Tuttle Capital has submitted applications to the SEC for offering spot ETFs for Bonk, Sui, and Litecoin. This announcement led to over a 3% increase in the prices of these cryptocurrencies within 24 hours. This strong market reaction underscores the influence and expectations surrounding ETFs in the crypto industry.

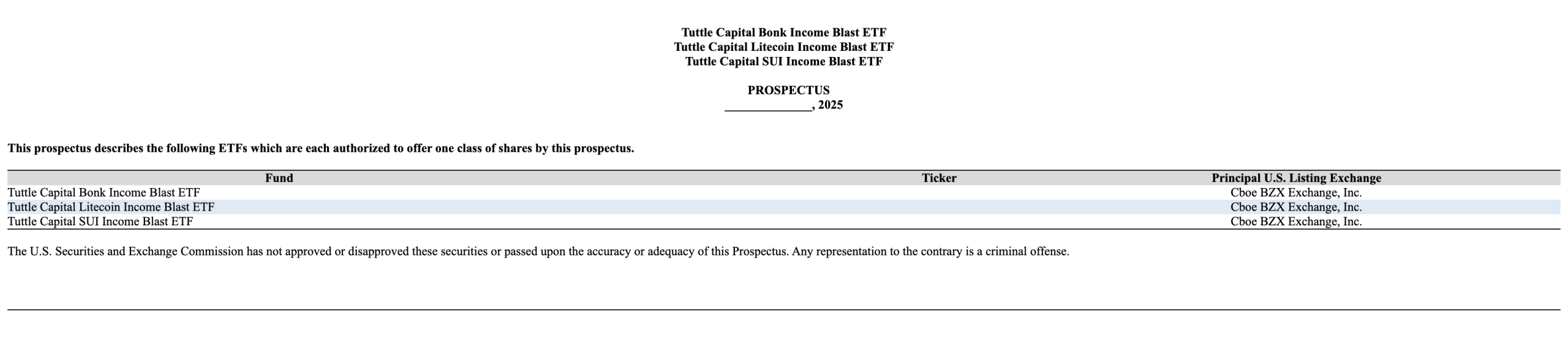

Details of Tuttle Capital’s ETF Proposals

Applications were submitted through the ETF Opportunities Trust on September 16, with the primary objective of providing investors with income and secondary access to the price movements of Bonk, Sui, and Litecoin. The ETFs aim to use customizable options contracts known as Flexible Exchange Options (FLEX Options) to generate investor income. This innovation introduces a new dynamic to traditional ETF structures.

FLEX Options allow investors to personalize contract components like expiration date, strike price, and style. This method offers exposure to price movements without direct cryptocurrency ownership, providing an innovative way for investors to engage with the crypto market . The application specifies generating income through the options market rather than directly holding cryptocurrencies.

Altcoins’ Reaction to ETF News

Following the applications, altcoins showed significant transactions. Bonk rose by 4% to $0.0000242, while SUI’s price increased by over 3%, reaching $3.61. Meanwhile, Litecoin appreciated by 3%, reaching $115.2. This surge in prices demonstrates the market’s responsiveness to regulatory signals in the crypto space.

Bloomberg ETF analysts Eric Balchunas and James Seyffart noted the risk profile of these new products. Seyffart highlighted the volatility of Solana $236 -based Bonk, attracting investor attention. The SEC continues to delay spot ETF decisions, particularly for SUI and Litecoin-focused ETFs, indicating a thorough review process.

The industry remains attentive to regulatory developments, which significantly impact market dynamics. This close monitoring is crucial as the SEC’s decisions could substantially influence altcoin movements and investor strategies.

In summary, these ETF applications highlight the growing intersection between traditional finance and cryptocurrency. The significant market reactions point to the evolving investor approach towards digital assets and the potential for financial instruments like ETFs to shape market trends.