Tom Lee Predicts Bitcoin’s Market Growth Beyond $2 Trillion

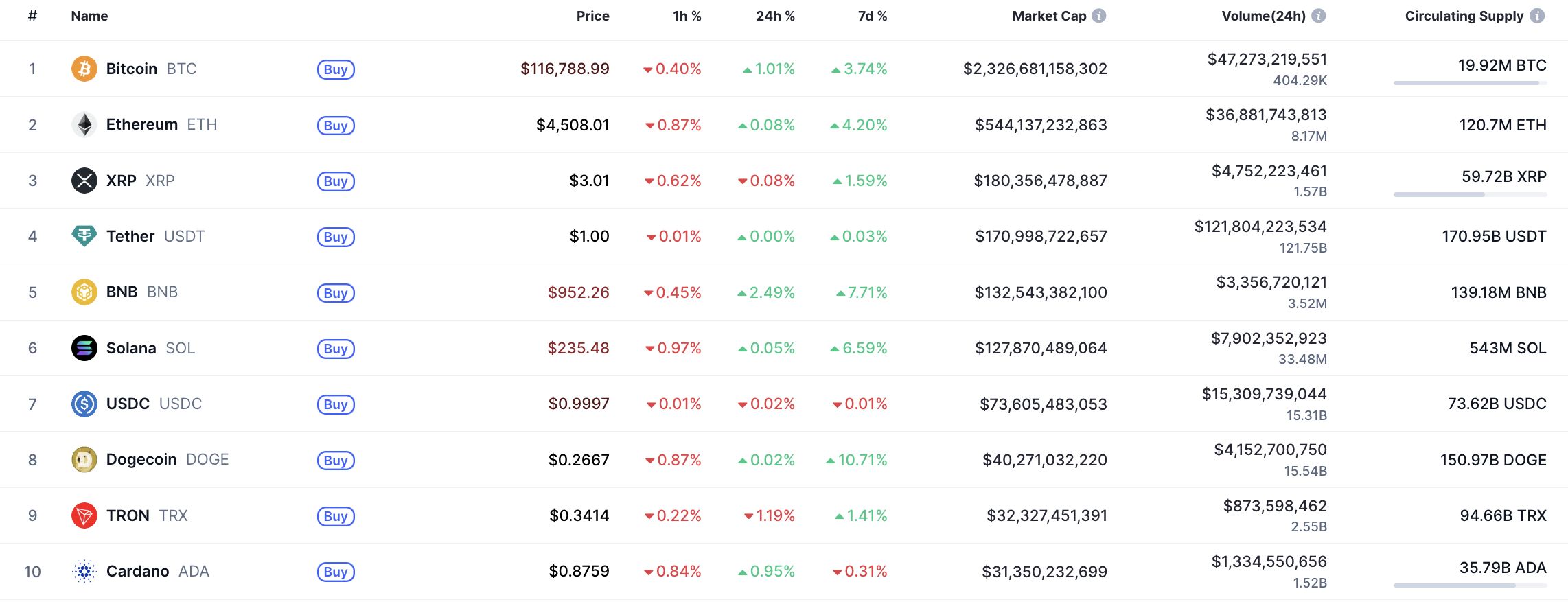

- Tom Lee highlights Bitcoin’s $2 trillion market cap milestone.

- Bitcoin could reach $200,000 by 2025.

- Institutional inflows drive market changes, says Tom Lee.

Tom Lee, co-founder of Fundstrat Global Advisors, reaffirmed his bullish stance on Bitcoin, highlighting its $2 trillion market cap as a milestone indicating its long-term viability.

Lee’s forecast suggests Bitcoin’s market dynamics are shifting, with significant potential valuations and institutional inflows impacting both market stability and broader crypto ecosystem developments.

Tom Lee highlighted Bitcoin’s recent achievement of a $2 trillion market cap , marking a pivotal point for the cryptocurrency. He predicts further growth, emphasizing that no asset reaching this milestone has ever vanished.

Tom Lee, noted for his bullish Bitcoin stance, stated that with Bitcoin becoming a $2 trillion market, its risk profile has transformed. He anticipates Bitcoin could soar to $200,000 by 2025 driven by institutional factors.

Experts note that institutional investors like ETFs provide consistent capital inflows, reshaping the market dynamics. Such changes could alter Bitcoin’s historical price behavior, resulting in steady liquidity and possibly minimizing volatility.

The financial sector has experienced shifts with ETF launches seeing inflows of over $1.3 billion. This participation marks a move away from largely retail-dominated cycles to one dictated by corporate influences.

Analysts observe that Bitcoin’s market capitalization hit $2.2 trillion alongside new price highs around $124,500. This growth aligns with a weakened dollar and institutional appetite , indicating robust confidence in Bitcoin’s future.

Tom Lee comments that institutional inflows may redefine Bitcoin’s four-year cycle, creating counter-cyclical trends. Historical analysis points to post-halving rallies affecting Ethereum and other Layer 1 assets significantly.

“Institutional buyers may break Bitcoin’s traditional four-year cycle as sustained ETF inflows and corporate adoption introduce counter-cyclical dynamics.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Could Remain Rangebound Near $230–$240 After False Breakout, Possibly Testing $220–$230

Midweek CoinStats: DOGE May Consolidate Near $0.27, Could Break Toward $0.30–$0.35

SHIB May Remain Sideways Near $0.000013 After False Breakout, Could Test $0.00001290