3 Reasons Why PUMP Price Rally Could Extend Despite Whales Offloading $8 Million

PUMP price slipped after heavy whale selling, but smart money flows and retail demand suggest the rally is not over.

PUMP has dominated chatter on Solana’s meme coin scene, gaining more than 120% in a month. But after whales offloaded $8.26 million in tokens in the past 24 hours, the PUMP price slipped about 5%.

Selling pressure is real, yet charts and flows suggest the PUMP rally’s structure is still intact.

Selling Pressure Mounts, but Smart Money and Retail Flows Hold the Line

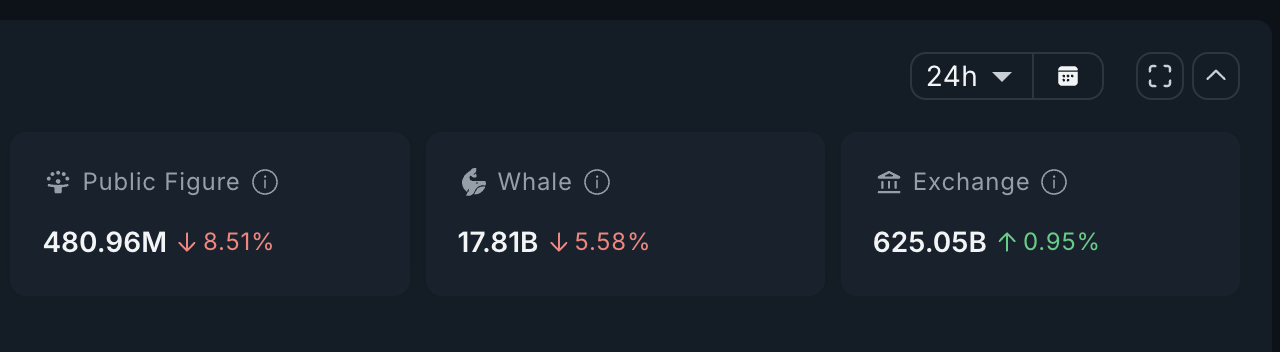

The last 24 hours saw whales cut their holdings by 5.58%, leaving 17.81 billion tokens. At current prices of $0.00775, that’s roughly $8.26 million worth sold.

Exchange balances also rose by about 5.88 billion to 625.05 billion, suggesting retail selling, or rather, profit booking. Even public figure wallets joined in, reducing their stash by 8.51% to 480.96 million.

In summation, PUMP recently experienced selling pressure of almost $55 million as key cohorts offloaded.

PUMP Selling Intensifies:

PUMP Selling Intensifies:

On paper, this explains the 5% dip. But two signals suggest the selling spree may not derail the bigger rally.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

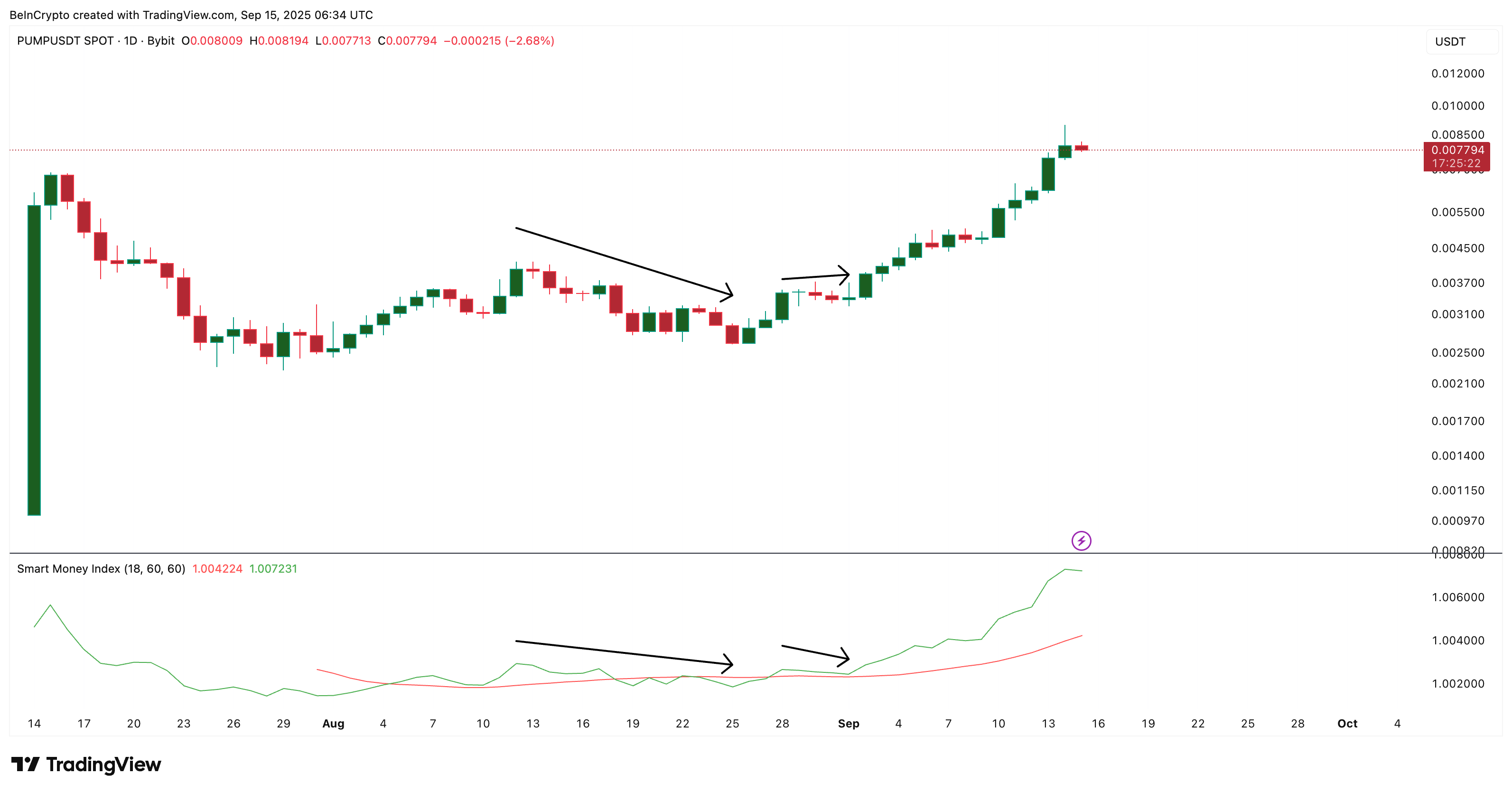

First, smart money flows have not rolled over. Wallets tagged as sharp traders are still positioned higher than earlier in September, showing that experienced players are not exiting. The recent flatlining in smart money looks similar to late August, when PUMP went sideways before resuming its climb.

PUMP Price Gets Smart Money Boost:

PUMP Price Gets Smart Money Boost:

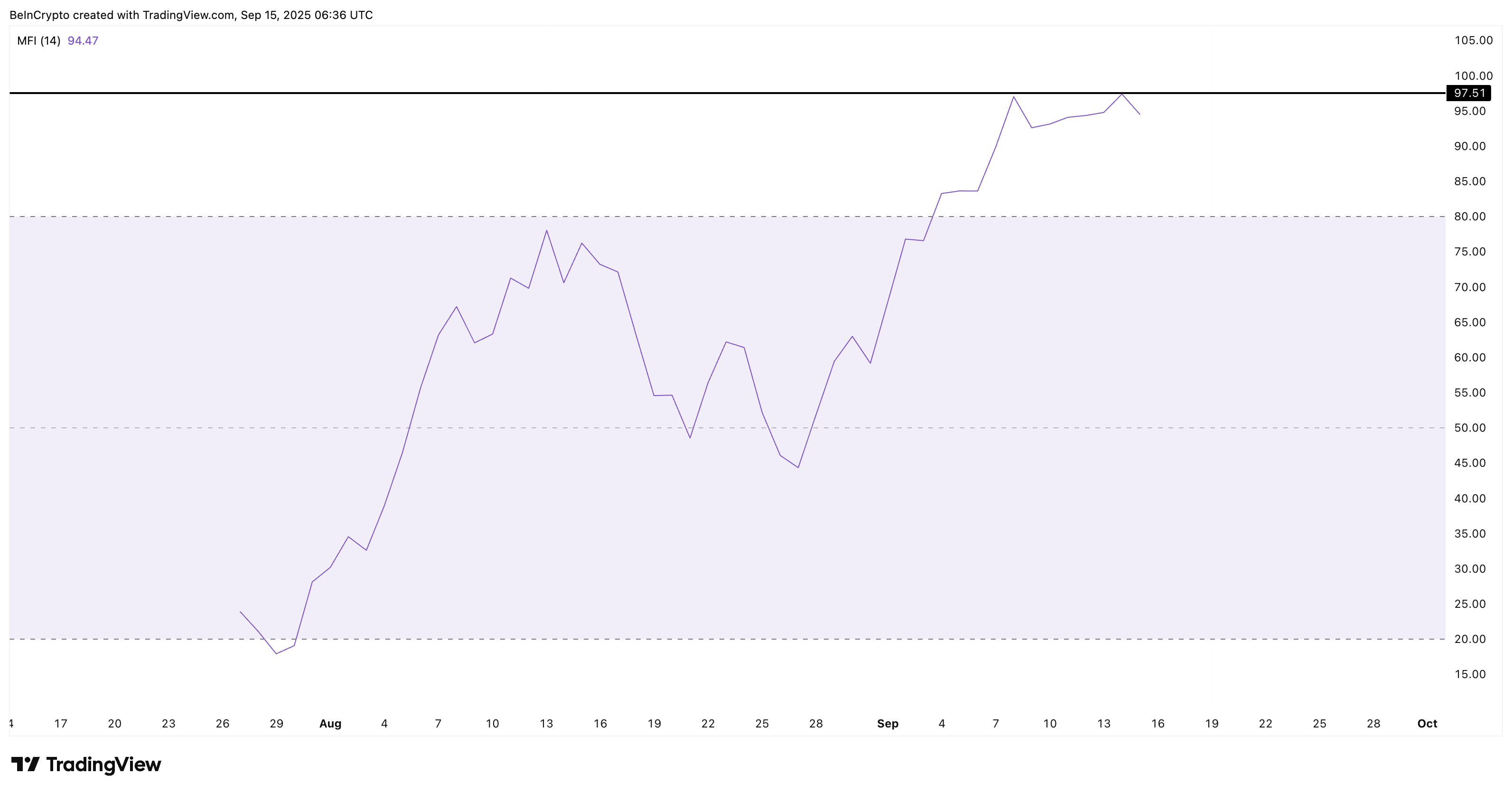

Second, retail demand is still there. The Money Flow Index (MFI), which measures buying pressure by blending price and volume, has made a higher high at 97.5. That’s above its September 8 peak, which preceded a 65% rally.

Rising MFI even as whales sell signals that dip buyers are stepping in.

Money Flow Continues Into PUMP:

Money Flow Continues Into PUMP:

Together, this mix of whale offloading and retail absorption sets the stage for a pullback rather than a collapse.

Channel Pattern and Bull-Bear Signals Show PUMP Price Path Still Bullish

To gauge near-term strength, the 4-hour chart gives the clearest view of PUMP’s short-term levels. It captures intraday shifts that the daily chart may smooth over, making it ideal for spotting pullbacks.

PUMP Price Analysis:

PUMP Price Analysis:

Here, the bull-bear power indicator — which measures whether buyers or sellers are stronger by comparing prices to an average line — still shows bulls in control.

Even as PUMP has moved sideways and dipped slightly, buyers continue to defend the $0.00771 level, close to where it trades now. This defense is critical, as it signals that bulls are not giving up ground easily.

At the same time, the PUMP price action remains inside an ascending channel, which happens to be the third bullish reason after the SMI and MFI. If selling deepens, supports sit at $0.00660 and $0.00621. Even a pullback to those levels would not break the channel, keeping the broader rally alive. Only a confirmed close below $0.00575 would flip the bias from bullish to bearish.

However, if the PUMP price reclaims $0.00876 (close to its all-time high) with a complete candle close, it would mean that the pullback has run its course.

And it would then prime the price to reach newer highs by helping break the bullish channel pattern, with the next set of targets sitting at $0.00940 and $0.009924.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Foreigners Endorsing Crypto: An Alternative Business Model in the Crypto World

A combination of Chinese and Western styles, everyone makes money together.

NAKA stock price plummets 54% in one day, is the market getting tired of DAT?

Investors are generally showing weak interest in Bitcoin Treasury (DAT) strategies, reflecting a saturated market demand and a rational return. Meanwhile, new altcoin DATs continue to emerge, but there is controversy within the industry regarding the prospects of such companies.

Bitget CEO Open Letter: On the Seventh Anniversary, Bitget Breaks the Boundaries of CEX

This article is an open letter from Bitget CEO Gracy Chen on the occasion of the company's seventh anniversary. Using the metaphor of the "nonexistent seventh gear" in motorcycle racing, she explains Bitget's spirit of pursuing breakthroughs and moving forward at full speed. In the letter, Gracy announces the new concept of the "Universal Exchange (UEX)" and defines it as the future form of exchanges.

Hyperliquid integrates Circle’s USDC and CCTP V2 on HyperEVM for cross-chain deposits and institutional access