Forward Industries doubles down on Solana strategy with $4 billion equity offering

Quick Take Galaxy-backed Forward Industries seeks to raise up to $4 billion from share sales to buy more Solana. The company recently spent approximately $1.6 billion accumulating SOL, after a $1.65 billion PIPE financing last week.

Forward Industries (FORD), a Nasdaq-listed design firm that has repositioned itself as a Solana-focused corporate treasury, said it filed a $4 billion at-the-market equity offering program with the U.S. Securities and Exchange Commission to raise more capital for SOL accumulation, according to a press release .

The company said proceeds may go toward “general corporate purposes,” including the pursuit of its Solana balance sheet and purchases of income-generating assets.

Kyle Samani, Forward’s chairman, said the ATM plan should give the flexibility to sell new shares from time to time to finance its strategy. The sales, if any, would be made through Cantor Fitzgerald under a sales agreement dated Sept. 16, 2025, and are covered by an automatic shelf registration statement that became effective upon filing.

The SEC filing follows Forward’s $1.65 billion private investment in public equity that closed last week, led by Galaxy Digital, Jump Crypto, and Multicoin Capital. The company began deploying that capital this week, disclosing it acquired 6.82 million SOL at an average price of $232, spending roughly $1.58 billion as it kicked off its treasury program.

ATMs have become a favored mechanism among crypto-exposed corporates and firms seeking opportunistic access to equity markets while building digital asset treasuries. The Block’s data dashboards on public treasuries show a growing cohort of listed firms amassing crypto holdings across bitcoin, ether, SOL, and altcoins, a trend that has accelerated alongside ETF flows on Wall Street. Solana treasuries alone hold about $3.2 billion in assets as of Sept. 17, led by Forward's recent purchase.

After today's news, Yahoo Finance data logged a 6% decline in FORD shares. SOL price action flattened on Wednesday ahead of the Federal Reserve meeting, according to The Block's price page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto To Buy As Saylor’s Strategy Adds 525 Bitcoin to Company Pile

Fair3 Foundation Mechanism In-Depth Analysis: How Did the Coin Circle's First "Decentralized Insurance" Form a Buying Pressure Flywheel?

A new initiative is gaining community attention: the Fair3 Fairness Foundation. This is an on-chain insurance mechanism established entirely by the community, independent of the project team and the trading platform. It is seeking to address a long-overlooked question: "What can we actually do when the risk truly materializes?"

Cathie Wood teams up with UAE for $300 million investment; another Nasdaq-listed company accumulates coins and transforms into a "Solana treasury"

Brera Holdings announced its transformation into a "Solana treasury" and rebranded as Solmate. After economist Laffer joined the company, Cathie Wood quickly decided to invest, having previously referred to Laffer as her "mentor." Solmate plans to pursue a dual listing in the UAE, leveraging local relationships to enhance its ability to accumulate SOL tokens.

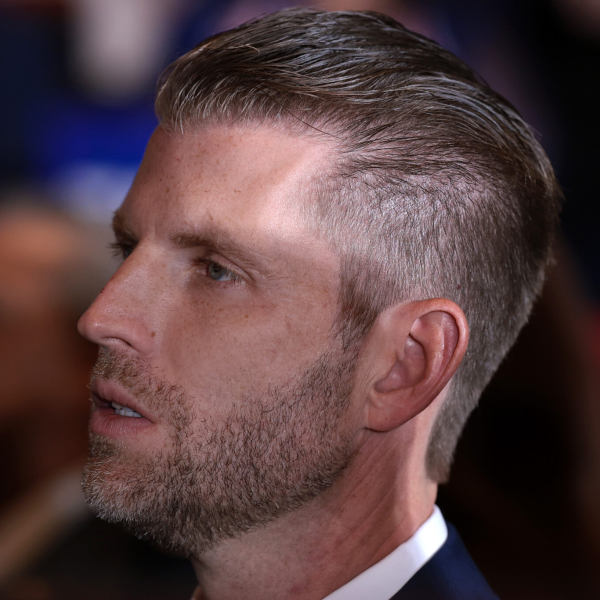

Trump's son: Cryptocurrency will "save the dollar"

Eric Trump stated that attracting global capital into the U.S. digital asset market could provide new support for the U.S. dollar.