Why Has Bitcoin Not Reached $200,000 Yet? The Psychological Game of Old Whales Selling and the Power Struggle of the New Cycle

In the bullish atmosphere, many people are asking: Since the market opportunities are huge and capital keeps flowing in, why hasn't Bitcoin broken through $200,000 yet?

There is only one answer: veteran whales continue to sell during every rally.

The psychology of old whales: fear-driven selling

Most of these veteran whales entered the market before 2017.

At that time, $20,000 was already a dream, and $60,000 was almost unimaginable.

Therefore, when Bitcoin surged to around $60,000 or even $100,000, their first reaction was to cash in on these "unbelievable profits."

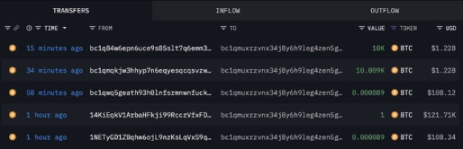

Their mindset is deeply influenced by the crashes in 2018 and 2022 (both around 80%).

Every new high reminds them of the "instant wipeout" back then;

As a result, they choose to gradually sell during the rally to avoid another cliff-like correction.

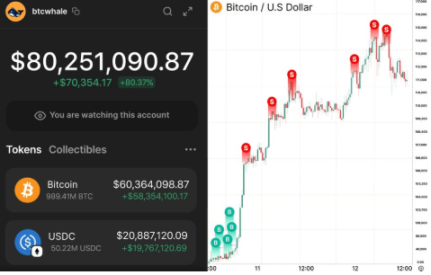

On-chain data confirmation

Old wallets make moves in every wave of price increases;

These sell-offs often coincide with local tops;

They don't dump all at once, but sell in batches to avoid "crashing the market too hard."

Because of this, what we see are only periodic corrections, not a complete market collapse.

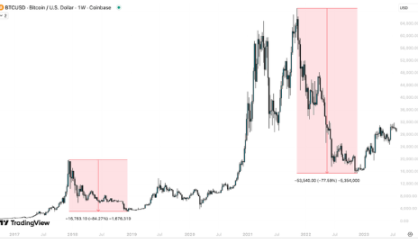

The power of the new cycle: institutional takeover

The biggest difference in this bull market is:

Institutional investors, Bitcoin ETFs, and even some national reserve funds are actively buying in.

Every drop caused by old whale selling is quickly absorbed by these "new players."

Their logic is not short-term arbitrage, but long-term allocation.

This dynamic of "fear-driven selling vs. long-term buying" actually provides the market with a healthier upward structure.

Scarcity and future trends

The supply of Bitcoin is limited.

The chips held by old whales are not infinite; one day, they will be sold out;

Once their selling pressure fades, the market will be dominated only by ETFs, institutions, and long-term holders;

At that time, the true long-term scarcity effect will push prices to new heights.

Therefore, $200,000 is not an unrealistic fantasy, but a stage result that will inevitably arrive sooner or later.

Conclusion

The reason why Bitcoin did not immediately break through $200,000 in 2025 is not due to a lack of market demand, but because veteran whales continue to sell out of fear.

But this time, things are different:

The emergence of institutions and ETFs is taking over market dominance;

Long-term scarcity will gradually emerge;

When the selling pressure from old whales completely dissipates, the market will enter an unstoppable upward channel.

In other words: $200,000 Bitcoin is not a prediction, but a matter of time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Reaches Netscape Moment, Says Paradigm Founder

Bitcoin Climbs Past $94K Amid Fed Uncertainty

Chainlink Price Prediction 2025-2030: Can LINK Realistically Reach $100?

PEPE Price Prediction 2025-2030: Can This Memecoin Achieve the Impossible 1 Cent Target?