Date: Tue, Sept 16, 2025 | 11:56 AM GMT

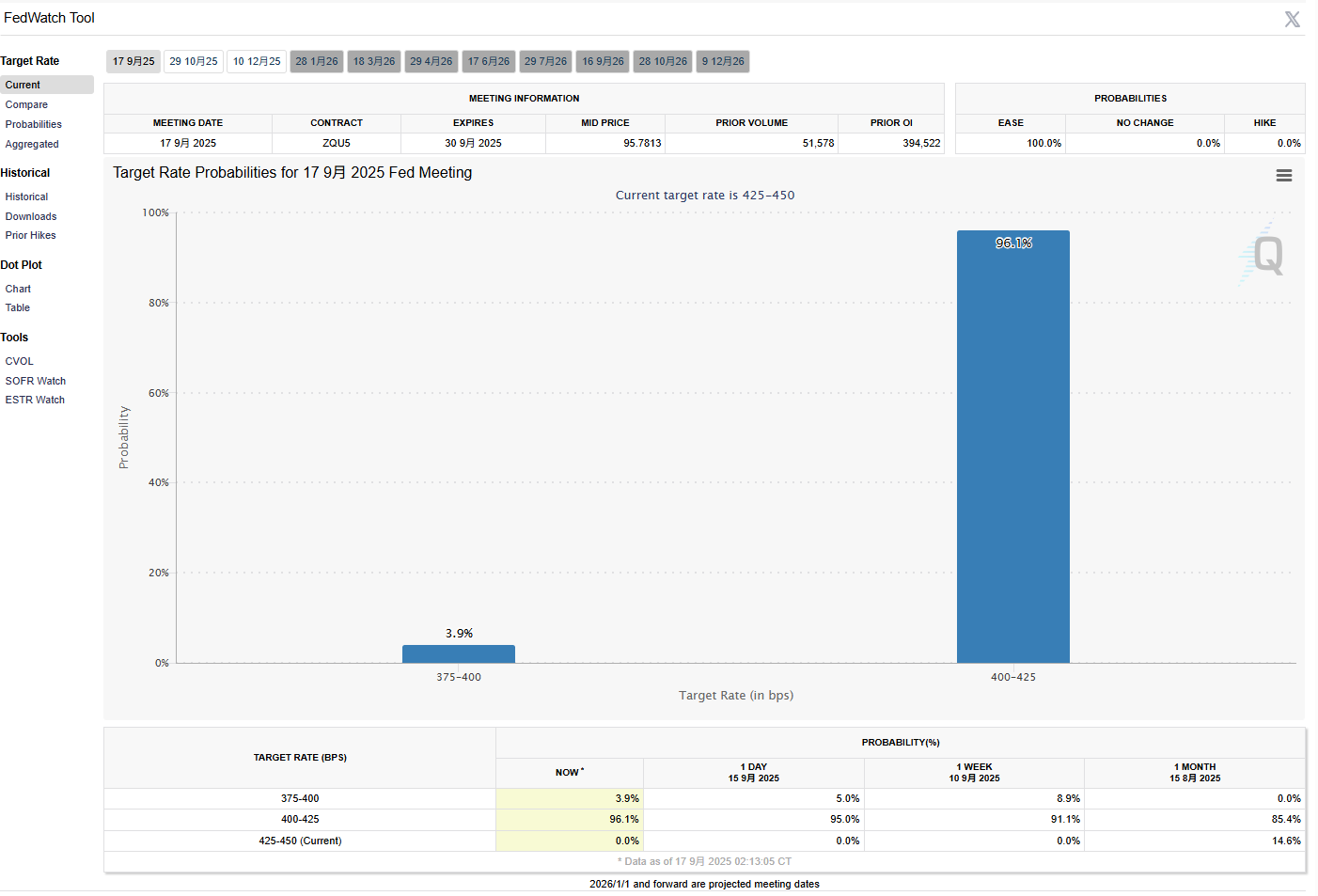

The cryptocurrency market is showing slight volatility amid the US Federal Reserve meeting this week, with Bitcoin (BTC) and Ethereum (ETH) both trading flat today. Meanwhile, several altcoins are delivering mixed performances — including Filecoin (FIL).

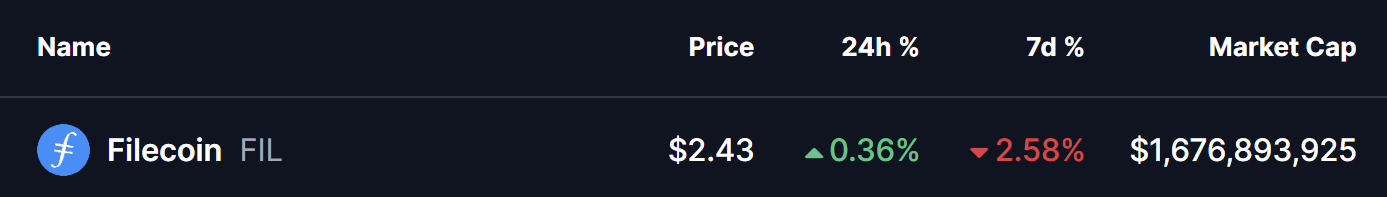

FIL is trading in green after wiping out its weekly gains. However, beneath the short-term weakness, the chart shows a much more important signal: the token is currently retesting a textbook breakout, and the outcome of this retest could decide its next major move.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting Falling Wedge Breakout

For several weeks, FIL was trading inside a falling wedge — a classic bullish reversal pattern that often precedes significant rallies. The token found support near $2.20 and then rebounded sharply.

This rebound pushed FIL above the wedge’s descending resistance line, confirming a breakout around $2.43. That move carried FIL as high as $2.64, touching resistance close to the 200-day moving average (MA).

Filecoin (FIL) Daily Chart/Coinsprobe (Source: Tradingview)

Filecoin (FIL) Daily Chart/Coinsprobe (Source: Tradingview)

However, as is common after breakouts, the price has since pulled back to retest the breakout trendline. At the moment, FIL is hovering near $2.43, where buyers could be preparing to step back in.

What’s Next for FIL?

The current retest looks healthy but is still in its early phase. For bulls to regain full control, buyers must hold the trendline support and ideally push the price back toward the 200-day MA and the $2.64 local high. A decisive breakout above these levels could act as the trigger for a larger rally.

According to the wedge breakout projection, FIL could climb toward the $3.20–$3.25 zone, marking nearly a 33% upside from current levels.

On the flip side, if FIL fails to hold the breakout trendline, it risks falling back inside the wedge — which would raise the possibility of a fake breakout and delay the bullish outlook.