Bitcoin Whale Suddenly Wakes Up After 12 Years To Move 1,000 Coins Worth $116,880,000 Ahead of Fed Meeting: Lookonchain

One deep-pocketed Bitcoin ( BTC ) investor suddenly awoke from a 12-year slumber to move more than a hundred million dollars worth of the crypto king ahead of Wednesday’s Fed meeting, according to on-chain data.

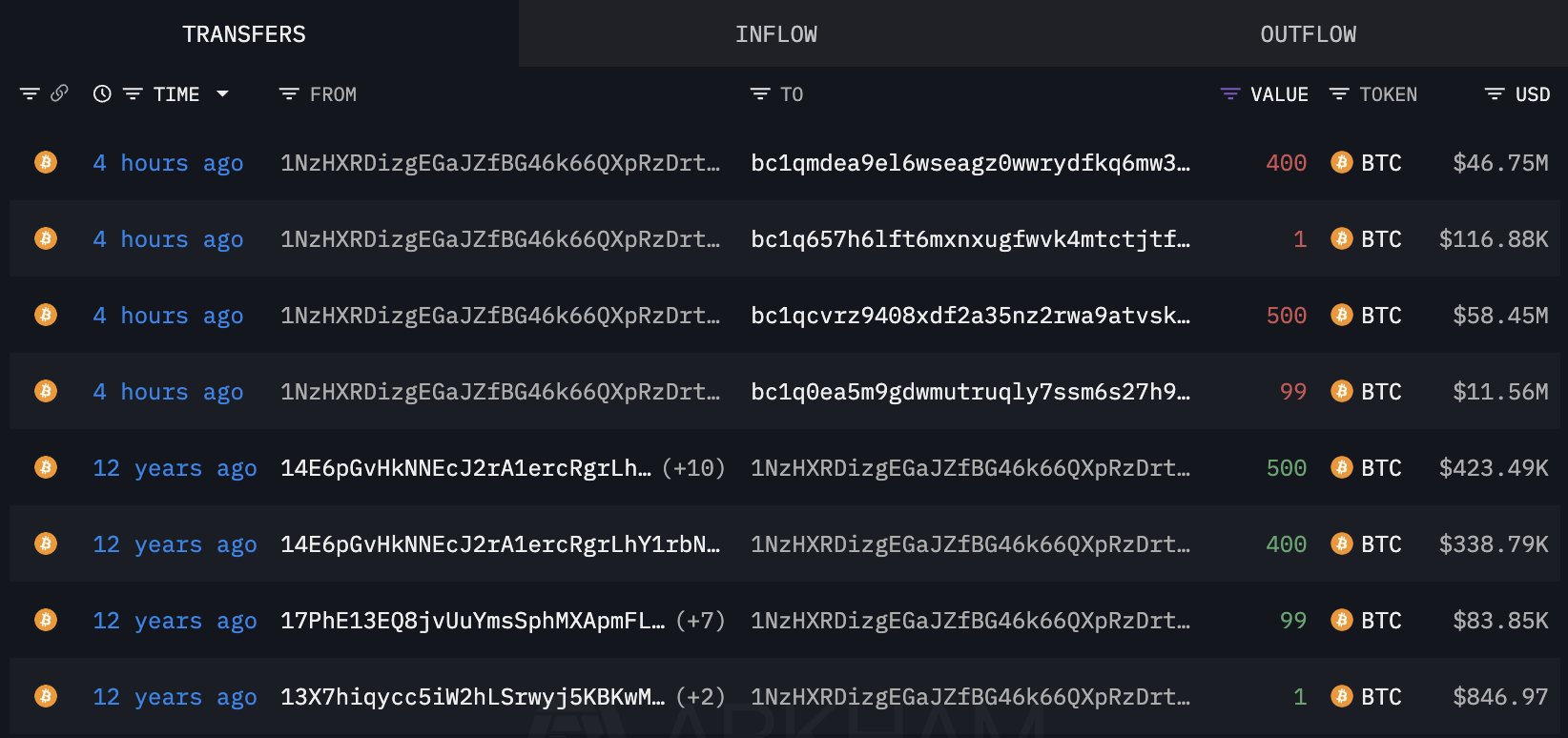

In a new thread on X, the market intelligence platform Lookonchain says that the long-dormant crypto whale suddenly transferred all of his Bitcoin holdings, which are up nearly 13,700% in value.

“A whale transferred all 1,000 BTC ($116.88 million) to new wallets after 12 years of dormancy. The whale received 1,000 BTC ($847,000 at the time) 12 years ago, when the price of BTC was $847.”

Source: Lookonchain/X

Source: Lookonchain/X

The Federal Reserve is expected to announce the first rate cut of the year at its September 17th meeting, amid a weakening labor market.

Data from the CME FedWatch Tool shows that 96% of market participants are expecting a cut of 25 basis points (bps). The remaining are projecting a 50 bps cut.

Meanwhile, investor Tom Lee predicts big rallies are in store for Bitcoin to close out the year if the Fed starts cutting rates.

“I’m looking at September 1998 and September 2024 as the playbook, because those are both years when the Fed was on an extended pause and they cut in September. The number one trade is Nasdaq 100. I think that’s why the Mag 7 and the AI trade get a lot of liftoff.

The second is monetary liquidity sensitivity, global central banks’ easing. That’s Bitcoin and Ethereum… I think they could make a monster move in the next three months, like huge. And the third, of course, is interest-rate sensitive. That’s really small caps and financials. But really, the first two might be the standout trades.”

Bitcoin is trading for $115,790 at time of writing, flat on the day.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Big Volatility During the Rate-Cut Cycle: Will Bitcoin Rise First and Then Fall?

The Federal Reserve has begun a rate-cutting cycle, which could trigger a parabolic surge; however, this bull market may end with a historic crash.

Fed Cuts Rates, Bitcoin Dominance Forms Death Cross, Alts Get Ready

Former BlackRock Executive Joseph Chalom: Ethereum is Redrawing the Global Financial Landscape

Ethereum OBV, Bullish Cross Indicate Possible Test Above $5,000 This Month