Bitcoin’s illiquid supply could hit 8.3M by 2032: Fidelity

Around 42% of Bitcoin’s current circulating supply, or 8.3 million Bitcoin

BTC$115,140, could be “illiquid” by 2032 at the current rate of Bitcoin treasury firm buying, according to asset management firm Fidelity.

In a report published on Monday, Fidelity identified two groups whose supply could be considered illiquid, with the criteria being that their Bitcoin supply has ticked up each quarter or at least 90% of the time for the last four years.

Based on this, it found two cohorts: Long-term Bitcoin holders and publicly-traded companies with at least 1,000 Bitcoin, the latter of which have been growing this year.

Bitcoin’s illiquid supply means there is less available on the open market, which could be positive for the price of Bitcoin.

“We estimate that this combined group will hold over six million Bitcoin by the end of 2025 — or over 28% of the 21 million Bitcoin that will ever exist,” said Fidelity.

It found that long-term Bitcoin holders, defined as those who have not moved Bitcoin from their wallet in at least seven years, have not witnessed any decrease in supply since 2016.

The second group, publicly traded companies holding at least 1,000 BTC, has also generally held strong on their Bitcoin holdings, only witnessing a single quarter of supply decrease in Q2 2022.

This cohort may also increase in the future, as there are currently 105 publicly traded Bitcoin holding companies. Currently, the publicly traded companies hold more than 969,000 BTC, amounting to 4.61% of Bitcoin’s total supply, according to data from Bitbo.

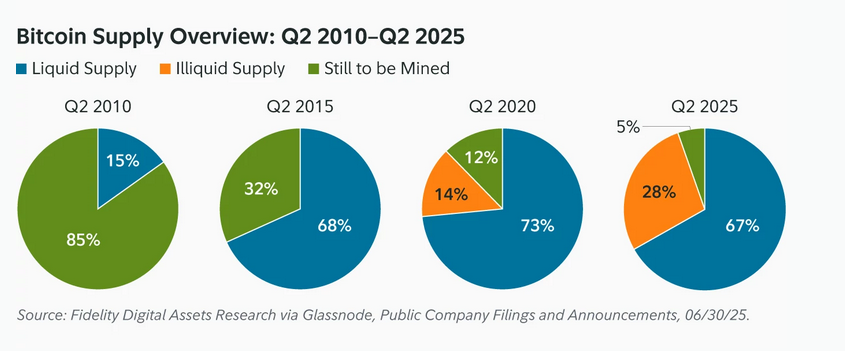

Bitcoin’s supply has changed drastically in the past 15 years. Source: Fidelity

Bitcoin’s supply has changed drastically in the past 15 years. Source: Fidelity

42% of Bitcoin supply to become illiquid

Looking ahead, Fidelity predicts that 8.3 million BTC could become illiquid by the second quarter of 2032.

The firm arrived at the figure by assuming that the group of wallets holding BTC for at least seven years will continue to increase their supply at the same rate as in the past ten years.

The firm did not factor in additional supply shortages created by additional public companies.

“At the close of Q2 2025, Bitcoin’s circulating supply stood at roughly 19.8 million. Of that, we estimate that nearly 42% — or over 8.3 million Bitcoin — will be considered illiquid by Q2 2032.”

Potential sell-off by the whales

The report highlighted that the two groups combined now hold Bitcoin worth $628 billion at an average price of $107,700, double last year, at the end of the second quarter.

This raises the question of what will happen to the price of Bitcoin should whales start selling their BTC stack.

Bitcoin whales have collectively sold BTC worth nearly $12.7 billion in the past 30 days, which is the largest sell-off since mid-2022. Meanwhile, the price of Bitcoin has decreased by 2% in the past 30 days, according to CoinGecko.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Foreigners Endorsing Crypto: An Alternative Business Model in the Crypto World

A combination of Chinese and Western styles, everyone makes money together.

NAKA stock price plummets 54% in one day, is the market getting tired of DAT?

Investors are generally showing weak interest in Bitcoin Treasury (DAT) strategies, reflecting a saturated market demand and a rational return. Meanwhile, new altcoin DATs continue to emerge, but there is controversy within the industry regarding the prospects of such companies.

Bitget CEO Open Letter: On the Seventh Anniversary, Bitget Breaks the Boundaries of CEX

This article is an open letter from Bitget CEO Gracy Chen on the occasion of the company's seventh anniversary. Using the metaphor of the "nonexistent seventh gear" in motorcycle racing, she explains Bitget's spirit of pursuing breakthroughs and moving forward at full speed. In the letter, Gracy announces the new concept of the "Universal Exchange (UEX)" and defines it as the future form of exchanges.

Hyperliquid integrates Circle’s USDC and CCTP V2 on HyperEVM for cross-chain deposits and institutional access