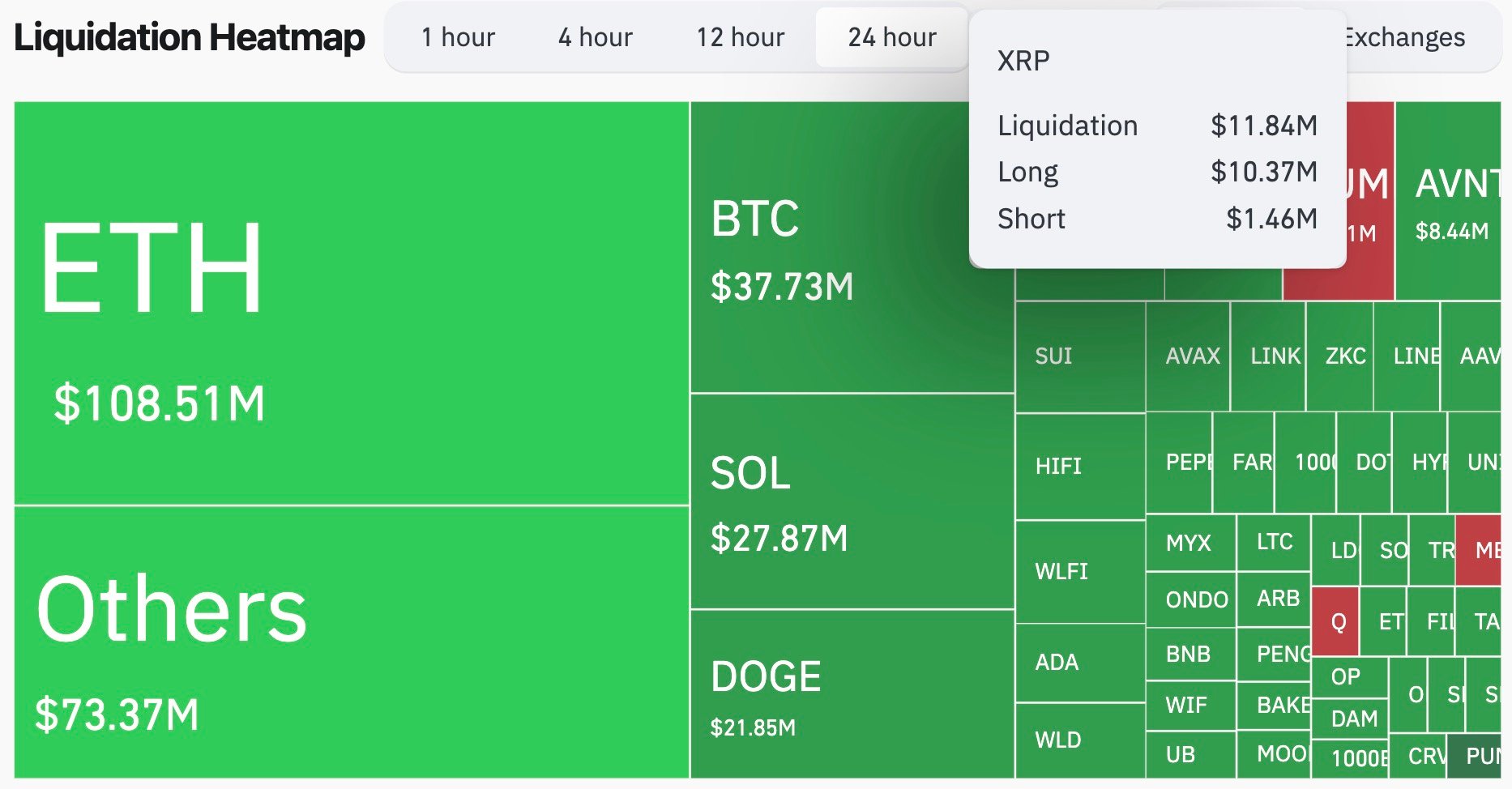

XRP liquidations spiked as leveraged long positions were force-closed, wiping out $11.84 million in 24 hours. Longs accounted for $10.37 million versus $1.46 million in shorts, creating a 710% imbalance and exposing extreme one-sided leverage among derivatives traders.

-

$11.84M total XRP liquidations in 24 hours

-

Longs: $10.37M (majority); Shorts: $1.46M

-

710% difference in long vs short liquidations; compare: ETH $108.5M, BTC $37.7M

XRP liquidations surged: $11.84M wiped out in 24 hours, with longs hit hardest. Read the full XRP price outlook and actionable takeaways from COINOTAG.

What caused the XRP liquidation surge?

XRP liquidations were driven by concentrated leveraged long positions that were force-closed after a short-lived price dip. Market-wide derivatives volatility amplified losses, causing $11.84 million in XRP liquidations over 24 hours while spot price movement remained relatively contained.

How did long vs short liquidations compare?

Long positions accounted for $10.37 million of the total, while shorts made up $1.46 million. This created a 710% imbalance, indicating traders were heavily skewed toward leverage on the long side before the move. CoinGlass is cited for the liquidation figures as a derivatives data provider (plain text reference).

Source: CoinGlass

How did XRP price react to the liquidations?

The XRP price dipped to $2.96 in early trading before recovering to about $2.99, showing a tight spot range despite large derivative losses. The $3.00 level remains a key technical reference: holding it could stabilize spot markets; failing it may renew liquidation pressure for levered traders.

Why does XRP stand out versus other assets?

Although XRP’s dollar-value liquidations were lower than Ethereum’s $108.5M and Bitcoin’s $37.7M, its imbalance ratio is notable. The relative size of long liquidations versus shorts highlights extreme one-sided positioning unique to XRP derivatives during this event.

Frequently Asked Questions

How large were XRP long liquidations compared to shorts?

Long liquidations totaled $10.37 million versus $1.46 million for shorts, creating a 710% gap and revealing a pronounced long-side bias among leveraged traders during the event.

What price levels should traders watch for XRP?

Traders should watch the $3.00 mark closely. Holding above $3.00 may reduce forced selling; a decisive break below could trigger further derivative liquidations and volatility.

Key Takeaways

- Total impact: $11.84M in XRP liquidations within 24 hours.

- Positioning: Longs bore the brunt — $10.37M vs $1.46M in shorts (710% imbalance).

- Market insight: Spot price showed limited movement, highlighting a divergence between derivatives stress and spot liquidity.

Conclusion

This liquidation event underscores the risks of concentrated leverage in XRP derivatives markets. COINOTAG analysis shows a severe long-side imbalance, while spot prices held a narrow range near $3.00. Traders should monitor derivatives flows and technical levels and adjust leverage to manage downside risk.