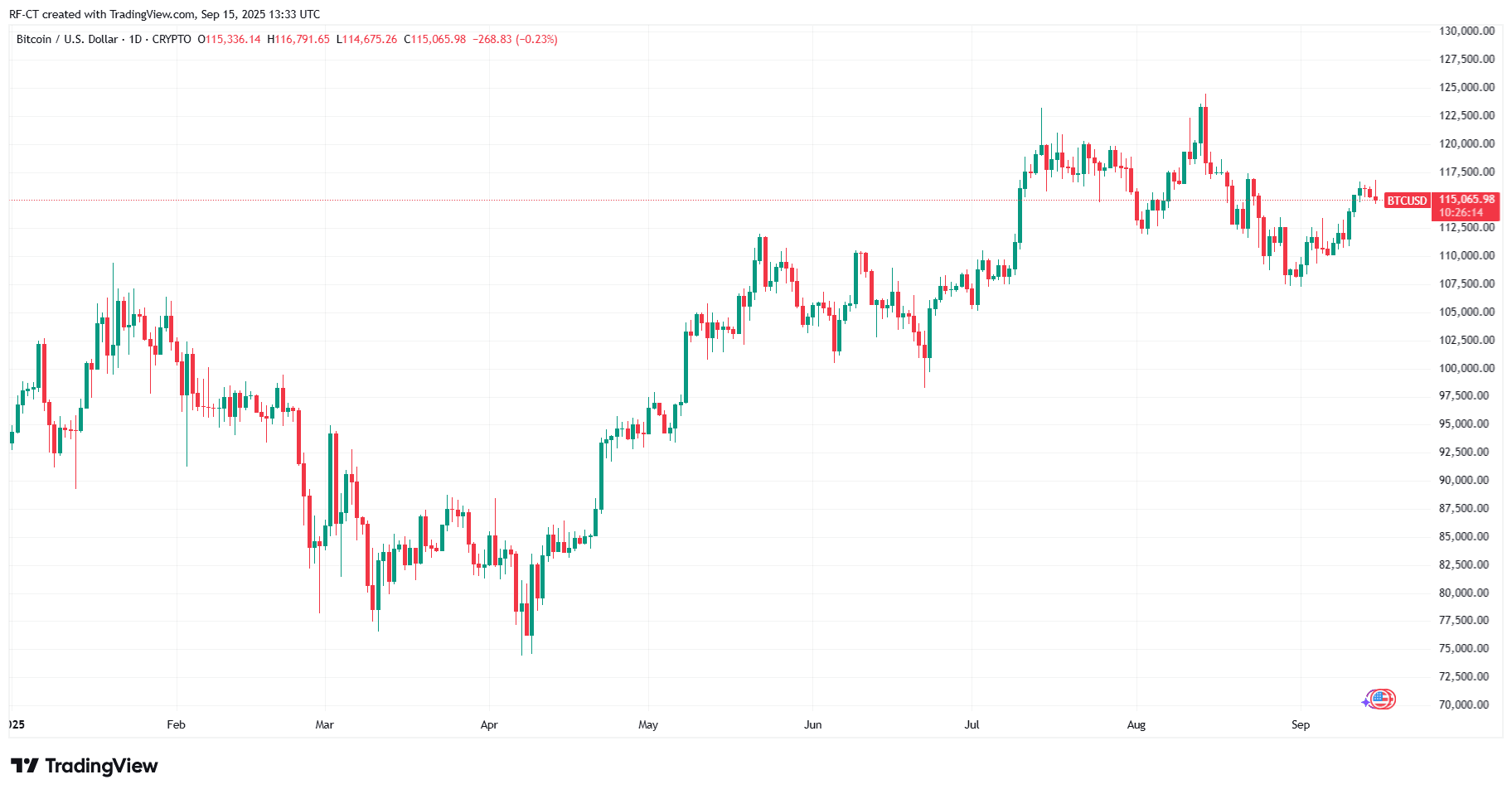

1 trillion dollars.

You read that right—this isn’t the GDP of some small country, but rather the “super package” Tesla is preparing for its boss, Elon Musk.

Recently, Tesla’s board announced a jaw-dropping proposal: they’ve designed an unprecedented compensation plan for Musk. Over the next decade, if Musk can lead the team to accomplish a series of “almost impossible” tasks, he could receive up to 1 trillion dollars in rewards. This is by far the largest executive incentive plan in the history of American companies.

According to the proxy statement Tesla filed last Friday, the additional shares Musk could receive would increase his stake in Tesla to 25%. Musk has previously stated publicly that he hopes to achieve this level of ownership. Shareholders are scheduled to vote on these proposals on November 6.

Of course, this money isn’t just handed over for nothing. There’s no such thing as a free lunch—especially not one this big. Tesla has set a series of sky-high targets for Musk, including expanding Tesla’s robotaxi, FSD, and robotics businesses, as well as increasing its market cap from the current approximately 1 trillion dollars to at least 8.5 trillion dollars.

So, the question is: how can this 1 trillion dollars move from what seems like an impossible dream into Musk’s pocket? Let’s crunch the numbers together and see how Musk could turn this dream into reality.

Building Cars Isn’t the End—It’s the Ticket to the Future

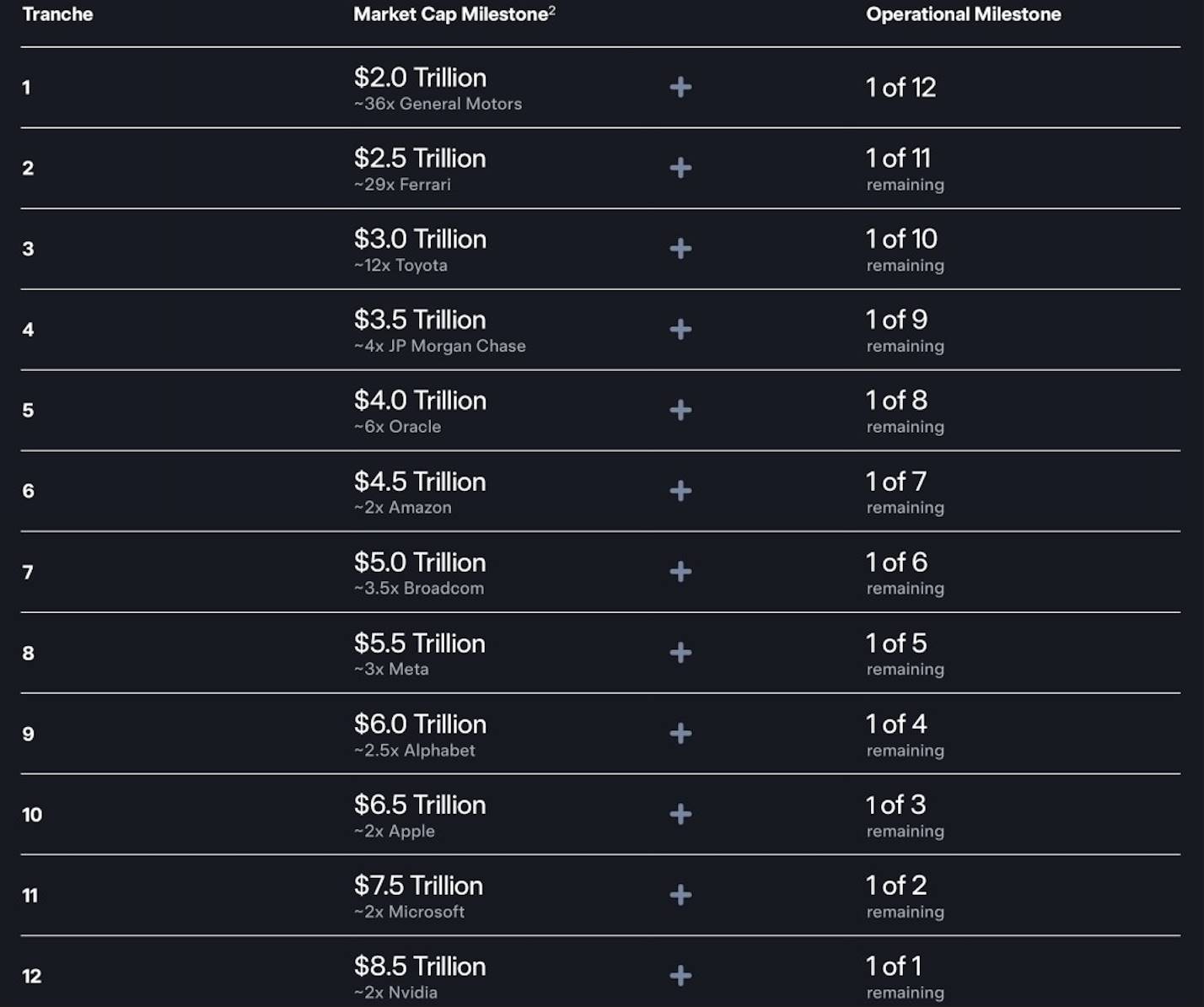

You can think of this as a hell-level challenge game tailor-made for Musk. The entire plan is to be completed within ten years, divided into 12 major checkpoints. With each checkpoint cleared, he unlocks a portion of the equity rewards.

And to open each “treasure chest,” you need to turn two keys at the same time—both are indispensable.

First key: Company Market Cap

This key is straightforward: make Tesla bigger. The starting goal is 2 trillion dollars (about double its current size), then, like climbing stairs, each checkpoint adds 500 billion, ultimately reaching a staggering 8.5 trillion dollars. What does that mean? It’s like adding another “Amazon + Google” on top of today’s Tesla.

Second key: Hardcore Performance

It’s not enough to just inflate the stock price—there must be solid business support. This second key is that Tesla’s four core businesses must achieve “milestones,” each one pushing the limits:

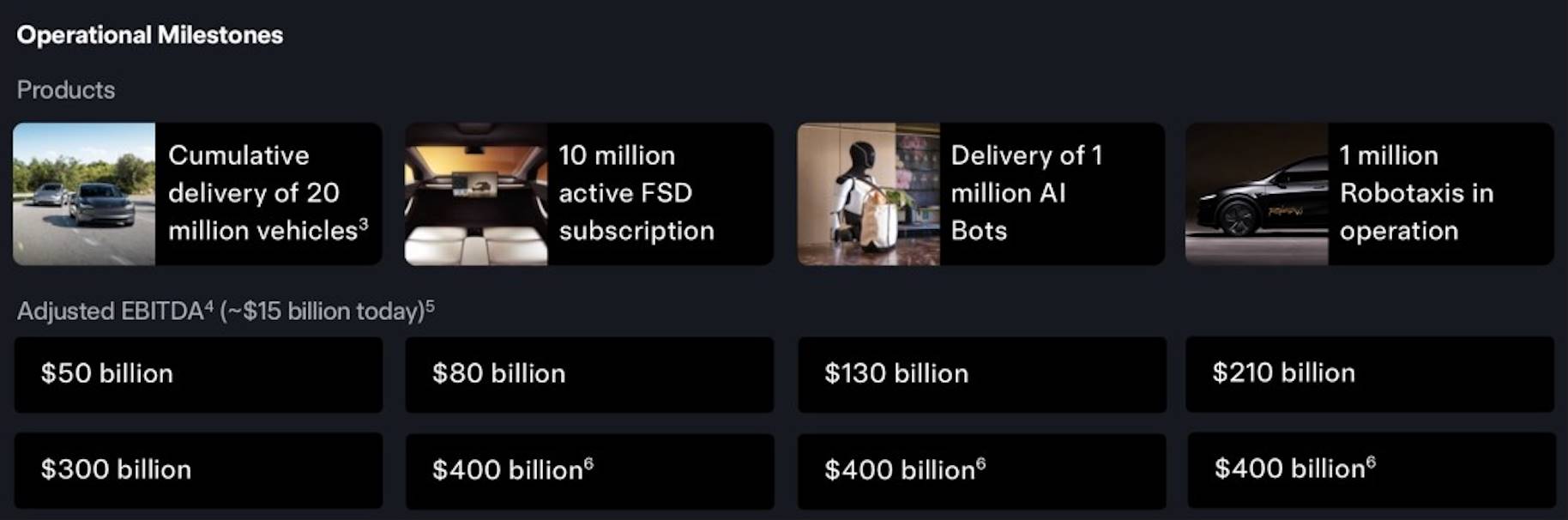

-

Sell another 12 million cars: By 2025, Tesla will have spent nearly twenty years delivering about 8 million cars in total. This plan requires selling another 12 million over the next decade.

-

Develop 10 million FSD paying users: This means the FSD (Full Self-Driving) software must become extremely user-friendly and safe, so that the vast majority of owners feel “it’s worth the money” and are willing to subscribe.

-

Deploy 1 million Robotaxis: This is essentially a massive project from 0 to 1. Turning driverless taxis from sporadic tests into a million-vehicle commercial fleet requires overcoming huge technological, regulatory, and safety hurdles.

-

Deliver 1 million humanoid robots: To mass-produce and successfully market a million Optimus robots (like those in the movies) within ten years—every step is a huge challenge.

In addition to these four pillars, the plan is also tied to a series of continuously growing EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) targets, starting from 50 billion dollars and reaching an astonishing 400 billion dollars. This ensures that while Tesla pursues scale, it must also maintain strong profitability and healthy cash flow.

You might wonder, with so many grand goals, where do you even start?

The automotive business is Tesla’s “foundation”—the starting point for all future stories. The hard metric in Musk’s compensation plan is to reach a total delivery of 20 million vehicles over the next 10 years. This means, on top of the current base, they need to ramp up annual production from the current 2 million level to selling three or four million cars per year.

Assuming more affordable models in the future, let’s say the average selling price per car is $40,000. With annual sales of 3.5 million vehicles, just car sales alone would bring Tesla $140 billion in revenue each year.

In many people’s eyes, car manufacturing is a “heavy asset” industry with low valuations. But considering Tesla’s brand, technology, and profitability, it could be given a P/S (price-to-sales ratio) of 5-7 times.

More importantly, every Tesla sold is not just a car, but a “mobile terminal” to the future. So, overall, when Tesla achieves the 20 million delivery milestone, the automotive business alone could support a valuation of 1 to 1.5 trillion dollars.

Where Does the Additional 7.5 Trillion Dollar Valuation Come From?

If Tesla’s cars are the “body” that keeps running, then the FSD software is the “soul” injected into it.

Another milestone in this plan is 10 million FSD subscription users. Let’s do some simple math: suppose the global average monthly subscription fee is $100. When 10 million users are on board, that means $1 billion per month, or $12 billion per year!

FSD subscriptions are essentially a SaaS business, characterized by high gross margins and strong customer stickiness. The market is willing to pay very high valuation multiples for high-quality SaaS revenue, often 20-40 times P/S or even higher. Given FSD’s uniqueness and its central role in the trillion-dollar mobility market, a super-high valuation is justified.

Just this $12 billion in annual revenue, if the market believes its growth potential is huge (for example, licensing to other automakers), could be valued at over 100 times P/S, directly contributing $1.2 trillion in market cap. If future price increases or tiered services are considered, this business could reach $20 billion in annual revenue, supporting a valuation of $1.6 to $2 trillion at an 80-100 times P/S.

Once the FSD “brain” is smart enough, Tesla’s trump card—Robotaxi (driverless taxi)—will take the stage.

The goal here is to deploy 1 million Robotaxis, creating a massive, driverless, money-making fleet. Today, your private car sits idle 95% of the time. In the Robotaxi network, every Tesla can become a 24/7 money-making tool for you.

-

Suppose each Robotaxi operates 5,000 hours per year, generating $25 net income per hour for Tesla (after electricity, maintenance, cleaning, etc.).

-

Annual revenue per vehicle is about $125,000, so a fleet of 1 million vehicles would generate $125 billion per year.

This is a brand-new, technology-driven, high-margin service network. Its business model is similar to Uber or Didi, but without driver costs, so profit margins are huge. The market will view it as a combination of technology and utility, and a 20-25 times P/S is entirely possible. Therefore, the Robotaxi network alone could support a valuation of $2.5 to $3 trillion.

When automotive, energy, AI software, and mobility networks are all in place, Tesla will set its sights on an even grander goal: Optimus humanoid robots. The target here is to get 1 million Optimus robots into factories, warehouses, and even homes.

This isn’t just about selling robots at a $20,000–$30,000 hardware price. The real power lies in disrupting the largest market of all—the labor market.

-

Model 1: Hardware sales. 1 million units × $25,000/unit = $25 billion annual revenue. This is just the beginning.

-

Model 2: Robot-as-a-Service (RaaS). Hiring a factory worker costs at least $50,000 per year. Now, a factory rents an Optimus robot from Tesla for just $30,000 per year, saving $20,000 annually. Annual revenue = 1 million units × $30,000/unit = $30 billion.

Optimus is targeting the global labor market, worth tens of trillions. So, we can’t value it with traditional metrics. The capital market will define a whole new track for it, and a P/S of 50 or even 100 times is a bet on the future.

Even just based on $30 billion in annual service fees, at an 80 times P/S, its valuation would reach $2.4 trillion. If the market believes Tesla will dominate this trillion-dollar emerging industry, it could be valued at $2.5 to $3.5 trillion.

Beyond valuation, this compensation plan also includes an extremely stringent target—annualized EBITDA of up to $400 billion, which is the ultimate condition for unlocking a key part of the compensation plan. Based on the above projections, how far are we from this “ultimate goal”?

Musk’s trillion-dollar compensation plan is not a free ride. In addition to achieving a sky-high market cap, there’s also an extremely harsh ultimate condition: earning $400 billion in “core profit” every year.

Based on the boldest predictions above, let’s sum up the profits from Tesla’s future “money printers”:

-

Automotive business ($140 billion revenue, 20% margin) = $28 billion

-

FSD software ($12 billion revenue, 90% margin) = $10.8 billion

-

Robotaxi network ($125 billion revenue, 70% margin) = $87.5 billion

-

Optimus robot services ($30 billion revenue, 80% margin) = $24 billion

Adding in the often-overlooked energy and other businesses, let’s optimistically give it $30 billion.

Now, let’s total it up: 28 + 10.8 + 87.5 + 24 + 30 = $180.3 billion. That’s still $220 billion short of the $400 billion ultimate goal—not even halfway there!

So, how can this massive $220 billion gap be filled?

First, there must be absolute economies of scale. The previously assumed 1 million Robotaxis and 1 million Optimus robots are far from enough. These numbers need to be ramped up to 2 million or even 3 million. Just 2.5 million Robotaxis alone could directly contribute over $200 billion in EBITDA, enough to fill most of the gap single-handedly.

Besides quantity, “quality” must also improve—meaning higher profit margins. FSD pricing or subscription rates may be higher than we expect, Optimus service fees may rise as capabilities improve, and car manufacturing costs may drop to unimaginable levels due to scale.

Furthermore, in this entire plan, the energy business is like a “hidden boss.” Imagine, in the future, tens of millions of Tesla EVs and countless homes and factories using Tesla’s energy storage batteries. Network them together, and you have a global “virtual power plant.” Selling electricity during peak times and storing it during off-peak—just this “middleman” business could be a hundred-billion-dollar profit space.

A Pair of “Golden Handcuffs”—A Trillion-Dollar Gamble

After discussing this grand, almost sci-fi blueprint, let’s zoom back in and look at the human dynamics and business games behind it. This sky-high compensation is far more than just money; it’s a brilliant game played out in the open.

Musk’s intentions have long been no secret. He has publicly stated more than once that he wants about 25% voting power in Tesla; otherwise, he’d rather go solo on AI and robotics.

After Musk sold a large amount of stock to buy Twitter (now X), his ownership stake dropped significantly. This new compensation plan, if completed from start to finish, would bring his stake back to the 25%-29% range.

So, this is more like a scheme for him to “legitimately” and firmly hold the steering wheel of Tesla’s future. He wants to ensure that his AI visions—which many see as risky or even crazy—won’t be derailed by short-term-focused shareholders or “barbarians at the gate.”

For Tesla’s board, this is a pair of “golden handcuffs” for Musk.

Musk is an energetic “Iron Man of Silicon Valley,” simultaneously running rocket-building SpaceX, brain-interface company Neuralink, and making waves in social media and politics.

The board’s biggest headache is probably: how do you get this “patriarch” to focus his main energy solidly on Tesla?

The answer is this ten-year plan, deeply tied to the future blueprint he drew himself. It’s undoubtedly the most glamorous pair of “golden handcuffs” tailored for him. Want the reward? Then you must deliver on these promises over the next decade.

So, circling back to our original question: how exactly will Musk take home this 1 trillion dollars?

The answer: by personally transforming Tesla from a leading electric vehicle company into a super tech platform integrating AI software, robotics, shared mobility, and energy.

Therefore, for shareholders voting on November 6, the choice is unusually clear and crucial. This vote is far more than deciding whether to give the boss a sky-high bonus. It’s more like a national referendum, letting every investor answer with real money:

Are you investing in a better car company, or in an AI and robotics empire that could define the next era?

No matter the outcome, this compensation plan itself has already painted a stunning vision of the future. It tells the world in the most direct way: in Musk’s dictionary, limits are meant to be broken.