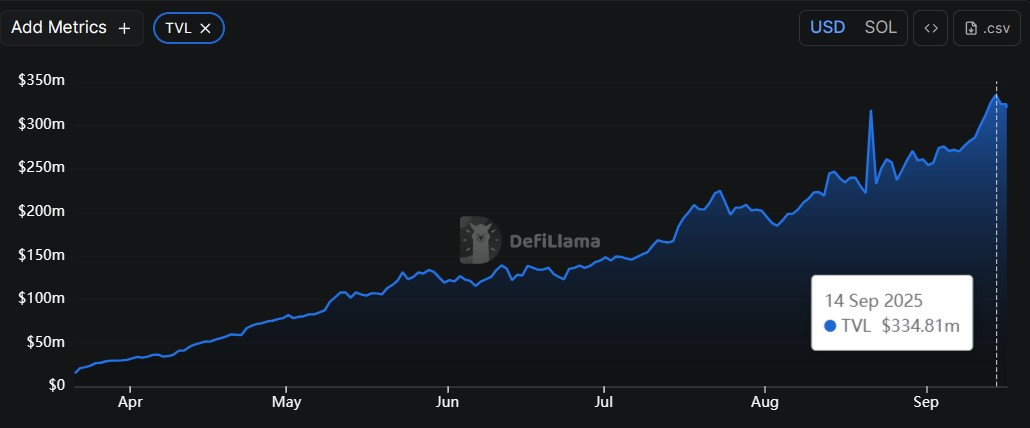

Pump.fun trading volume surged above $1 billion on Monday, signaling a sharp uptick in memecoin activity. Solana-based Pump.fun processed $942 million on Sunday and reached $1.02 billion Monday, while its total value locked (TVL) climbed to $334 million, underlining rising DeFi engagement.

-

Pump.fun surpassed $1.02B in daily trading volume — a clear memecoin-sector catalyst.

-

Pump.fun’s TVL hit a record $334M, supporting protocol liquidity and creator payouts.

-

Memecoin sector cap spiked to $83B (30-day high), supporting elevated trading flows.

Pump.fun trading volume tops $1.02B as memecoin rally lifts TVL to $334M — COINOTAG’s data-driven analysis and key takeaways. Read the full report now today.

Pump.fun recorded a trading volume of $942 million on Sunday, followed by a spike to $1.02 billion on Monday as the broader memecoin market surged.

Solana-based memecoin launchpad Pump.fun recorded more than $1 billion in daily trading volume Monday as the sector extended its September rally.

Data from decentralized exchange Jupiter showed Pump.fun processed $942 million in transaction volume on Sunday before topping $1.02 billion on Monday. These figures reflect heightened user activity across memecoin trading and liquidity pools.

Pump.fun volume data. Source: Jupiter

Pump.fun volume data. Source: Jupiter

What is Pump.fun trading volume and why does it matter?

Pump.fun trading volume is the total value of trades routed through the Pump.fun launchpad and related liquidity channels over a given period. High daily volume indicates increased user activity, tighter spreads on DEXs, and greater fee revenue for the protocol, which can support creator payouts and platform growth.

How did Pump.fun reach $1.02 billion in daily volume?

The move to $1.02 billion followed a $942 million day on Sunday. Short-term drivers include a broader memecoin market surge, increased liquidity on Solana, and elevated trading on decentralized exchanges. Pump.fun also reported creator reward distributions that likely boosted platform engagement.

Total value locked of the Pump.fun protocol. Source: DefiLlama

Total value locked of the Pump.fun protocol. Source: DefiLlama

How has Pump.fun’s TVL and revenue trended?

Pump.fun’s total value locked (TVL) reached a high of $334 million on Sunday, a milestone for the protocol. DefiLlama data shows rising TVL and increased 24-hour revenue, placing Pump.fun third among DeFi protocols for daily revenue behind Circle and Tether on the referenced reporting window.

The protocol also reported paying out $4 million in creator rewards on Monday, with a majority allocated to first-time creators—an operational metric that demonstrates active user incentives and content monetization momentum.

Source: Pump.fun

Source: Pump.fun

When did memecoin market cap surge and what was the scale?

The broader memecoin sector cap climbed to $83 billion on Sunday, a 30-day high and near the $85 billion mark seen in July. At the time of reporting, the memecoin sector’s overall market cap measured approximately $76 billion, reflecting intraday volatility across tokens.

Comparative metrics table

| Trading volume (Pump.fun) | $942 million | $1.02 billion |

| Total Value Locked (TVL) | $334 million (peak) | $334 million (maintained) |

| Memecoin market cap (sector) | $83 billion (30-day high) | ~$76 billion (current) |

| 24h revenue rank (DeFi) | 3rd (behind Circle, Tether) | 3rd |

Why do creator rewards and livestreaming matter for Pump.fun?

Creator rewards and livestreaming features increase retention and on-platform liquidity. Pump.fun reported $4 million in creator payouts, most to first-time creators, and co-founder commentary suggests livestreaming adoption is growing versus niche competitors. These product metrics can directly support sustained trading volume.

Frequently Asked Questions

How reliable are the reported Pump.fun metrics?

Reported metrics originate from decentralized exchange and DeFi aggregator data and protocol disclosures. While Jupiter and DefiLlama provide on-chain aggregation, protocol-level claims (for example, market-share percentages) may not be independently verifiable without on-chain proofs.

Will Pump.fun volume gains affect broader memecoin prices?

Elevated platform volume often correlates with higher speculative interest in memecoin tokens, which can raise token prices temporarily. However, price direction depends on wider liquidity and market sentiment across exchanges and wallet flows.

Key Takeaways

- Volume spike: Pump.fun exceeded $1.02B in daily trading, signaling strong short-term demand.

- Rising TVL: TVL reached $334M, supporting liquidity and revenue generation.

- Product impact: Creator rewards and livestreaming appear to have boosted platform engagement and revenue.

Conclusion

Pump.fun’s recent metrics — including a peak daily trading volume above $1 billion and a TVL high of $334 million — point to meaningful user activity amid a resurgent memecoin market. COINOTAG will continue to monitor on-chain data and protocol disclosures as the sector evolves. Subscribe for ongoing data-driven reporting.