SOMI Chart Shows Smart Trading Indicators Pointing to $1.53 — Another Rally Next?

SOMI price hovers near $1.30, with smart money signals and hidden RSI divergence hinting at a rebound setup. A breakout above $1.53 could shift momentum into a full rally.

SOMI’s price trades near $1.30, up almost 5% in the past 24 hours and 10% over the week. But don’t let those short-term gains fool you. The token has been correcting and rebounding sharply within small windows.

Just yesterday, the Somnia price briefly crossed $1.53 before pulling back, yet it still shows daily gains. That kind of movement reflects persistent selling pressure, but on-chain signals and chart patterns are now flashing rebound signs — the kind that smart traders usually watch.

Smart Money and Bulls Keep Rebound Hypothesis Alive

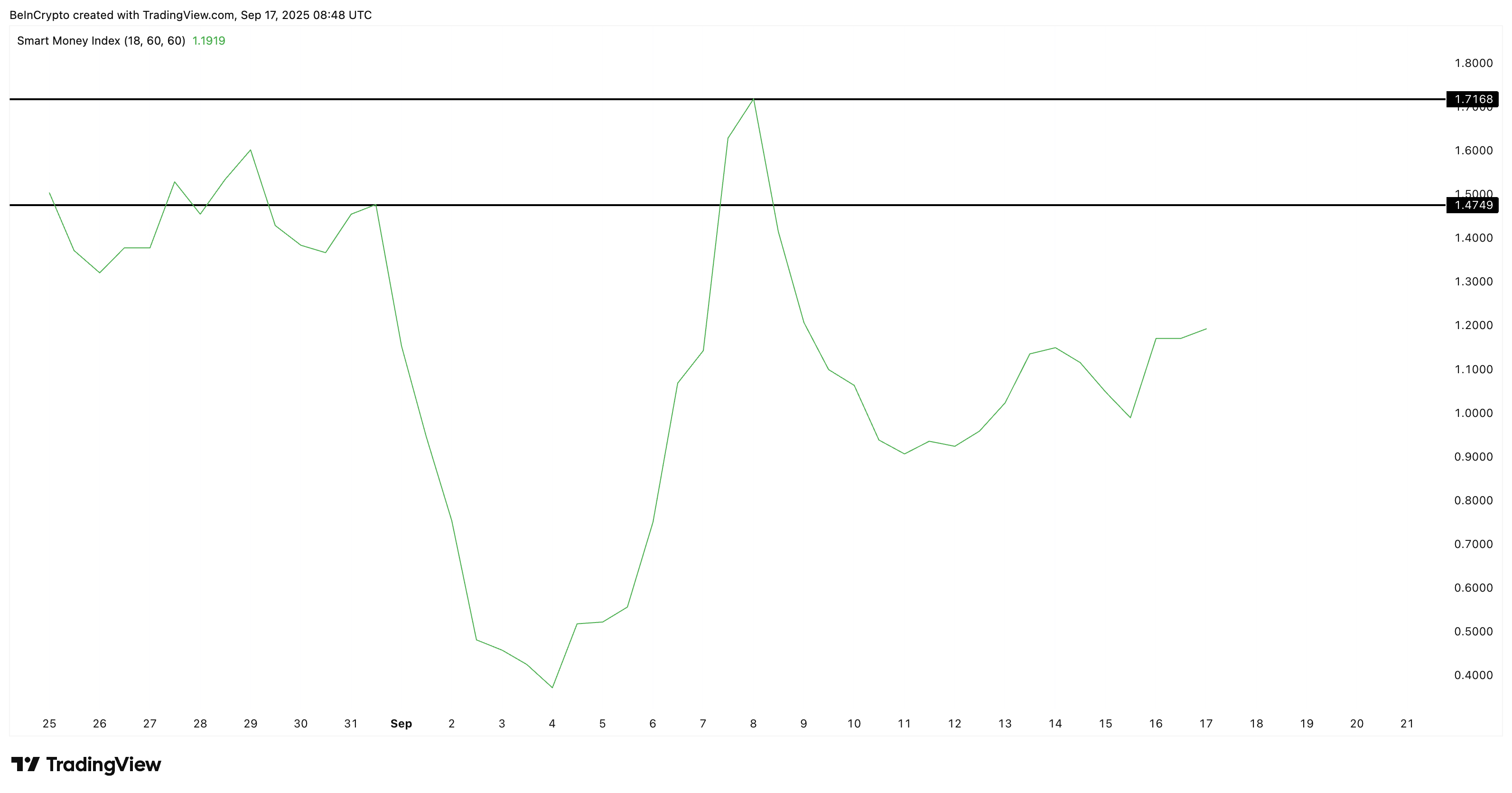

On the 12-hour chart, the Smart Money Index (SMI), which tracks buying and selling by smart traders, has quietly made a higher high since September 13. This suggests that traders who focus on quick rebounds are re-entering.

Still, confirmation is needed: the SMI must climb from its current 1.19 toward 1.47, and ideally 1.71, to unlock a broader rally setup.

Smart Money Is Coming Back To Trade SOMI:

TradingView

Smart Money Is Coming Back To Trade SOMI:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the Bull-Bear Power Indicator, which measures the balance between buying (bulls) and selling (bears), has stayed in the green.

SOMI Bulls In Control:

TradingView

SOMI Bulls In Control:

TradingView

This means bulls have remained stronger than bears even during the September 10–16 SOMI price pullback. Bearish strength increased, but bulls never fully lost control.

Now, green bullish power candles are returning, showing that buyers are regaining momentum. This, along with the smart money index getting a move on, furthers the rebound narrative.

SOMI Price Action and Hidden Bullishness Strengthen the Case

The 4-hour chart offers clarity to capture the shorter-term moves. SOMI is trading inside an ascending triangle, a bullish structure that often signals the continuation of an uptrend.

The token has already broken past one resistance at $1.28, with the next checkpoints for the SOMI price rebound sitting at $1.35 and $1.45.

SOMI Price Analysis:

TradingView

SOMI Price Analysis:

TradingView

A clean breakout above $1.53, where past bounces have been rejected, would mean that the rebound narrative changed into a rally setup. That would even bring the all-time high narrative back into play. In that scenario, upside targets sit at $1.78 and $2.19, based on Fibonacci extension levels.

Adding credibility to the setup is the Relative Strength Index (RSI). Between September 14 and September 17, SOMI’s price formed higher lows, while RSI made lower lows. This hidden bullish divergence often signals trend continuation, backing the rebound smart trader-friendly theory and supporting the case for cautious optimism.

Still, risks remain. The rebound hypothesis weakens if SOMI closes below $1.12, with a deeper slide possible toward $0.92. That could happen if smart money withdraws and bears take control of the SOMI price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price gets $92K target as new buyers enter 'capitulation' mode

Full statement from the Reserve Bank of Australia: Interest rates remain unchanged, inflation expectations raised

The committee believes that caution should be maintained, and that outlook assessments should be continuously updated as data changes. There remains a high level of concern regarding the uncertainty of the outlook, regardless of its direction.