Analysts Warn of Local Top as Crypto Market Shows Fragile Signals

Analysts warn the crypto market may be nearing a local top as altcoin open interest overtakes Bitcoin and seasonal signals flash caution. Still, many view any pullback as a healthy reset within a broader bullish cycle.

The crypto market may be approaching a local top, with an analyst suggesting a correction could follow after the upcoming Federal Open Market Committee (FOMC) meeting.

Moreover, several market watchers are pointing to key technical signals as evidence that the latest rally is losing steam.

Where Is The Crypto Market Headed?

In a detailed post on X (formerly Twitter), a pseudonymous analyst, arndxt, highlighted that one of the clearest signals comes from derivatives markets. The analyst observed that open interest in altcoins has surpassed Bitcoin’s (BTC) for the first time since December.

It indicates that traders are shifting their focus from Bitcoin to altcoins. So, more money is now tied up in altcoin futures and options than in Bitcoin, which usually dominates.

Furthermore, this signals risk appetite overheating — people move away from “safer” BTC into more speculative bets. Previous instances of this shift coincided with local market tops, raising concerns that speculative enthusiasm is reaching unsustainable levels.

“The last 2 times it happened were in December 2024 and March 2024, and both times alts formed a local top within 2 weeks,” analyst Ted Pillows stated.

ALT OI > BTC OI for the first time in 9 months since the Jan 2025 local top. Time to pay attention.

— CryptoCondom (@crypto_condom) September 13, 2025

Concerns about a potential local top aren’t limited to derivatives or seasonal signals. Market structure is also shifting. Bitcoin has started to diverge from traditional assets.

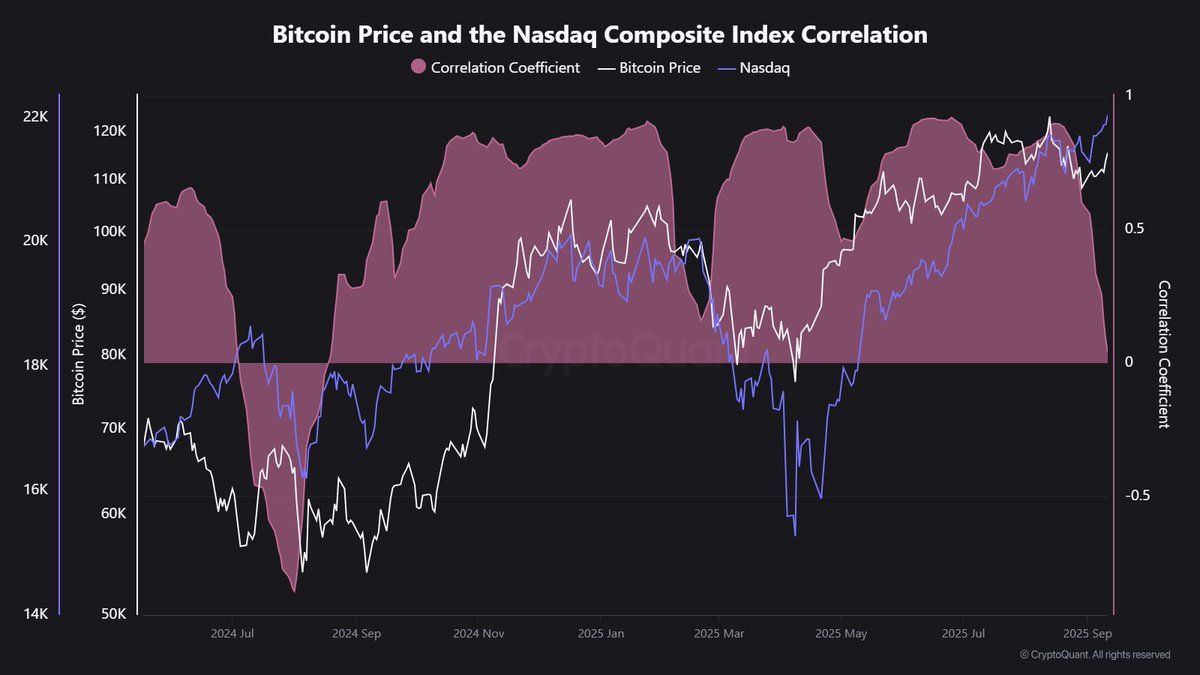

According to recent data, the cryptocurrency’s correlation with the Nasdaq has turned negative. The coefficient has fallen to its lowest level since September 2024.

“BTC is clearly lagging behind tech,” analyst Maartunn noted.

Bitcoin/Nasdaq Correlation. Source:

Bitcoin/Nasdaq Correlation. Source:

The trend extends beyond tech. CryptoQuant data revealed that Bitcoin’s correlation with both the S&P 500 and gold is also weakening, suggesting the asset is no longer moving in tandem with broader risk markets or traditional hedges.

Even so, analysts caution against interpreting these signals as the end of the cycle. Instead, some argue they point to a typical reset within a broader uptrend.

Ted Pillows emphasized that during bullish cycles, pullbacks of around 20%–30% are a typical part of the trend before momentum resumes upward.

“Wouldn’t be the first time a dip shows up before the next leg,” he said.

Taken together, rising altcoin speculation, seasonal warning signals, and Bitcoin’s weakening ties to traditional markets all point to a fragile setup. While some see this as a sign that a local top is forming, others argue it may simply mark the kind of correction that often precedes another rally. The upcoming weeks will likely determine which path the market takes next.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Price predictions 12/10: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, BCH, LINK, HYPE

Ether vs. Bitcoin: ETH price poised for 80% rally in 2026

Prediction markets bet Bitcoin won’t reach $100K before year’s end

Bitcoin rallies fail at $94K despite Fed policy shift: Here’s why