BTC Market Pulse: Week 38

Over the last week, the market managed to recover back to $116k amid anticipation of a Fed rate cut, but is now facing renewed sell pressure.

Overview

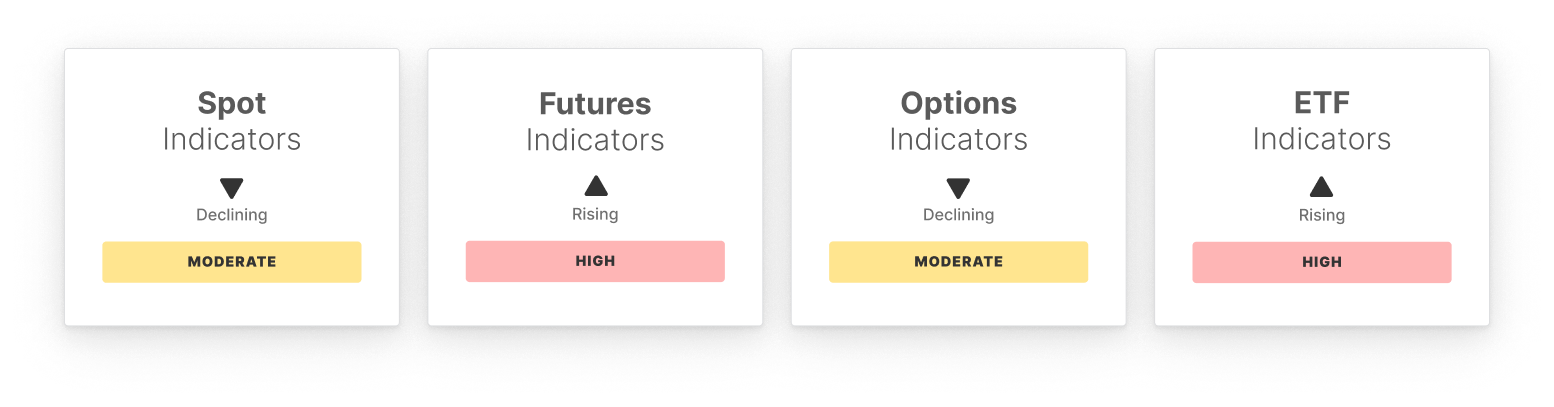

In the spot market, RSI surged into overbought territory, while CVD weakened and volumes held flat, reflecting strong momentum but limited conviction as sellers pressed into strength.

The futures market showed elevated participation, with open interest rising and perpetual CVD spiking on aggressive buy-side flows. Yet, softer funding highlighted reduced long demand, suggesting leverage remains active but sentiment is shifting toward caution.

In the options market, open interest grew, but volatility spreads fell below range and skew declined sharply, pointing to reduced hedging and a more complacent tone. Traders appear less defensive, though this raises the risk of surprise if volatility re-emerges.

Flows into US spot ETFs strengthened significantly, with net inflows far above range and trade volumes steady, signaling robust institutional demand. ETF MVRV climbed, keeping holders in profit, reinforcing cautious optimism from TradFi investors.

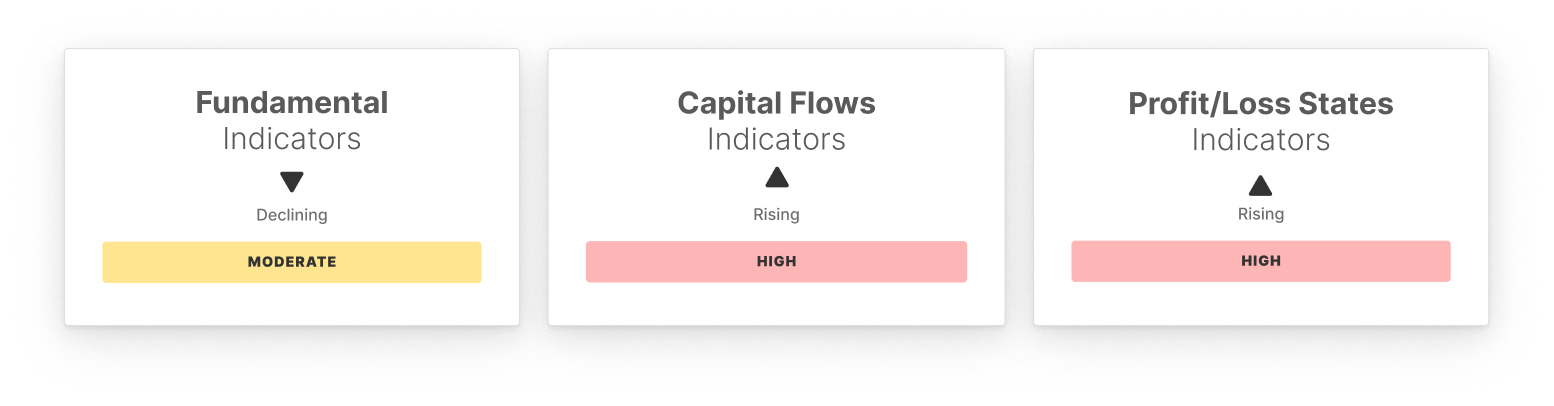

On-chain fundamentals were mixed, with addresses slipping toward cycle lows, but transfer volume increasing, suggesting renewed capital flows despite quieter user activity. Fees dipped, underscoring softer block space demand and subdued speculative pressure.

Capital flows signaled balance, with realized cap change steady, STH/LTH ratio rising slightly, and hot capital share edging higher, showing moderate speculative presence but a stable underlying structure.

Profitability metrics improved, with supply in profit, NUPL, and realized P/L all rising. This highlights broad investor profitability and stronger sentiment, though elevated profit realization raises the risk of demand exhaustion.

In sum, the market benefited from macro-driven momentum, with ETF inflows and futures accumulation supporting the recovery. Yet, weakening spot flows, softer funding, and rising profit-taking point to emerging sell pressure. Sentiment is improving, but fragility remains, leaving Bitcoin vulnerable if demand fails to sustain.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.