Tether launches compliant stablecoin USAT, officially challenging Circle's dominance with USDC

Written by: 1912212.eth, Foresight News

Original Title: Tether Launches US-Compliant Stablecoin USAT, Competing with Circle?

On September 12, Tether announced the launch of a brand-new stablecoin, USAT, which is a fully compliant, US dollar-backed stablecoin specifically designed for the US market. At the same time, it announced the appointment of Bo Hines as the future CEO of Tether USAT in the United States.

In the cryptocurrency sector, Tether’s USDT has a market capitalization exceeding $170 billions, and is widely used for trading, cross-border payments, and DeFi applications. Tether’s total profit for 2024 exceeded $13 billions, with total profit for the first half of 2025 around $5.7 billions. In Q2 alone, net profit reached a record $4.9 billions, mainly driven by US Treasury yields and reserve appreciation.

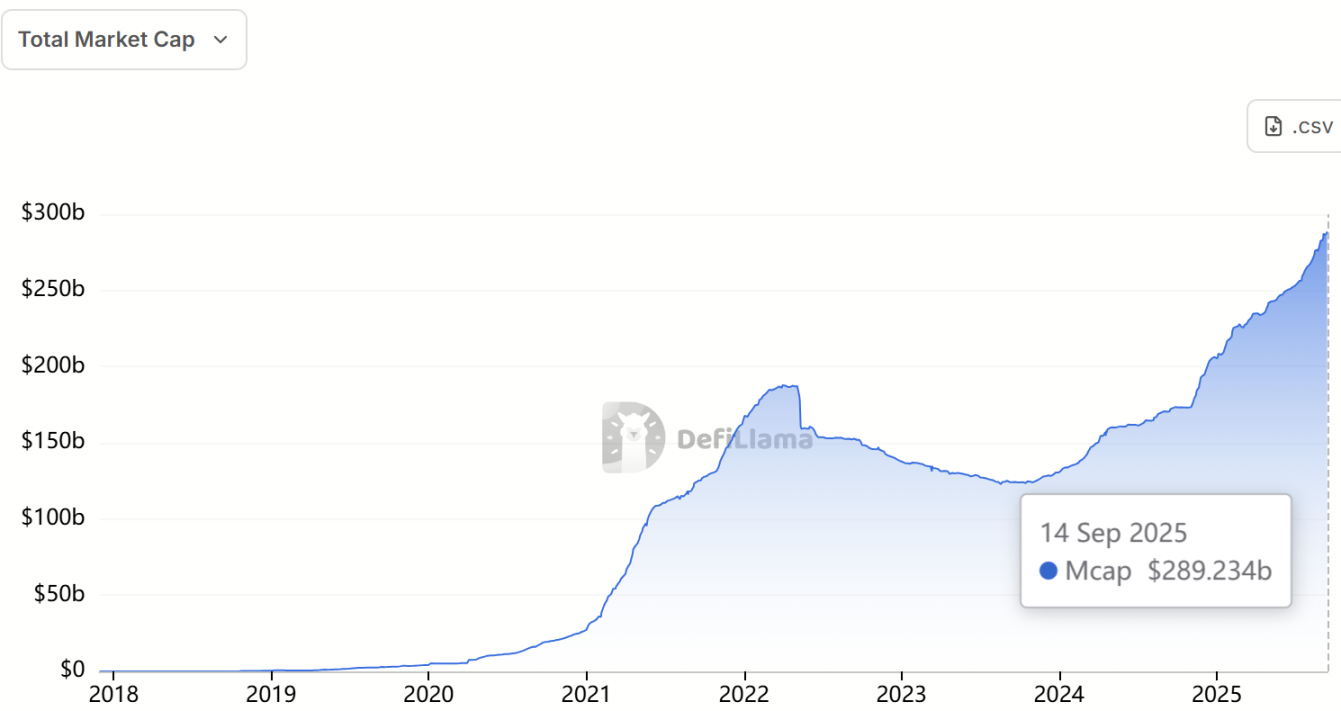

According to data from defiLlama, as of September 14, the total market capitalization of stablecoins is about $289.234 billions, with USDT accounting for 58.96%, occupying a dominant position in the market.

However, as the US regulatory environment becomes increasingly stringent, Tether is facing compliance pressure. The launch of the new stablecoin USAT by Tether is seen as a strategic move to enter the US domestic market.

Tether’s decision is not a sudden whim, but a response to global regulatory trends. Since 2022, the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have strengthened their supervision of stablecoins. As a non-US issued product, USDT has been involved in multiple controversies, including reserve transparency and anti-money laundering compliance issues. Tether is headquartered in the British Virgin Islands, and although its stablecoin circulates globally, its use in the US is restricted, with some exchanges and institutions reluctant to directly support non-compliant assets. The purpose of launching USAT is precisely to fill this gap and provide a stablecoin option that fits within the US legal framework. USAT will be pegged to the US dollar at a 1:1 ratio, backed by Tether’s reserves, including cash, US Treasuries, and other highly liquid assets.

The core highlight of USAT lies in its "US compliance" attribute. According to Tether’s official statement, this stablecoin will be issued and managed by a newly established US subsidiary, and is expected to officially launch before the end of 2025, initially targeting US residents, businesses, and institutional users. Unlike USDT, USAT will strictly comply with the Bank Secrecy Act (BSA) and anti-money laundering (AML) regulations, supporting KYC verification.

In addition, the official USAT website issued an important notice stating that USAT is not legal tender and will not be issued, supported, approved, or guaranteed by the US government. USAT is not insured by the Federal Deposit Insurance Corporation (FDIC), the Securities Investor Protection Corporation (SIPC), or any other government agency.

It is worth noting that Tether has appointed Bo Hines as CEO of the new business. Bo Hines is a veteran in the political and business fields, having served as an advisor to former President Donald Trump and ran for a congressional seat in North Carolina in 2022. He is known for his conservative stance, especially his proactive attitude towards cryptocurrency regulation and innovation policy.

Hines’s joining is seen as a signal of Tether seeking to strengthen its influence in US political circles. Hines revealed that the company’s new US headquarters will be located in Charlotte, North Carolina.

From a market perspective, the launch of USAT may reshape the US stablecoin landscape. Currently, USDT dominates global trading volume, but domestically in the US, Circle’s USDC has taken the lead due to its compliance advantages. USDC’s market capitalization is about $73.1 billions, mainly serving US institutions, with companies like Visa and Mastercard having integrated it into their payment systems.

The emergence of USAT will directly challenge the position of USDC, especially in enterprise-level applications. Tether claims that USAT will support lower transaction fees and higher liquidity, making it suitable for supply chain finance, real estate transactions, and cross-border remittances. For example, a US exporter can use USAT to instantly settle overseas orders, avoiding high fees and delays from traditional banks. This is particularly attractive against the backdrop of increasing global economic uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price drop to $113K might be the last big discount before new highs: Here’s why

Trump Predicts a "Significant Rate Cut" by the Federal Reserve!

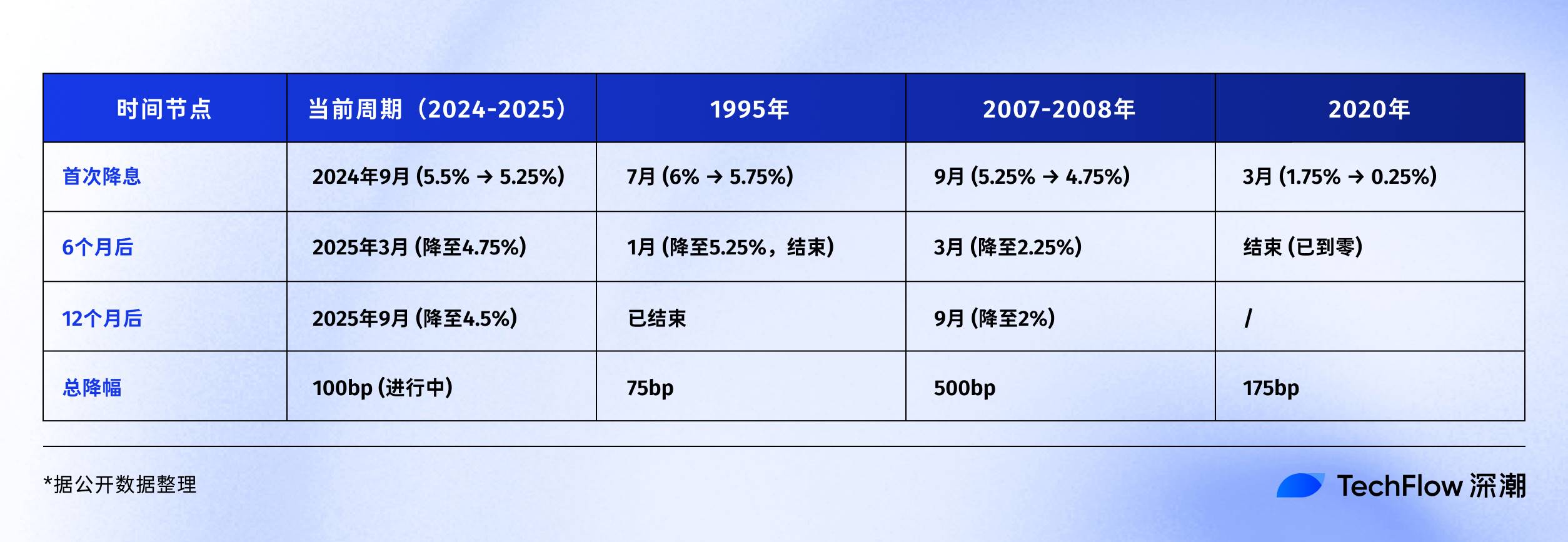

Reviewing the Fed's rate-cutting cycle: What’s next for Bitcoin, the stock market, and gold?

If history rhymes, the next 6-12 months could be a critical window.

Will Tesla and xAI merge? Hedge fund tycoon: It feels inevitable

Positive remarks from SkyBridge Capital founder Anthony Scaramucci have further fueled expectations of a possible merger between Tesla and xAI.