This week’s crypto weekly winners and losers: MYX Finance, Pump.fun and Worldcoin led gains, while Four, Cronos and World Liberty Financial lagged. Bitcoin held near $115k and Ethereum approached $4.7k as stablecoins near $300B and capital flows favored utility projects ahead of the Fed decision.

-

Top winners: MYX, PUMP, WLD — strong short-term momentum and price discovery.

-

Pivotal resistances: $15 for MYX, $2 for WLD, $0.010 target for PUMP.

-

Market context: BTC ~$115k, ETH ~$4.7k; stablecoins approaching $300B, Fed decision influences flows.

Meta description: Crypto weekly winners and losers — MYX, PUMP, WLD led gains while FORM, CRO, WLFI fell; read key takeaways and strategy updates from COINOTAG.

What were this week’s crypto winners and losers?

Crypto weekly winners and losers this week were clear: MYX Finance, Pump.fun and Worldcoin led rallies, while Four, Cronos and World Liberty Financial underperformed. Market leadership clustered in small-cap altcoins, with large-cap BTC and ETH trading in tight ranges as macro headlines steered flows.

How did Bitcoin and Ethereum perform this week?

Bitcoin held around $115k and Ethereum traded toward $4.7k, both showing measured strength but limited breakout conviction. BTC’s range-bound action kept volatility muted, while ETH’s gradual advance reflected steady demand ahead of macro clarity from the Fed.

Weekly winners

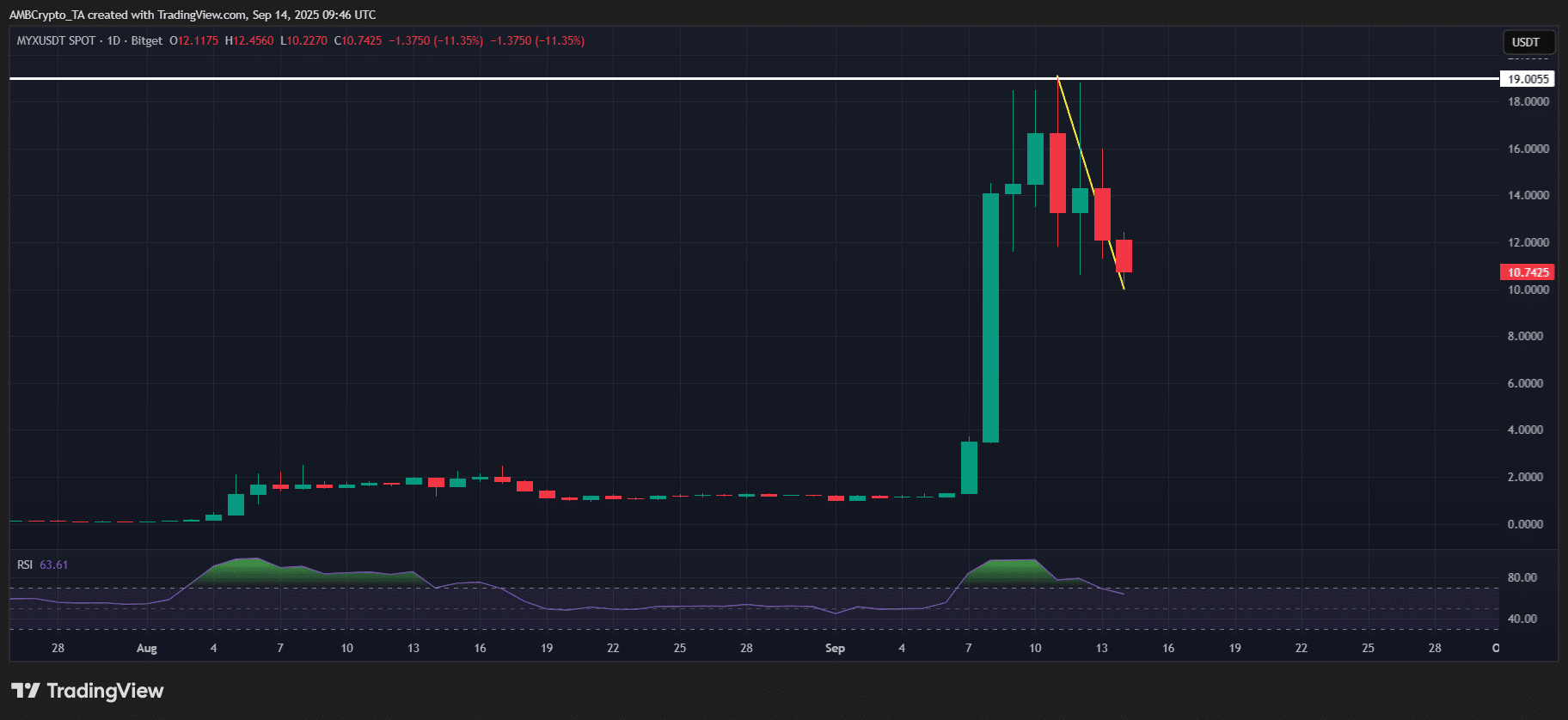

MYX Finance [MYX] — DeFi protocol pulled off a triple-digit rally

MYX posted the largest weekly gain, rallying roughly 200% after running from $3.50 to multi-digit highs. Profit-taking followed: the token peaked at $19 on 11 September and softened to $10.70 at press time, indicating a classic overbought unwind.

Technical notes: RSI spiked above 90, signaling extreme momentum and a likely correction window. Support and pivot levels to watch include $15 (failed flip) and $10 for consolidation.

Source: TradingView (WYX/USDT)

Pump.fun [PUMP] — Memecoin launchpad extended its hype cycle

PUMP climbed ~65% this week after successive all-time highs, moving from $0.005 to $0.008 and eyeing $0.010. Momentum is retail-driven and remains vulnerable to quick reversals if buyers step back.

Worldcoin [WLD] — AI-driven token project broke out to Q1 level

WLD surged ~60% this week, briefly reclaiming $2.21 before pulling back to $1.60. The spike followed a prior 52% run, but follow-through requires reclaiming $2 to confirm sustained strength rather than short-term FOMO.

Other notable winners: Hifi Finance (HIFI) +812%, XDOGE (XDOG) +534%, Naoris Protocol (NAORIS) +230%.

Weekly losers

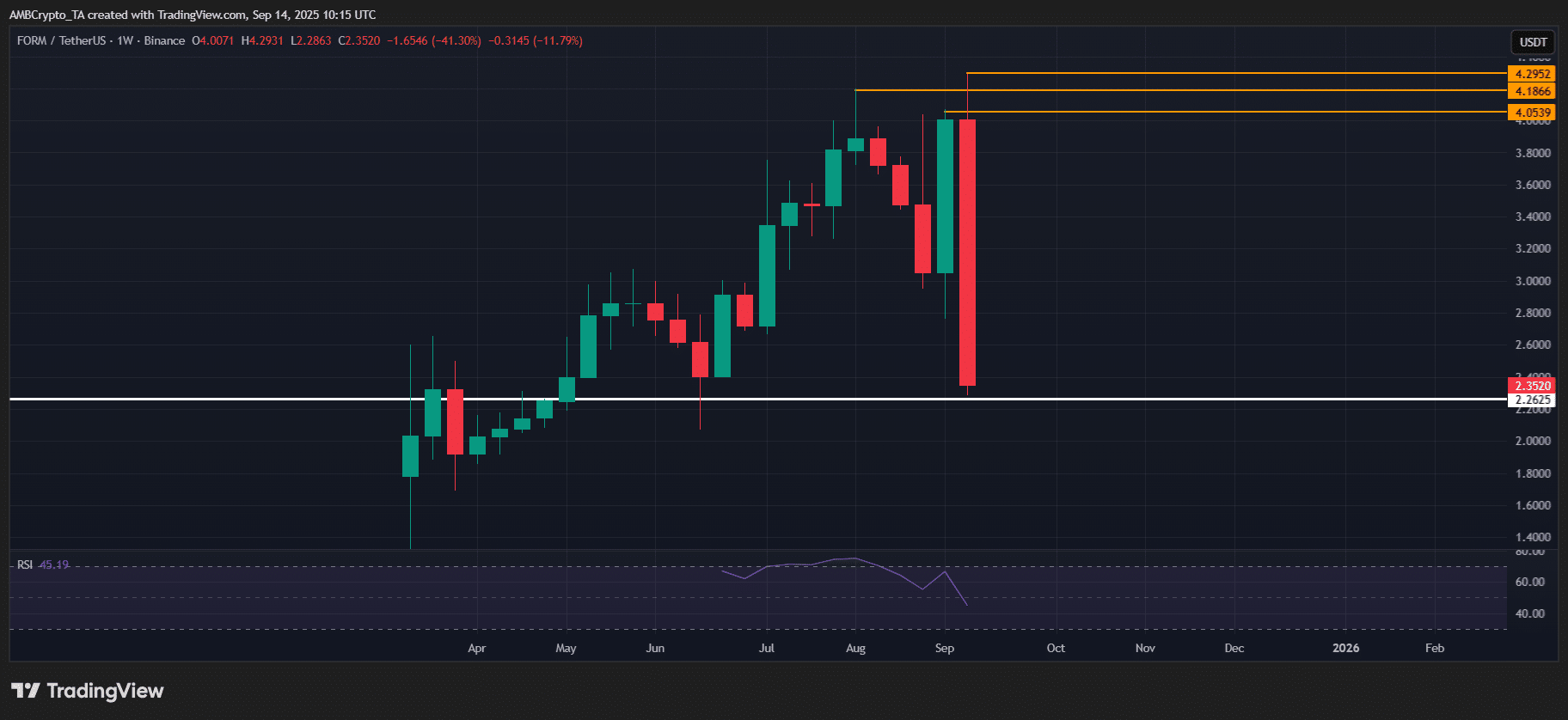

Four [FORM] — Utility protocol marked its weakest performance

FORM led losses with about a 40% drop from a $4 open to near $2.30, pushing the token to a three-month low. Price action shows three failed retests of $4 and a bearish daily structure with lower lows.

Source: TradingView (FORM/USDT)

Cronos [CRO] — Native token of L1 protocol failed to break resistance

CRO slipped ~7% but retains a constructive weekly base after an August three-year high. Weekly consolidation suggests the dip may be a tactical buying window rather than trend reversal.

World Liberty Financial [WLFI] — DeFi token pressed up against a major ceiling

WLFI lost ~2.5% and remains range-bound under $0.25. The token formed a higher low this week; a successful hold above $0.20 and a flip of $0.25 into support would point to a Q4 recovery path.

Other notable losers: Gems VIP (GEMS) -36%, Etherex (REX) -26%, MBG -24%.

Frequently Asked Questions

Which coins had the biggest weekly gains?

MYX Finance, Pump.fun and Worldcoin posted the largest weekly gains, with MYX up ~200%, PUMP ~65% and WLD ~60%, driven mostly by retail momentum and short-term FOMO.

How should traders approach this late-week volatility?

Adopt defined risk controls: use position sizing, set stop-losses at clear technical invalidation points and avoid adding into extreme RSI levels or thin liquidity rallies.

Key Takeaways

- Winners and losers: MYX, PUMP and WLD led; FORM, CRO and WLFI lagged.

- Macro influence: BTC and ETH range-bound; stablecoins nearing $300B and Fed decisions are shaping flows.

- Trading action: Prioritize risk management, monitor pivot levels ($15 MYX, $2 WLD, $0.25 WLFI) and avoid chasing exhausted rallies.

Conclusion

This week’s snapshot shows small-cap altcoins driving outsized returns while large caps tread water. Keep focus on verified data, trade with clear risk controls, and monitor macro catalysts as markets digest the upcoming Fed decision. COINOTAG will continue tracking leader shifts and key levels.