Report: Ethereum Becomes the Preferred Institutional-Grade Financial Infrastructure

Jinse Finance reported that Etherealize recently released a report stating that the global financial system is accelerating its transition to blockchain, with mainstream institutions such as BlackRock, JPMorgan, and Fidelity having tokenized and settled tens of billions of dollars in assets via Ethereum. Regulatory frameworks such as the US GENIUS Act, CLARITY Act, and the EU's MiCA are gradually being implemented, providing compliance assurance. The report points out that Ethereum, with its security, decentralization, and mature ecosystem, has become the preferred institutional-grade financial infrastructure. Currently, over 80% of on-chain real-world assets and 62% of stablecoin trading volume are within the Ethereum ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

EU may propose 19th round of sanctions against Russia as early as Friday

BBH View: Risk sentiment remains positive but limited after the Fed's neutral rate cut

Trump Signs the "Technology Prosperity Agreement," Designates "ANTIFA" as a Terrorist Organization

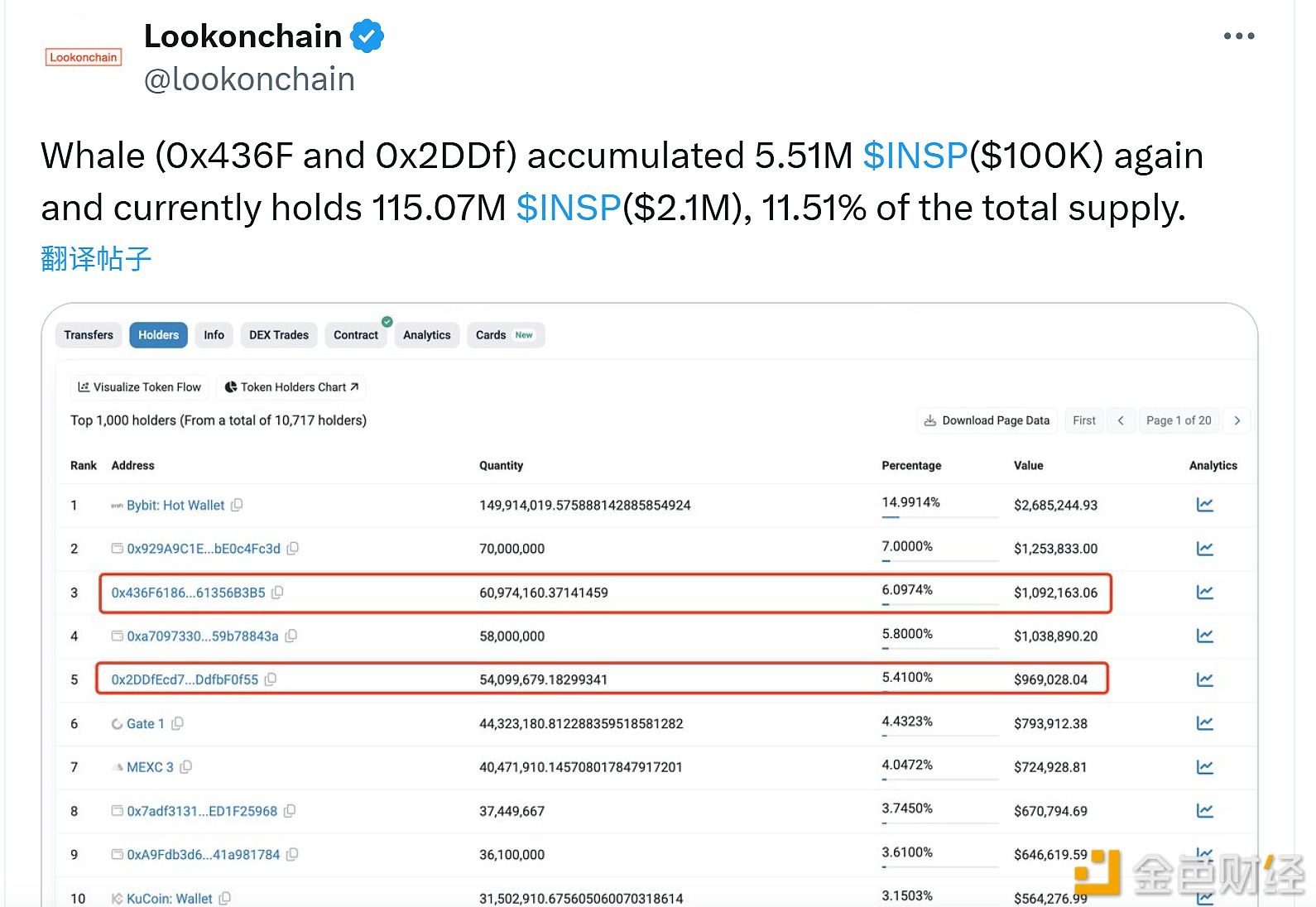

A certain whale address has accumulated an additional 5.51 million INSP tokens.