Native Markets officially claims Hyperliquid's USDH stablecoin ticker

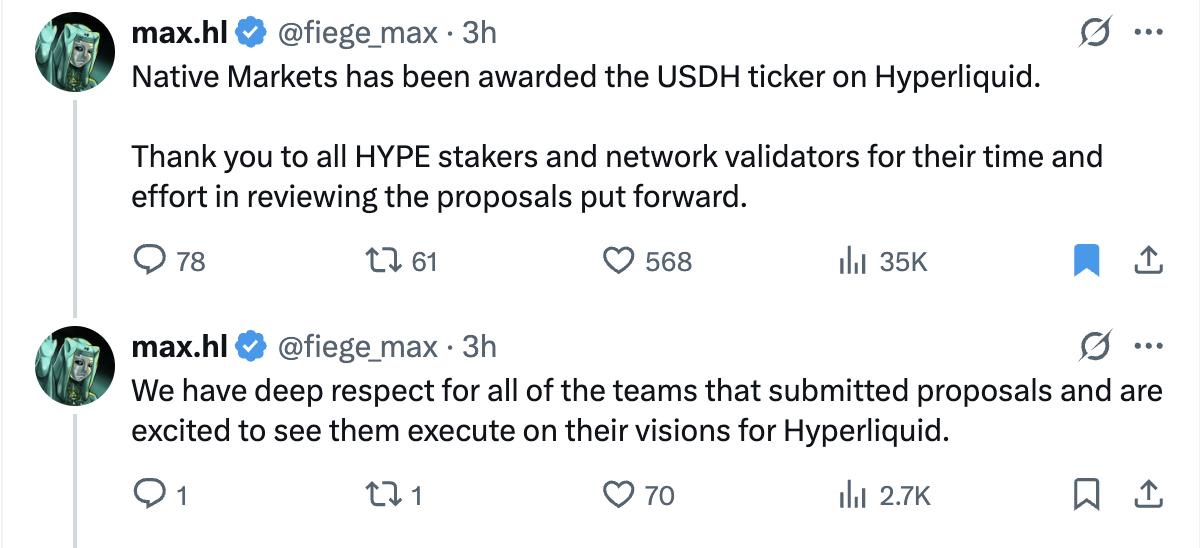

Native Markets, one of the teams that submitted a proposal to issue and manage the Hyperliquid US dollar stablecoin (USDH), officially claimed the USDH ticker on Sunday, following a community vote.

The project will deploy the inaugural Hyperliquid Improvement Proposal (HIP) for USDH and an ERC-20 token, the token standard for the Ethereum network, in the coming days, Max Fiege, founder of Native Markets, said in an X post. He also outlined the next steps:

“We will then start with a testing phase for mints and redeems of up to $800 per transaction with an initial group, to be followed by the opening of the USDH/USDC spot order book, as well as uncapped mints and redeems.”

Native Markets’ odds of winning the ticker spiked to over 99% on Saturday, on prediction market Polymarket, following synthetic stablecoin issuer Ethena’s withdrawal from the race on Thursday.

The USDH bidding war was closely followed by the crypto community and industry executives, leading to accusations of a rigged selection process and reflections on the future of the stablecoin sector as a whole.

Related: Inside the Hyperliquid stablecoin race: The companies vying for USDH

Hyperliquid’s USDH bidding war draws criticism and sparks debate

Crypto industry executives voiced mixed reactions to the USDH bidding process and the outcome of the vote, which saw established stablecoin, crypto, and payment firms lose out to a newcomer.

“Starting to feel like the USDH RFP was a bit of a farce,” Haseeb Qureshi, managing partner of venture capital firm Dragonfly, said on Tuesday.

“Hearing from multiple bidders that none of the validators are interested in considering anyone besides Native Markets. It's not even a serious discussion, as though there was a backroom deal already done,” Quershi added.

Mert Mumtaz, the CEO of remote procedure call (RPC) node provider Helius, said that the bidding war revealed that stablecoins have become commoditized.

Mumtaz speculated that US dollar stablecoin tickers will be abstracted away in the future, and exchanges will only display a generic “USD” to front-end users.

These exchanges will do all the work of swapping the differently denominated stablecoins behind the scenes, in a backend process that the user never sees or interacts with, Mumtaz concluded.

Magazine: GENIUS Act reopens the door for a Meta stablecoin, but will it work?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Taking Over from $CARDS? A Detailed Explanation of the Pokémon Card RWA Trading Platform Phygitals

Can Phygitals bring the Pokémon card craze into the crypto world?

Data Insights: The Status of Local Stablecoins in Southeast Asia in Q2 2025

Local stablecoins are crucial.

Why did you end up with "illegal business operations" for playing with crypto just like everyone else?

Compliance comes first, no blame-shifting.

Monero Price Rises 7% Despite Major Blockchain Reorganization by Qubic