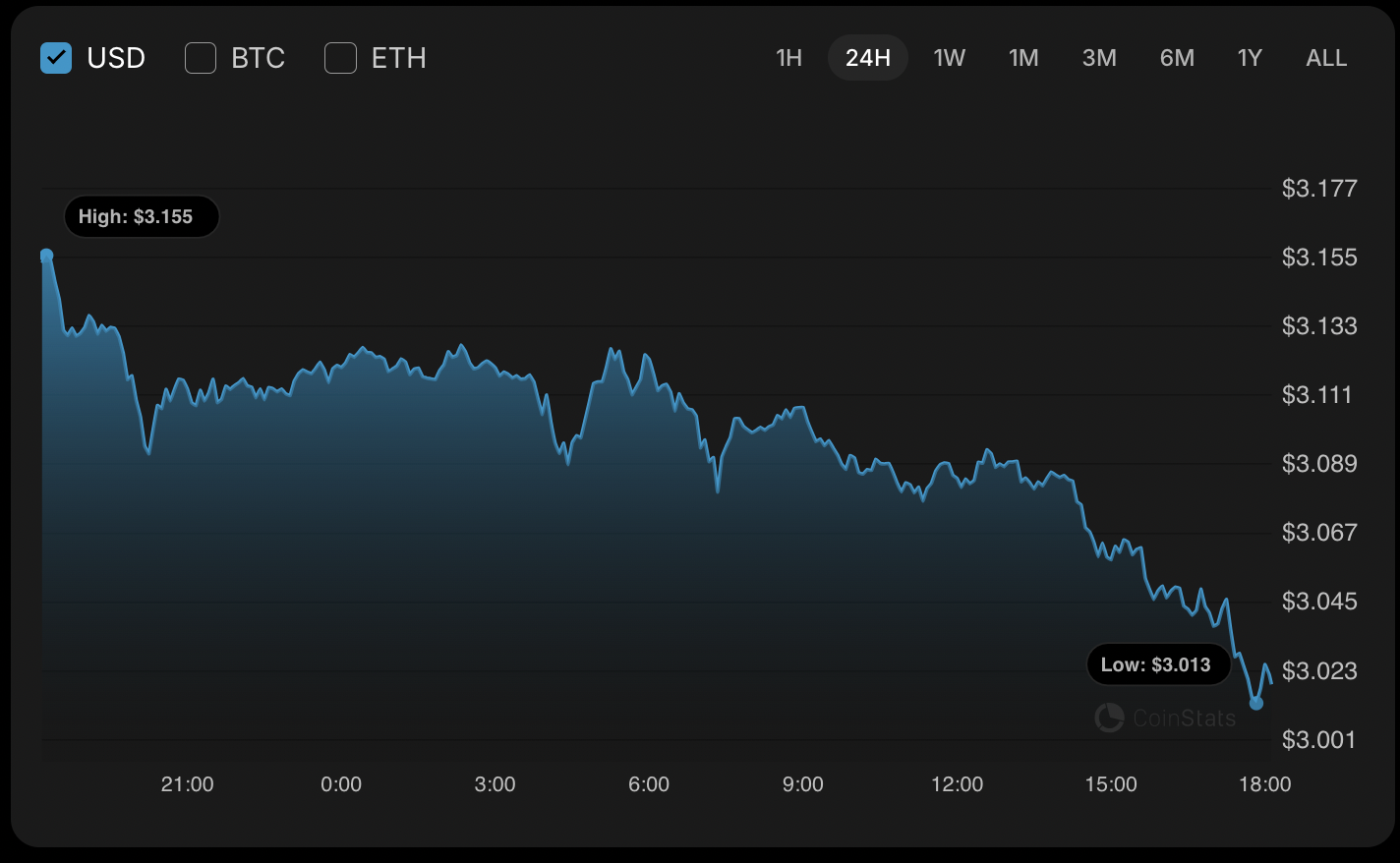

XRP price is trading around $3.03 and is testing short-term support near $3.00; consolidation is most likely as volume remains low and recent false breakout near $3.156 suggests limited upside in the immediate term.

-

Short-term support: $2.90–$3.00

-

Resistance tested near $3.156 after a false breakout; momentum is weak.

-

Daily ATR and low volume indicate lower probability of sharp intraday moves.

Meta description: XRP price update: XRP/USD trades near $3.03, testing $3.00 support after a false breakout; read short-term levels and market cues from COINOTAG.

Most of the coins are in the red zone on the last day of the week, according to CoinStats (plain text reference).

Top 10 market movers (image)

What is the current XRP price and trend?

XRP price is trading at $3.032 at press time and shows short-term weakness after a near-term false breakout. Volume is low and price action favors consolidation around $3.00 unless buyers regain control above $3.156.

How is XRP/USD performing today?

The price of XRP has fallen by almost 4% over the last 24 hours. On the hourly chart, the rate of XRP is near the local support of $3. Most of the daily ATR has been expended, reducing the chance of sharp moves before the next session.

XRP chart by CoinStats (plain text reference)

Why could XRP drop toward $2.90–$2.95?

If a bounce from current prices does not materialize, the decline may continue to the $2.95 zone. On the larger time frame, XRP fell after a false breakout of the $3.156 resistance level, suggesting sellers remain prepared to push lower if buying pressure fades.

Image by TradingView (plain text reference)

How strong is the current market momentum for XRP?

From a midterm perspective, neither buyers nor sellers dominate. The rate is far from established support and resistance bands, and trading volume is low. That lack of conviction makes consolidation the higher-probability outcome in the near term.

Image by TradingView (plain text reference)

Frequently Asked Questions

What are the immediate support and resistance levels for XRP?

Immediate support sits at $3.00 with a lower target range of $2.90–$2.95 if sellers accelerate. Immediate resistance is near $3.156, which acted as a rejection point after a false breakout.

How should traders interpret low volume in XRP moves?

Low volume during declines or gains suggests moves lack follow-through. Traders often wait for volume confirmation before assuming trend continuation; until then, expect range-bound price behavior.

Key Takeaways

- Current price: XRP trading near $3.03 with short-term downside risk.

- Momentum: Low volume and exhausted ATR point to consolidation rather than trend acceleration.

- Action: Monitor $3.00 support and $3.156 resistance; use confirmed volume breakout for directional bias.

Conclusion

This XRP price update shows short-term weakness and a high probability of consolidation around $3.00 due to low volume and a recent false breakout. Traders should watch $2.90–$3.00 support and $3.156 resistance for validated moves; COINOTAG will publish updates as new data emerges.