Fidelity Digital Assets forecasts 42% Bitcoin illiquid supply by 2032

Fidelity Digital Assets projects that 8.3 million BTC, or 42% of the Bitcoin supply, will be illiquid by 2032.

- Fidelity Digital Assets projects that 42% of the BTC supply will be illiquid by 2023

- Public companies and long-term holders will likely account for the majority of these holdings

- If the projections are true, they will have a significant impact on the price of Bitcoin

Bitcoin may become scarcer than ever, according to investment giant Fidelity. On Tuesday, September 16, Fidelity Digital Assets published a report on the potential state of the Bitcoin market in the coming years. According to the report, about 8.3 million BTC, or 42% of the current Bitcoin supply, may be in the hands of holders who are not looking to sell.

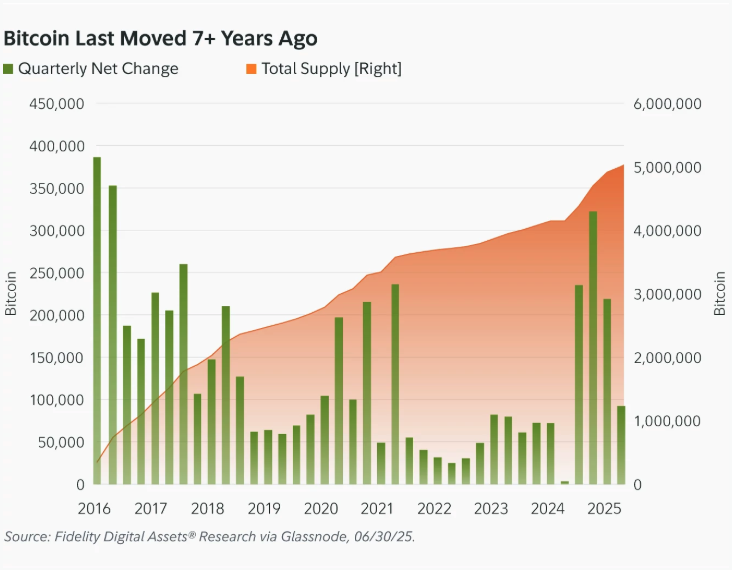

The largest contributors to the growth of this illiquid supply are long-term holders and public firms. Notably, Fidelity Digital Assets noted that the supply of Bitcoin that hasn’t been moved for seven or more years is steadily increasing. This figure currently stands at more than 350,000 Bitcoin (BTC) .

Quarterly net change and total supply of Bitcoin balances that did not decrease in seven years | Source: Fidelity Digital Assets

Quarterly net change and total supply of Bitcoin balances that did not decrease in seven years | Source: Fidelity Digital Assets

Public companies are increasingly buying up Bitcoin

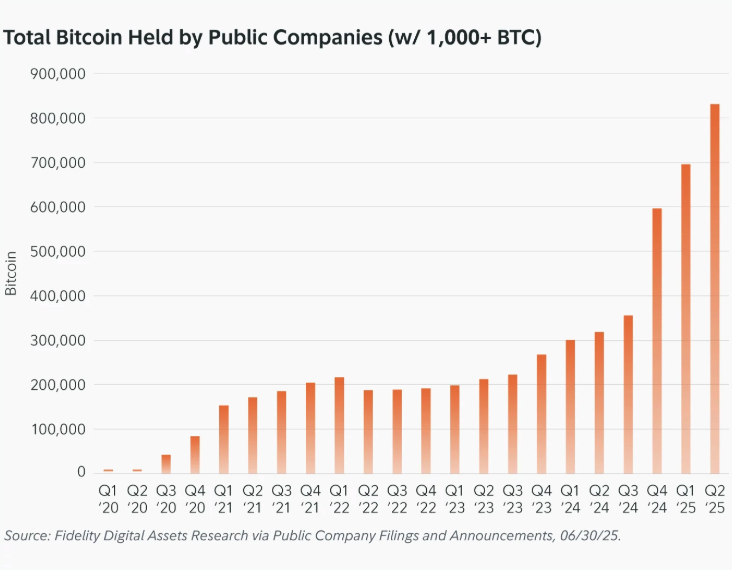

Public companies are another significant contributor to the illiquid supply. Their holdings have accelerated since the fourth quarter of 2024 and currently stand at more than 830,000 BTC. Moreover, the vast majority of these holdings, according to Fidelity Digital Assets, is concentrated among the top 30 holders.

Total number of BTC held by public companies | Source: Fidelity Digital Assets

Total number of BTC held by public companies | Source: Fidelity Digital Assets

Both public companies and long-term holders have contributed to positive price pressure on Bitcoin. Moreover, the value of their combined holdings has more than doubled since the same time last year.

Assuming the same rate of accumulation over the past 10 years continues, Fidelity Digital Assets projects that 42% of all Bitcoin could be illiquid by 2032. Still, the report cautions that these trends may change. Specifically, in July 2025, holders sold 80,000 “ancient Bitcoin,” which had been held for more than 10 years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Opinion: The GENIUS Act Has Become Law, Banks Should Not Attempt to Rewrite It Now

When there is competition, consumers are the real winners.

How much further can the institutional bull market go after the rate cut?

The project philosophies of Bitcoin, Ethereum, and Solana correspond to three human instincts when facing the future: survival, order, and liquidity, respectively.

Overtake partners with World to bring Proof-of-Human to the OVERTAKE trading marketplace

When identity verification is combined with custodial payments, the reliability of transactions is significantly enhanced, which has the potential to drive large-scale user adoption and long-term market expansion.

Big Volatility During the Rate-Cut Cycle: Will Bitcoin Rise First and Then Fall?

The Federal Reserve has begun a rate-cutting cycle, which could trigger a parabolic surge; however, this bull market may end with a historic crash.