- Litecoin Near Critical Support – LTC consolidates below $115 with weakening demand, risking a slide toward $110 if buyers remain subdued.

- Algorand Liquidity Remains Resilient – Even when it dropped by 3.38%, the growing trading volume of ALGO indicates positioning by the buyers and sellers around the 0.23 pivot line.

- VeChain Stands on Shaky Grounds, VET is supported by the fragile line at the level of $0.024, and the good news is that, provided that buyers remain active, the cryptocurrency will be able to recover and reach the levels of $0.025-0.026.

The mixed signals were evident in the cryptocurrency markets with Litecoin , Algorand and VeChain trading close to the key support levels. Each of the tokens showed unique technical trends, which determined the future momentum. Combined, they pointed out periods of consolidation where there is the risk of downside unless new demand is generated to push up prices.

Litecoin (LTC)

Litecoin fell by 1.64 percent in a day to trade at $113.36 and its market capital dropped to $8.64 billion. The trading volume decreased by 16.85 to 628.6 million dollars indicating low activity despite good liquidity conditions. The circulation supply was 76.3 million LTC, which was close to the capped supply of 84 million.

Source: Coinmarketcap

The price action was weak following the recurring unsuccessful attempts above the $115 116 region. The trend of momentum moved down at the end of the day indicating the continued pressure of selling in the short-term. The use of volume-to-market-cap ratio of 7.26 percent continued to show active trading pairs.

If $112 holds as support, Litecoin could stabilize before any recovery attempt. However, a breakdown may expose downside risk toward $110. The dynamics of scarcity are high but in the short run the sentiments are towards consolidation with little upside drivers.

Algorand (ALGO)

Algorand was down at 0.2321 and this represents a decrease of 3.38 per cent with a market capitalization of 2.03 billion. The daily volume increased by 16.46 percent to $102.7 million, which is an indication of increased participation with decreasing prices. The number of tokens in circulation is 8.77 billion out of 10 billion; this is a close to saturation.

Source: Coinmarketcap

The graph showed very steep turns mid-day which underscored market volatility. Since the prices had hit highs above the range of $0.2122, they have been on the downside and were resting around the levels of 0.23. It had strong liquidity, indicated by the value of 5.04% of the volume-to-market-cap ratio.

If Algorand maintains support above $0.23, consolidation could continue ahead of a rebound attempt toward $0.25. However, losing this pivot risks an extended decline toward $0.22. Current trends suggest traders remain active within these defined ranges.

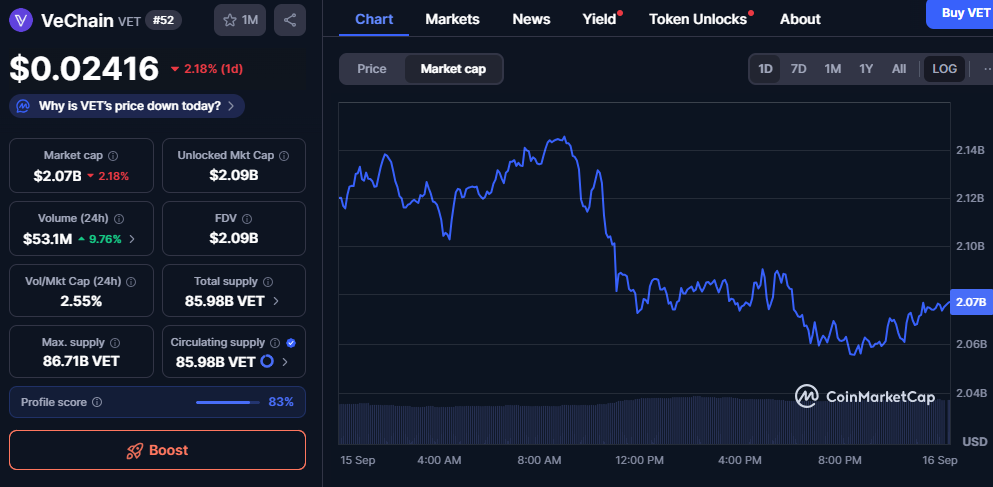

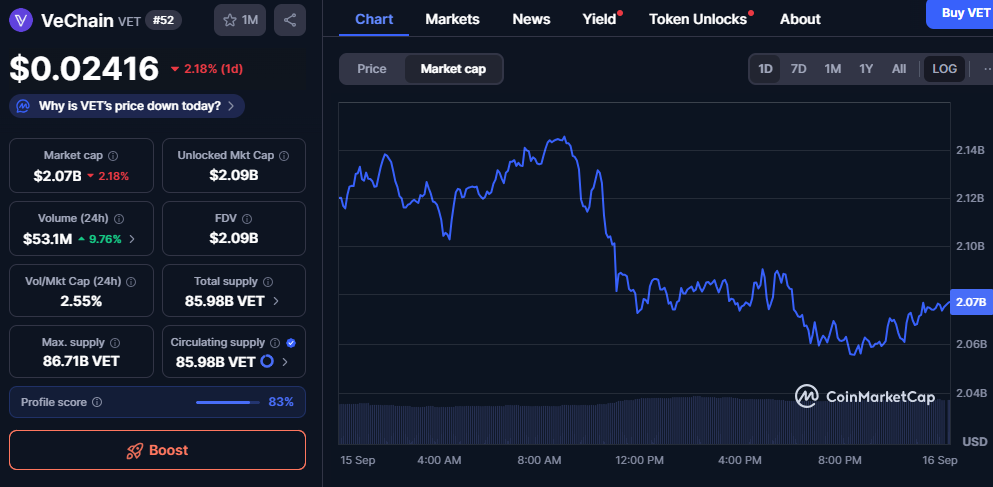

VeChain (VET)

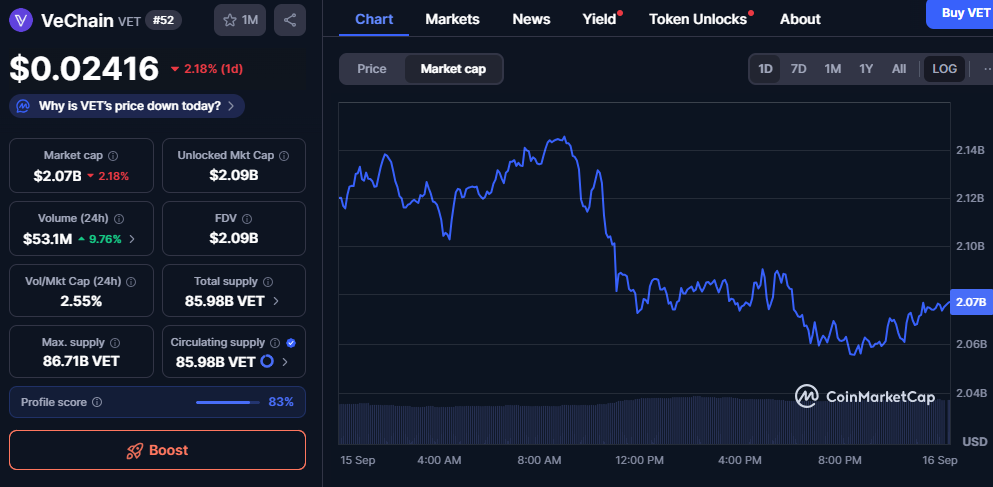

VeChain traded at $0.02416, slipping 2.18% on the day with a market cap of $2.07 billion. Trading volume climbed 9.76% to $53.1 million, highlighting stronger participation despite the bearish close. Circulating supply reached 85.98 billion, fully aligned with maximum supply availability.

Source: Coinmarketcap

Intraday weakness tested the $0.0240 floor multiple times, underlining fragile support. However, late-session buying activity helped prices stabilize above that threshold. A lower volume-to-market-cap ratio of 2.55% reflected moderate liquidity compared to peers.

If VeChain sustains support at $0.024, recovery attempts could target $0.025–$0.026. Failure to defend this zone may expose a drop near $0.0235. Momentum remains weak, but short-term stabilization hints at renewed attempts by buyers.

Summary

Litecoin consolidates below $115, Algorand tests volatility at $0.23, and VeChain struggles near $0.024 support. Each token highlights critical levels shaping September’s market direction. Together, they underscore how altcoins remain poised between consolidation phases and potential breakouts.