Bitcoin inflows from 2024-2025 beat 15-year record

CryptoQuant CEO Ki Young Ju highlighted that the total on-chain capital inflow for Bitcoin from the past 1.5 years has surpassed that of BTC from 2009 up to 2024 by a wide margin. What’s fueling the growth?

- Bitcoin on-chain inflows from 2024 to 2025 has surpassed inflows recorded from 2009 to 2024 by nearly $200 billion.

- The influx of inflows could be attributed to the capital flowing in from institutional players which have started accumulating BTC.

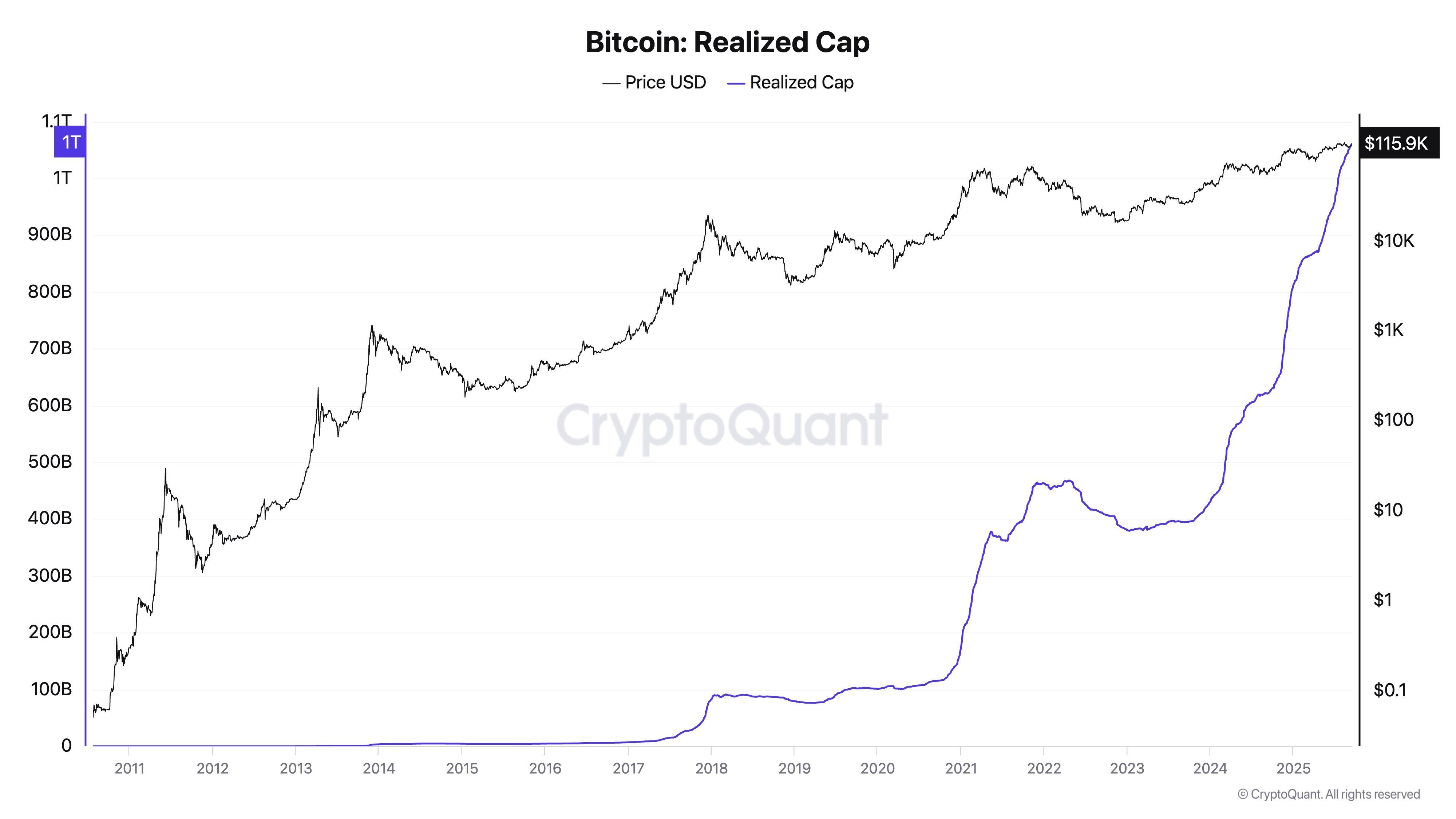

In a recent post, the analyst shared a comparison chart that showcases just how much realized capital has grown in terms of Bitcoin. According to the chart, BTC on-chain inflows have skyrocketed in the past 1.5 years, reaching a record high of $625 billion in realized funds.

It has even managed to surpass the amount of funds on-chain generated from the past 15 years, dating back from 2009 all the way up to 2024.

Based on data from CryptoQuant’s Ki Young Ju, BTC ( BTC ) capital inflows from 2009 to 2024 only garnered as much as $435 billion in the span of 15 years. Meanwhile it only took less than two years for the current market to surpass that number by nearly $200 billion.

Chart depicting the realized on-chain capital from Bitcoin in the past few years | Source: CryptoQuant

Chart depicting the realized on-chain capital from Bitcoin in the past few years | Source: CryptoQuant

What is fueling Bitcoin’s high inflows?

One of the main drivers behind this surge in capital being brought on-chain comes from the increase in institutional investors who are now involved in Bitcoin; whether that is through spot Bitcoin ETFs, corporate treasury allocations, sovereign or institutional investors.

According to data from Bitcoin Treasuries, there are about 3.71 million BTC held within treasuries, with the number of entities holding Bitcoin reaching 325. This number is dominated by publicly-listed companies, which make up 190 entities on the sheet. Michael Saylor’s Strategy remains the largest corporate holder of BTC, with 638,460 BTC to date.

Meanwhile, macro tailwind from softer inflation and looming Fed cuts has only amplified this capital rotation, with long-term holders accumulating and illiquid supply at records. This means that many are bracing for the impact of Fed interest rate cuts as they move funds on-chain, using BTC as an investment vehicle.

Price chart for Bitcoin, showing the price movement from 2024 to 2025 | Source: TradingView

Price chart for Bitcoin, showing the price movement from 2024 to 2025 | Source: TradingView

Aside from that, the rising price of BTC may draw in more capital as traders experience the fear of missing out. At press time, BTC has seen a 93.3% increase in the past year, reflecting the spike in on-chain capital. It has reached consecutive all-time highs throughout its recent rallies this year.

On the technical side, BTC is approaching historically overbought conditions, with the monthly Relative Strength Index sitting near 70. While this suggests strong bullish momentum, it also raises the risk of consolidation or pullbacks as traders take profit. However, the broader trend remains intact, and given the scale of fresh inflows, any retracement could be seen as healthy rather than signaling the end of the cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K

Fed rate cut may pump stocks but Bitcoin options call sub-$100K in January

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.