Solana rally is being driven primarily by strong spot demand from retail and growing institutional accumulation, with futures open interest rising but leverage remaining muted — a combination that points to a healthier, spot-led advance for SOL in the short term.

-

Spot-driven accumulation: retail and institutions accumulating SOL.

-

Futures show rising Open Interest but balanced Taker CVD, indicating cautious leveraged positioning.

-

Institutional buys (Galaxy Digital) and on-chain metrics (OBV, RSI) support momentum; price near $250.

Meta description: Solana rally: strong spot demand from retail and institutions fuels SOL momentum; learn what metrics matter and how this affects short-term outlook. Read now.

What is driving the Solana rally?

Solana rally is powered by robust spot demand — sustained retail buying plus significant institutional inflows — while futures traders remain cautious, keeping leverage limited and reducing the risk of an immediate blow-off top.

Solana [SOL] has moved higher on persistent spot accumulation rather than speculative derivatives pressure. On-chain indicators and exchange flow data show retail buyers leading volume while institutions add meaningful positions.

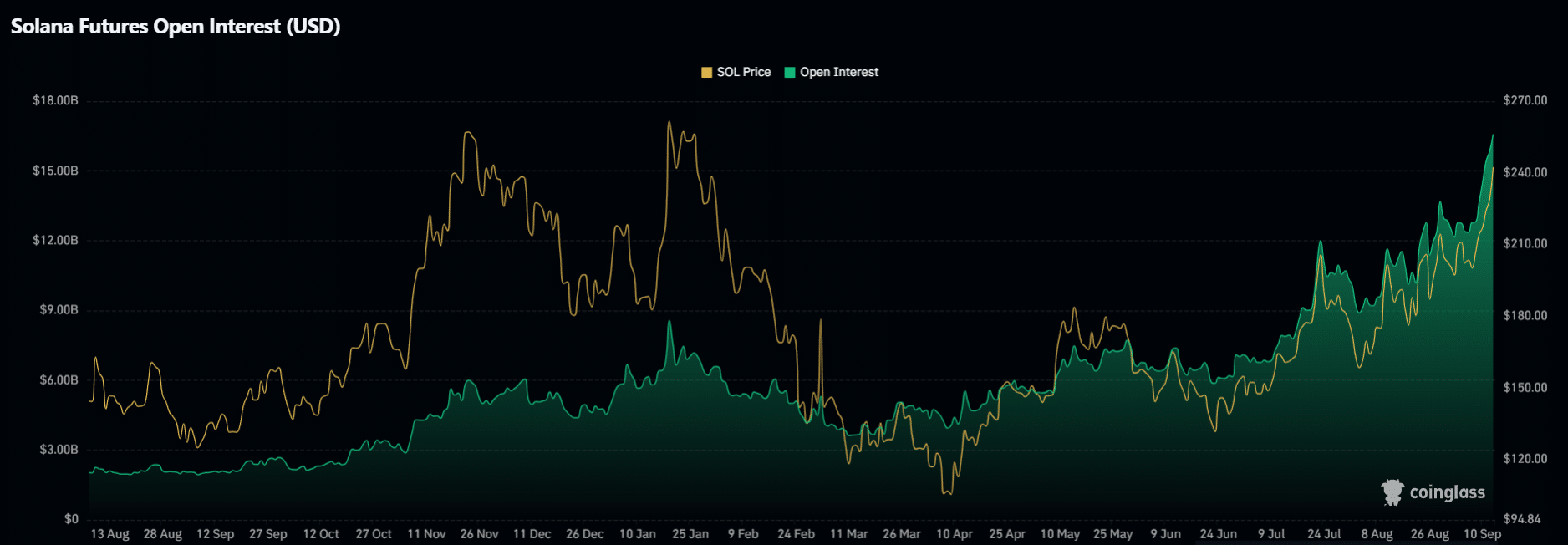

Source: CoinGlass

How is spot demand measured and what does it show?

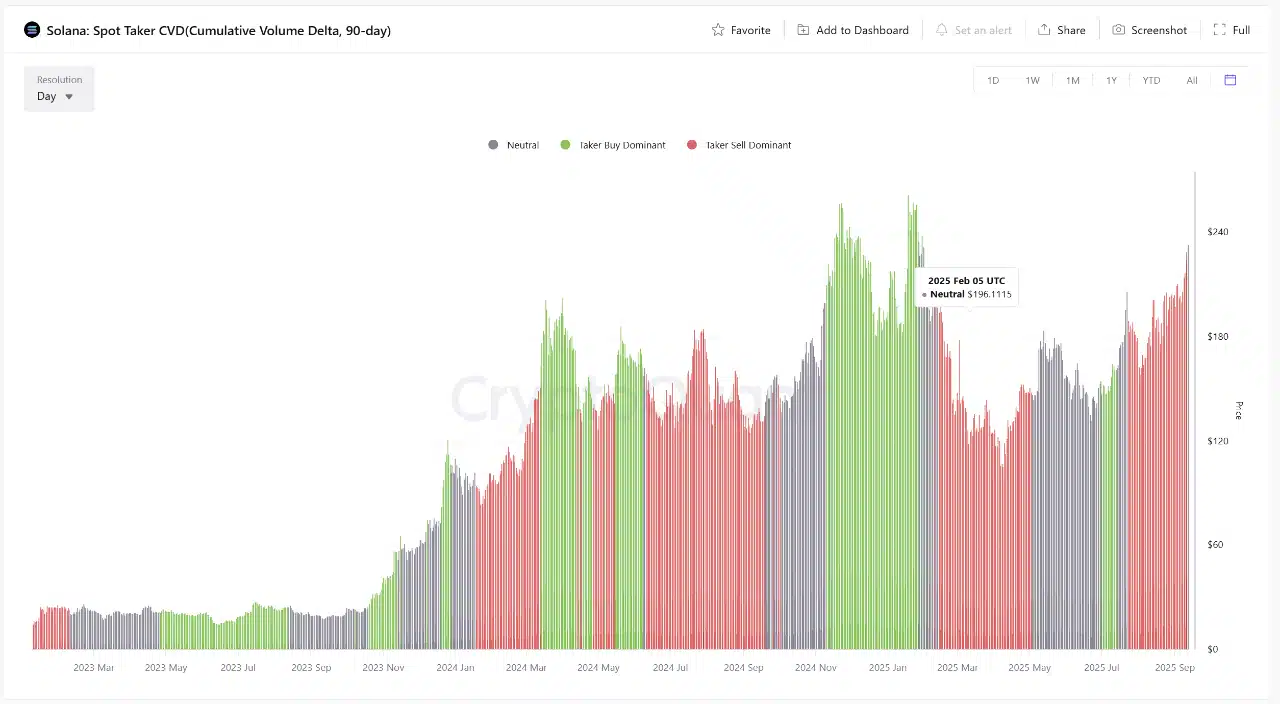

Spot demand is measured via exchange inflows/outflows, Spot Taker CVD, and on-chain exchange reserve changes. Over 90 days, Solana’s Spot Taker CVD shows steady positive flow, a signal of continuous buying pressure rather than a single speculative spike.

Exchange reserve declines and large single-day institutional purchases — converted to plain text: Galaxy Digital purchases — corroborate that accumulation is broad-based across investor types.

Why are futures traders cautious?

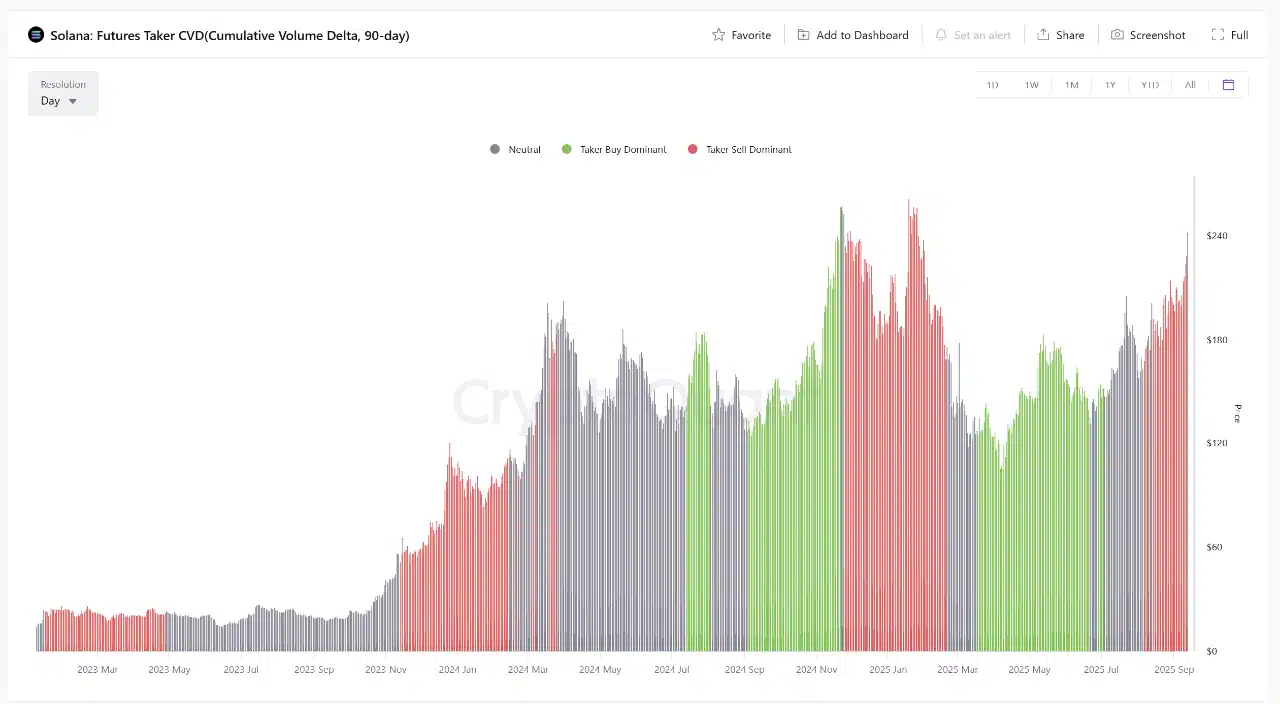

Futures metrics show rising Open Interest but a mostly flat Futures Taker CVD, indicating leveraged traders are not aggressively increasing directional exposure. This reduces systemic short-term liquidation risk.

Source: Cryptoquant

Balanced futures positioning means fewer forced liquidations if momentum pauses, supporting a more sustainable rally. Traders are increasing exposure but not with excessive leverage.

How are institutions influencing SOL price?

Institutions are adding spot exposure in sizeable increments, which raises the floor for price action. Reported institutional buys are sizable and frequent, shifting supply-demand dynamics on exchanges.

Source: CryptoQuant

Example flows show an institution adding hundreds of thousands of SOL within hours, shifting net exchange balances and supporting upward price pressure.

When might the rally cool off?

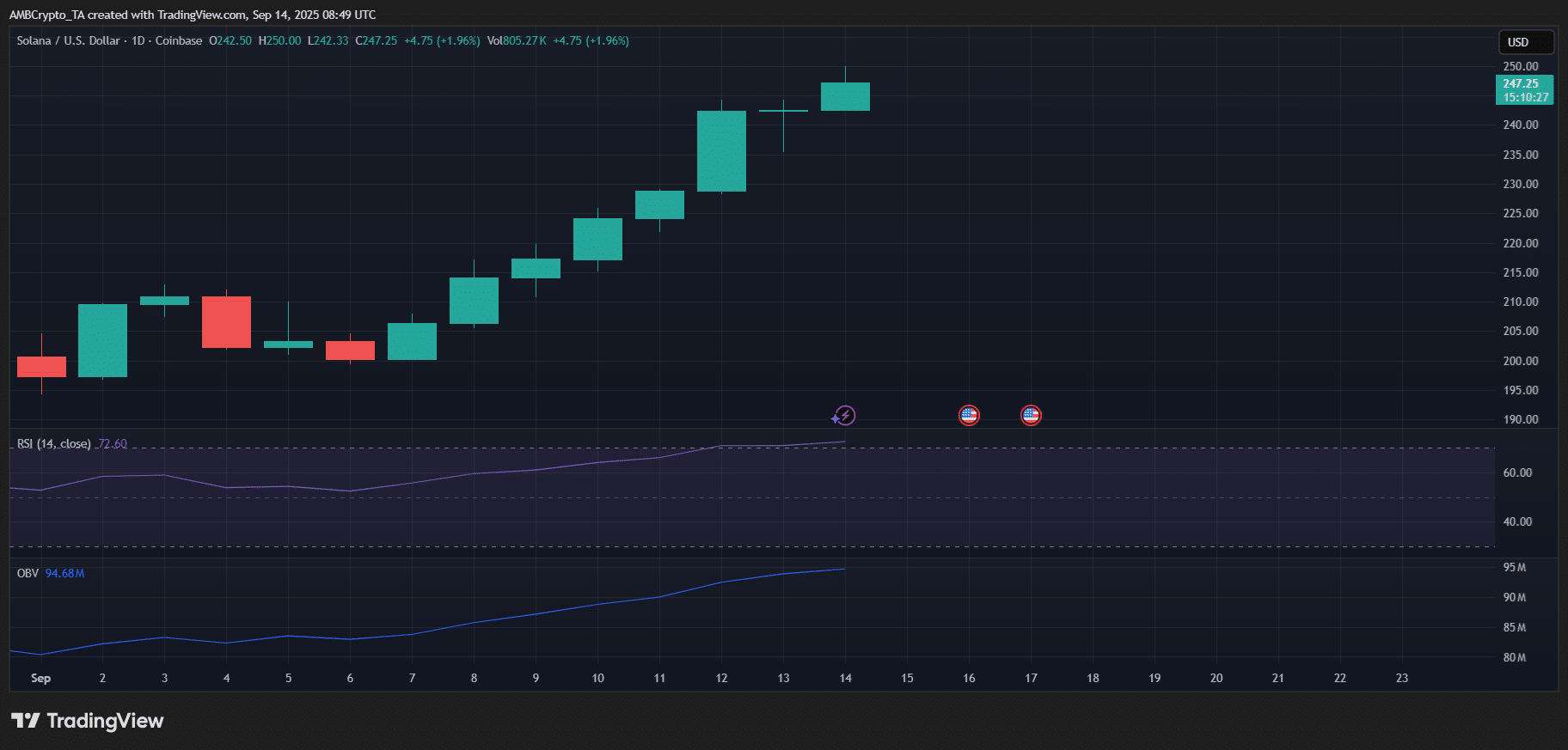

Short-term indicators like RSI are in overbought territory and may trigger profit-taking or consolidation near the $250 area. Expect potential cooling phases, but sustained spot accumulation would likely limit sharp pullbacks.

Source: X

On-balance volume (OBV) and higher candles suggest momentum remains intact for now. Watch for divergences between price and OBV or a sharp rise in leveraged long positions as early warning signs.

Source: TradingView

Frequently Asked Questions

How sustainable is the Solana rally?

Short-term sustainability looks stronger than prior spikes because the rally is spot-driven, combining retail accumulation with steady institutional buys. This mix reduces reliance on leveraged futures and lowers the probability of rapid, forceful reversals.

What indicators should traders watch now?

Watch Spot and Futures Taker CVD, Open Interest, OBV, and RSI. Divergence between price and OBV or a sudden spike in leveraged long positions would be key red flags to monitor.

Does institutional buying guarantee higher prices?

Institutional accumulation improves structural demand but does not guarantee continuous price gains. Market liquidity, macro factors, and derivatives positioning still influence short-term outcomes.

Key Takeaways

- Spot-led rally: Retail and institutions are accumulating SOL, creating a stronger demand base.

- Balanced futures: Rising Open Interest with flat Taker CVD suggests cautious leveraged positioning.

- Watch indicators: Monitor OBV, RSI, and exchange flows for signs of momentum exhaustion or increased leverage risk.

Conclusion

Solana’s rally is notable for being supported by steady spot demand from both retail and institutional buyers rather than a surge in leveraged derivatives. Solana rally dynamics point to a healthier short-term outlook, though traders should watch momentum indicators and futures leverage for signs of a cooling phase. For ongoing coverage, follow COINOTAG updates.