With a Fed Cut Likely These 3 Coins Have Huge Potential

The Federal Reserve is walking into one of its most consequential meetings in years. With markets already bracing for a rate cut, the decision will ripple far beyond equities and bonds. Cryptocurrencies , in particular, stand to benefit as liquidity loosens and borrowing costs fall. While uncertainty lingers over whether the cut will be 25 or 50 basis points, one thing is clear: a new cycle of monetary easing could ignite momentum in risk assets.

In this environment, 3 coins stand out as having huge upside potential: Bitcoin, Ethereum, and Solana.

Why Fed Cuts Matter for Crypto Market?

Lower interest rates reduce the yield investors can earn from bonds and savings, pushing capital into higher-risk, higher-reward assets. Crypto sits at the far end of that spectrum, thriving when liquidity is cheap and abundant.

At the same time, a softer labour market and political pressure on the Fed suggest an easing cycle could last well beyond a single cut. If markets are correct in pricing in 75 basis points this year and another 75 next year, crypto markets could see a surge of inflows similar to the 2020–2021 bull cycle. Let's take a look at the 3 coins

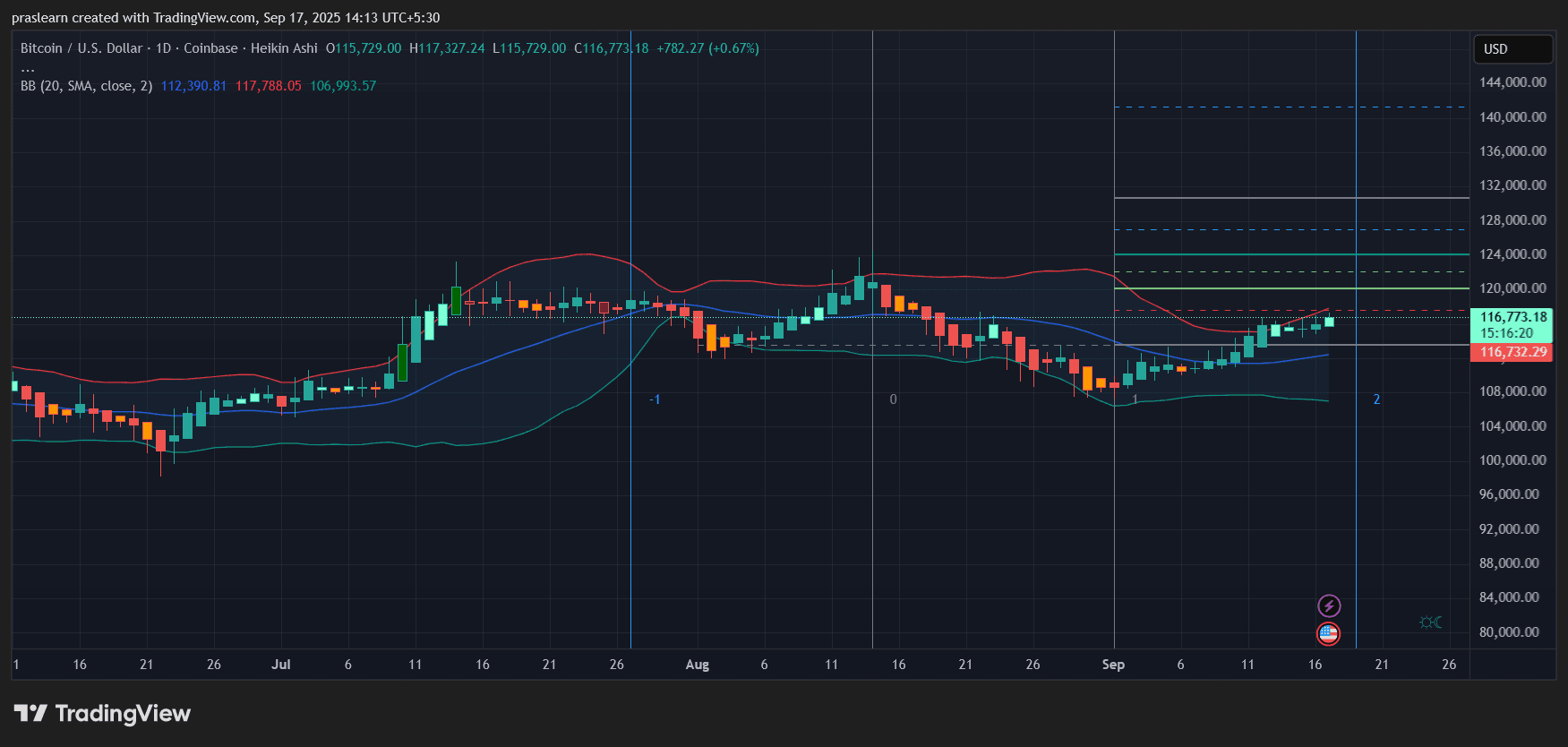

Bitcoin: The First Beneficiary of a Liquidity Wave

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

Bitcoin remains the first stop for institutional flows when monetary policy shifts dovish. A cut to 4.0–4.25% reinforces its appeal as digital gold, especially if real yields fall.

The August jobs report revealed economic softness, making Bitcoin’s scarcity narrative more powerful. If the Fed signals further cuts into October and December, BTC could revisit $1,25,000 in the short term and push toward $150K by early 2026. The key driver will be how much risk appetite revives as the dollar weakens and bond yields fall.

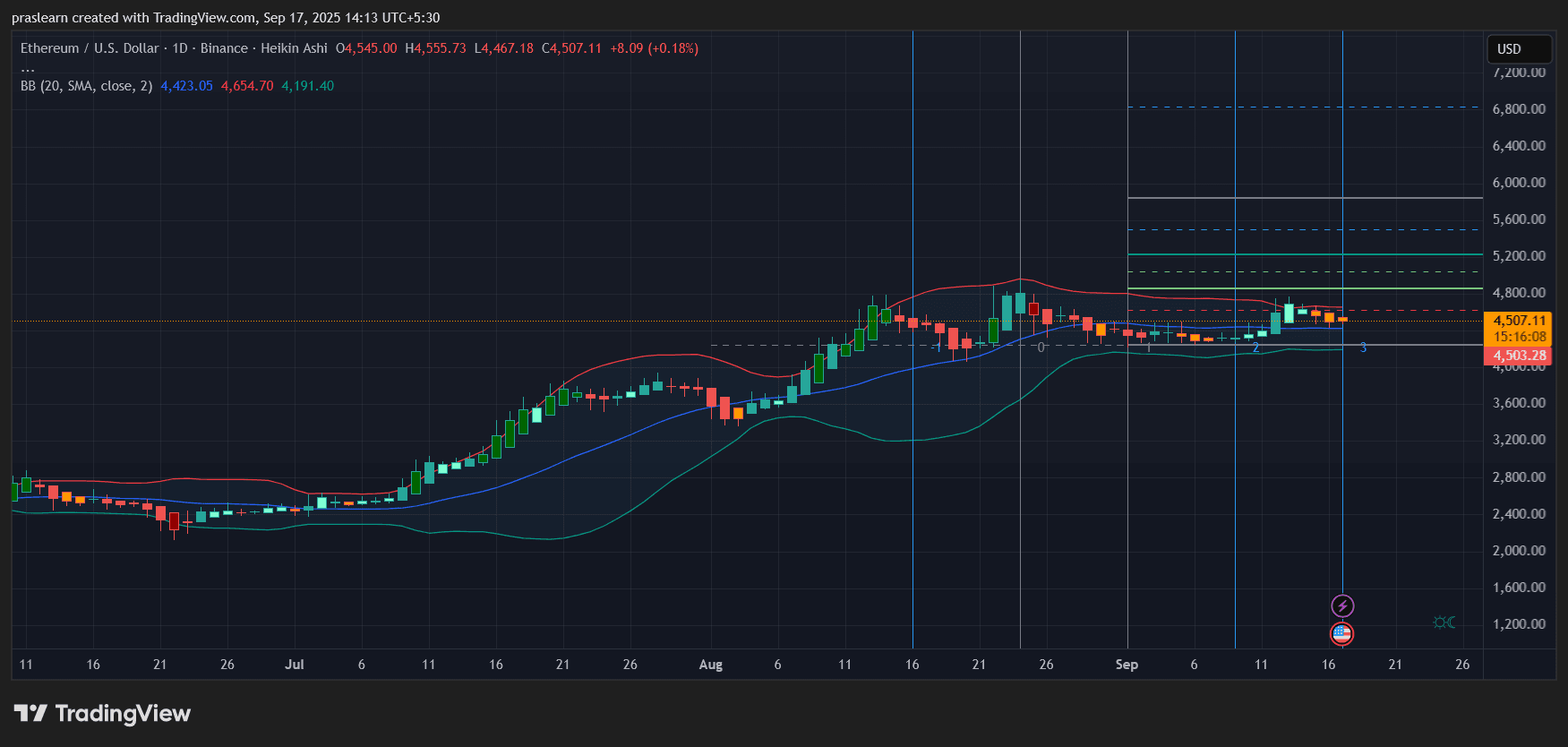

Ethereum: The Utility Play in an Easing Cycle

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

Ethereum benefits from lower rates differently. While Bitcoin absorbs the macro liquidity trade, Ethereum captures activity growth through its ecosystem. Cheaper capital and improving risk sentiment historically fuel DeFi and NFT markets, both of which rely on ETH as their backbone.

The Fed’s dot plot will be crucial. If investors sense multiple cuts ahead, ETH’s staking yields become even more attractive relative to Treasuries. This could accelerate institutional adoption. Price-wise, ETH looks positioned to touch $5000 in the near term, with an upside target of $6,000 if liquidity cycles strengthen through 2026.

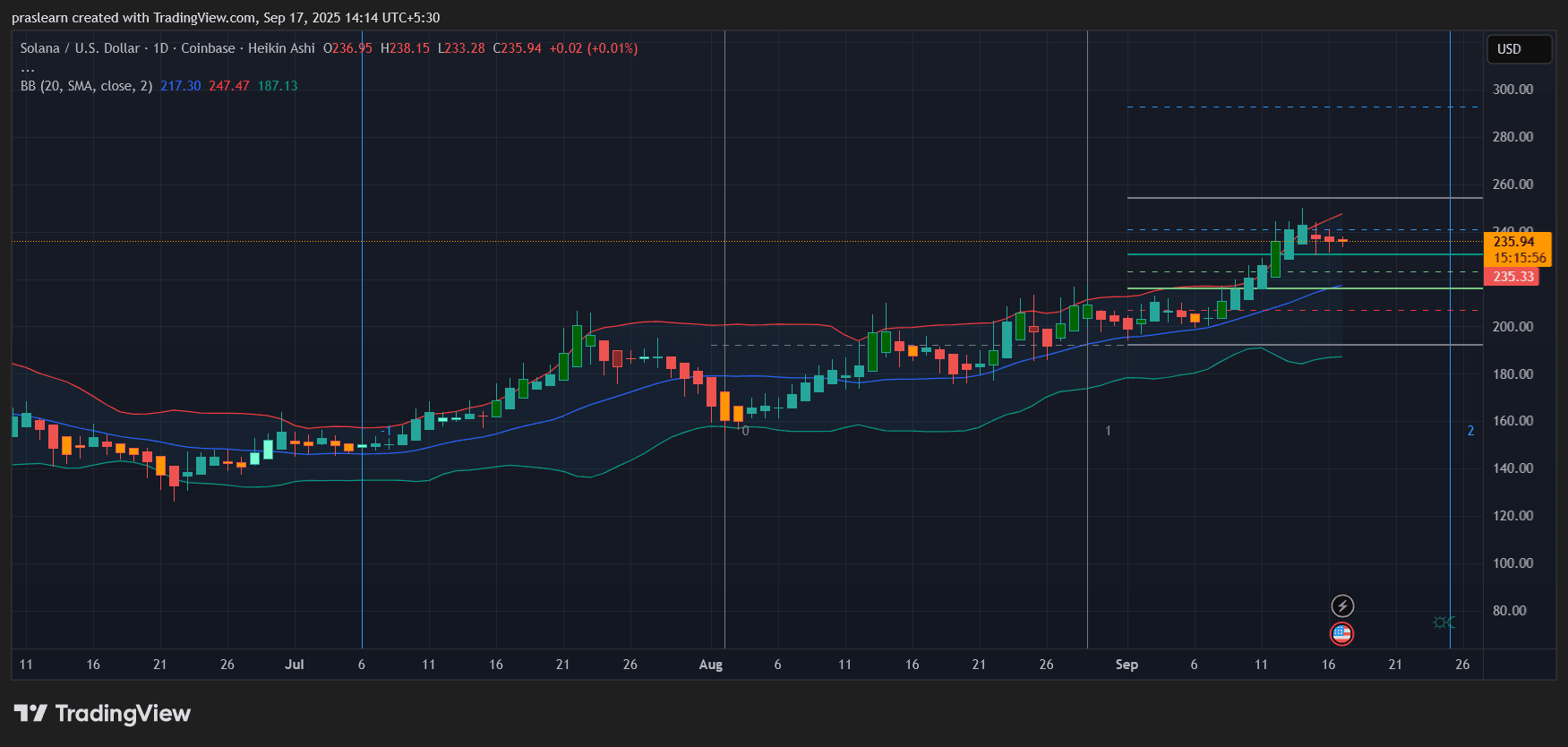

Solana: The High-Beta Winner

SOL/USD daily Chart- TradingView

SOL/USD daily Chart- TradingView

When liquidity is plentiful, high-beta coins like Solana often outperform. Solana’s ecosystem, already showing resilience with surging developer activity, could see explosive growth if borrowing becomes cheaper and risk-taking increases.

Markets don’t expect the Fed to validate the full 150 basis points in cuts that futures traders are pricing in, but even partial easing creates a powerful tailwind. Solana, more sensitive to speculative inflows than Bitcoin or Ethereum, could double from current levels, retesting $300–$400 within the next year.

Divided Fed, United Market Outlook

The intrigue of this FOMC meeting lies in its division. With Trump’s new appointee Stephen Miran joining and potential dissents from multiple governors, Powell’s press conference may leave more questions than answers. Yet, markets are clear: they are betting on a loosening cycle.

Crypto thrives not on certainty, but on momentum. Even if the Fed cuts cautiously now, the signalling of easier policy ahead will be enough to reignite flows.

The Fed is unlikely to surprise with a 50-basis-point cut, but even a smaller move opens the door to sustained easing. For crypto investors, that is the real story. Bitcoin, Ethereum, and Solana each represent a different angle of the trade: store of value, utility backbone, and high-beta growth.

With liquidity cycles turning, these three coins are poised to lead the next leg higher.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.

Elon Musk at the Center of an Unprecedented Showdown with the EU

Stablecoin Payments: Stripe’s Tempo Blockchain Launches Public Testnet

Trump Launches Fed Auditions: Who Will Replace Powell?