safe-haven demand: Bitcoin often outperforms during risk-on capital concentration.

- ETF and institutional flows: Large-scale BTC allocations by institutions can outpace ETH flows even when ETH rallies.

- Macro and trade tensions: Geopolitical and macro uncertainty compress risk appetite and affect cross-asset rotation.

When could ETH/BTC reclaim higher levels?

Reclaiming 0.05 would likely require sustained ETH-specific catalysts (stronger DeFi and on-chain activity, favorable regulatory developments for smart‑contract adoption) and either a BTC pause or outflows from BTC. Analysts at blockchain analytics firms suggest consolidation after large moves; timeframes could be weeks to months.

A chart comparing ETH and BTC price performance since 2015. Source: Checkmate

A chart comparing ETH and BTC price performance since 2015. Source: Checkmate

Frequently Asked Questions

How is the ETH/BTC ratio calculated?

The ETH/BTC ratio equals the price of one Ether divided by the price of one Bitcoin. Traders use spot market prices to compute the ratio in real time for cross-asset analysis.

Can ETH’s price rally but the ratio still fall?

Yes. If Bitcoin rises faster or attracts more inflows than Ether, ETH/BTC can fall even while ETH posts nominal gains. Relative performance, not absolute gains, determines the ratio.

Key Takeaways

- Current level: ETH/BTC ≈ 0.039 — below the 0.05 threshold.

- Drivers: Institutional flows, Bitcoin strength, macro factors, and on‑chain activity.

- Action: Monitor ETF and institutional flow data, ETH on‑chain metrics, and BTC momentum to time rotation decisions.

Conclusion

While Ether posted a strong price rally into August 2025, the ETH/BTC ratio remains below key thresholds, underlining Bitcoin’s persistent relative strength. Investors should track capital flows and on‑chain indicators to assess whether ETH can regain leadership. For continued coverage, consult official data sources and on‑chain analytics.

Published by COINOTAG — updated 2025-09-14.