UK–US crypto cooperation is a proposed regulatory alignment to accelerate innovation and attract investment by coordinating rules on stablecoins, exchanges, and digital securities. The UK aims to adopt a more crypto-friendly approach aligned with US priorities to unlock wider adoption and increase transatlantic market access.

-

Regulatory alignment on stablecoins and digital securities

-

Closer UK–US coordination aims to reduce cross-border friction for crypto firms and improve investor access.

-

Surveys show growing UK retail interest: 27% open to crypto in retirement funds; bank friction remains a barrier.

Meta description: UK–US crypto cooperation: regulatory alignment on stablecoins and digital assets aims to unlock UK innovation and attract US investment—read next steps.

The UK has discussed adopting a more crypto-friendly approach with the US in a bid to boost industry innovation and attract more investment to Britain.

What is UK–US crypto cooperation?

UK–US crypto cooperation refers to coordinated regulatory and policy efforts by British and American authorities to create compatible frameworks for stablecoins, exchanges, and digital securities. The goal is to reduce market friction, encourage safe innovation, and expand access to US capital for UK-based crypto firms.

How did talks between UK and US officials unfold?

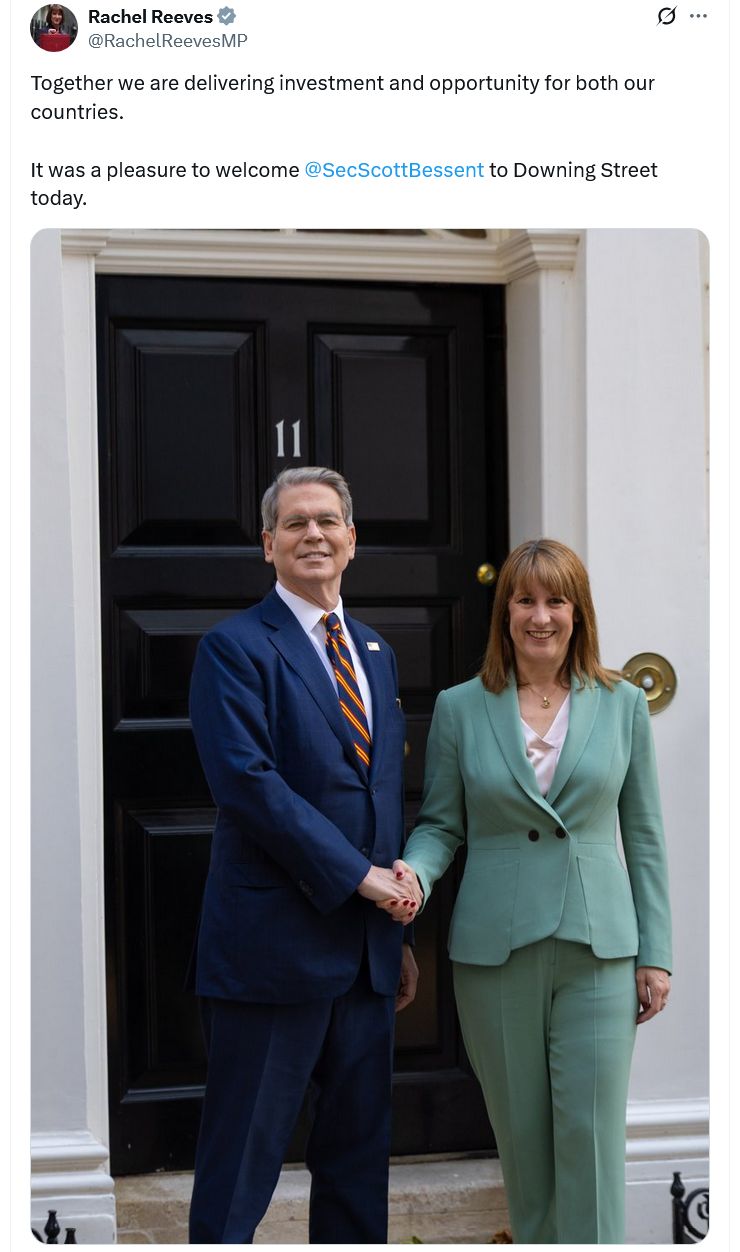

UK Chancellor Rachel Reeves and US Treasury Secretary Scott Bessent held discussions to explore deeper cooperation on digital assets. The meetings included industry representatives and bank executives and were described as a last-minute effort after advocacy groups pressed the UK for a more open stance.

Source: Rachel Reeves

Why would stablecoins be central to any UK–US agreement?

Stablecoins are likely to be central because they underpin many crypto payments and tokenized finance use cases. Aligning rules can enable cross-border payments, reduce operational fragmentation, and support institutions that rely on regulated, reliable digital cash-like instruments.

What are the current UK barriers to adoption?

UK banks have shown caution: surveys indicate about 40% of crypto investors reported blocked or delayed payments by banks. Proposed limits on individual stablecoin holdings and conservative bank policies have been cited by advocacy groups as obstacles to scaling innovation.

How could regulatory alignment unlock adoption?

- Develop consistent stablecoin rules to reduce compliance complexity for cross-border firms.

- Create digital securities sandboxes for testing tokenized financial services under supervision.

- Harmonize market access rules to allow UK firms smoother entry into US capital markets.

What do UK consumers think about crypto?

Recent survey data shows 27% of 2,000 UK adults are open to including crypto in retirement funds. About one in five respondents said they hold or have held crypto, and roughly two-thirds of that group still own crypto in some capacity.

Plain text source mentions: Financial Times reported discussions, and survey data was published by Aviva.

Frequently Asked Questions

How will regulatory sandboxes support innovation?

Digital securities sandboxes allow firms to pilot blockchain-based financial services under supervisory oversight, lowering barriers to experimentation while maintaining consumer protections.

Can UK banks speed up crypto payments?

Yes. Clearer regulation and coordination with US counterparts can reduce banks’ compliance uncertainty, making it easier for banks to process legitimate crypto-related payments without delays.

Key Takeaways

- Regulatory focus: Alignment will likely center on stablecoins, exchanges, and digital securities to unlock cross-border adoption.

- Market impact: Closer coordination could attract US investment and expand UK firms’ market access.

- Consumer signal: UK public interest in crypto is growing, but bank friction and regulatory limits hinder adoption.

How to prepare for potential UK–US crypto regulatory changes

Market participants should: document compliance practices, engage with sandbox opportunities, and monitor official guidance to ensure readiness for new cross-border rules.

Conclusion

The proposed UK–US crypto cooperation aims to create a more crypto-friendly environment through aligned rules on stablecoins and digital securities. If implemented, the coordination could reduce friction for firms, attract US investment to Britain, and accelerate responsible adoption—market participants should prepare to engage with evolving frameworks and sandbox initiatives.