dogwifhat (WIF) shows constructive signs: Spot Taker CVD tilting to buyers, Open Interest up 8.65% to $397.72M, and persistent exchange outflows (-$1.69M) all point to accumulation. A daily double-bottom with $0.87 support and $1.29 neckline suggests a breakout could target $1.40+ if sustained buying continues.

-

Buy-side Spot Taker CVD + rising Open Interest signal increasing bullish demand

-

Exchange Netflows negative (-$1.69M), indicating tokens leaving exchanges and reduced sell pressure

-

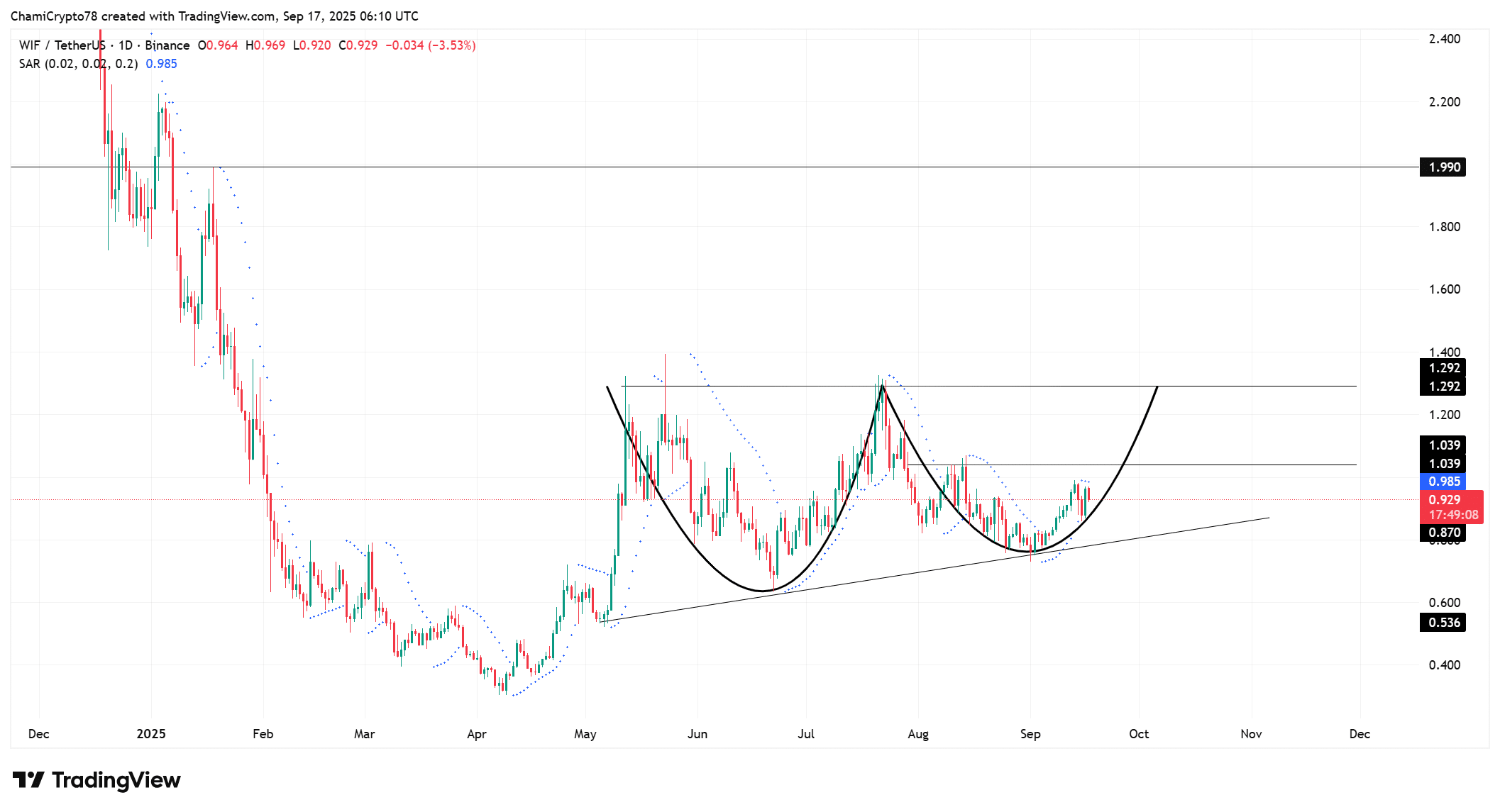

Chart structure: double-bottom support $0.87, neckline $1.29 — breakout target ~ $1.40+

dogwifhat WIF outlook: buy-side CVD, rising OI and exchange outflows point to accumulation — monitor $1.29 breakout for bullish confirmation. Read on for levels and risk signals.

What is driving dogwifhat’s (WIF) recent momentum?

dogwifhat (WIF) momentum is driven by buy-side dominance in Spot Taker CVD, an 8.65% jump in Open Interest to $397.72 million, and sustained negative exchange netflows. Together, these indicators show accumulation and growing speculative positioning ahead of a potential breakout.

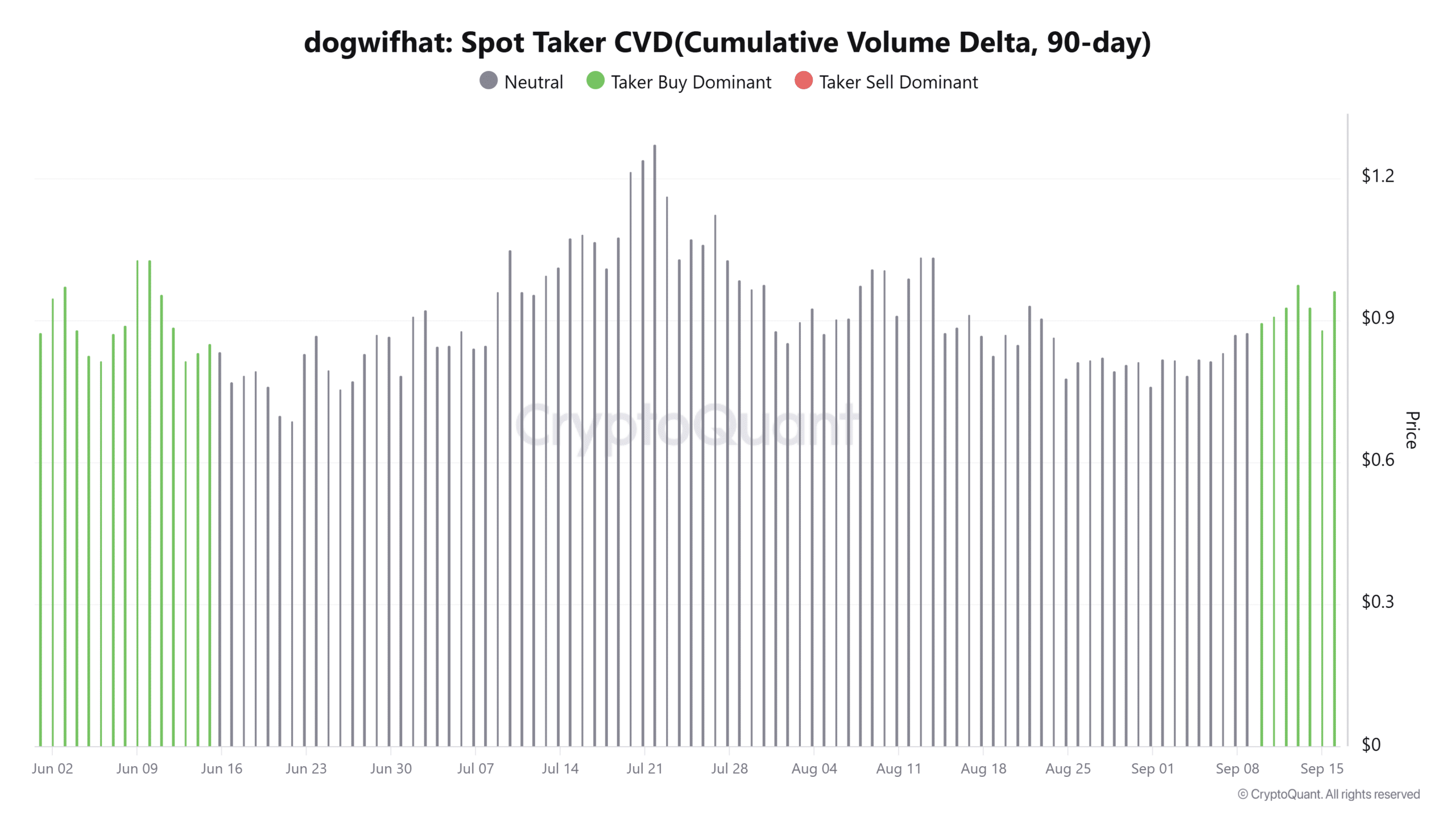

How does Spot Taker CVD signal buyer conviction?

Spot Taker CVD (90-day) tilted toward buyers, meaning taker activity favored market buys over sells. This indicates liquidity absorption by buyers and persistent demand despite volatility. Data source: CryptoQuant (reported as plain text).

Source: CryptoQuant

When takers consistently buy into dips, it signals conviction that prices may move higher. That dynamic often precedes directional trends as liquidity gets absorbed and fewer sellers remain on exchanges.

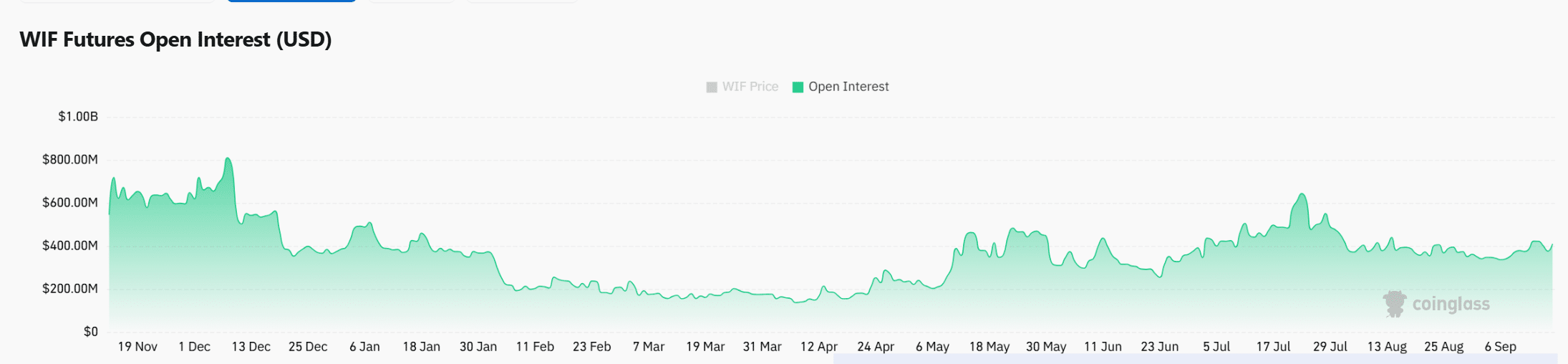

Why did Open Interest and netflows matter this week?

Open Interest rose 8.65% to $397.72 million, showing increased derivatives positioning and speculative interest. Rising OI with price or buy-side CVD often indicates conviction behind moves, but it also increases liquidation risk if momentum reverses.

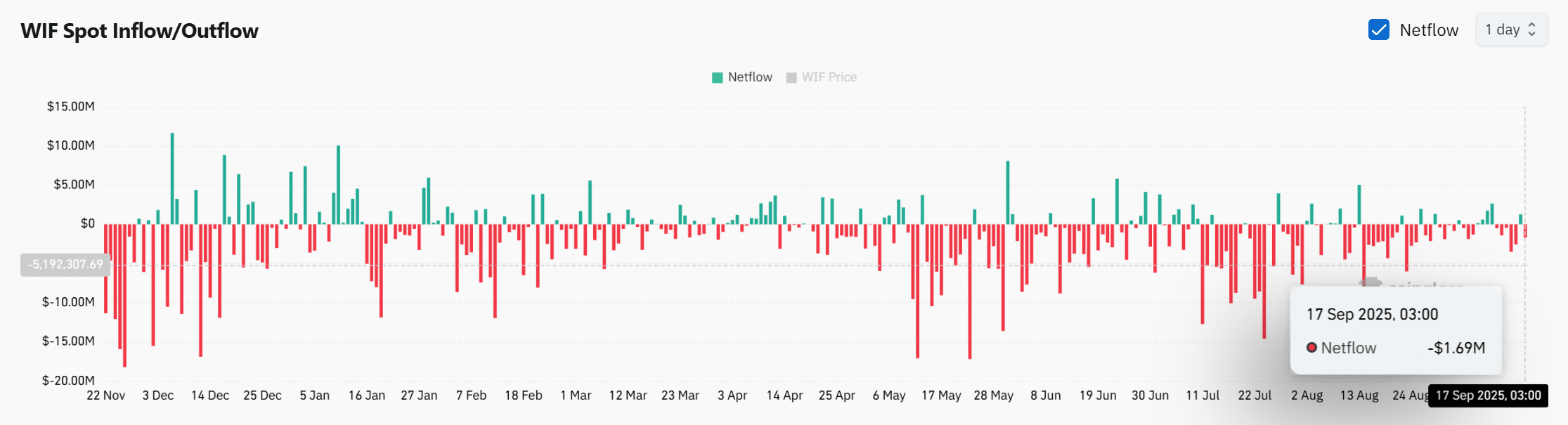

Exchange Netflows remained negative at -$1.69 million, reflecting withdrawals from centralized platforms. Persistent outflows typically reduce sell-side supply and support longer-term accumulation narratives. Data sources referenced: CoinGlass and CoinGlass (plain text).

Source: CoinGlass

When will the double-bottom confirm for WIF?

The daily chart outlines a round double-bottom with support at $0.87 and a neckline near $1.29. A decisive daily close above $1.29 with volume and derivatives support would validate the reversal and open targets beyond $1.40.

Source: TradingView

WIF: Netflows and accumulation — what to watch?

Exchange Netflows showed persistent outflows, with the most recent reading at -$1.69 million. Withdrawals reduce immediate selling supply and align with an accumulation-led recovery scenario.

Source: CoinGlass

Frequently Asked Questions

What are the immediate support and resistance levels for WIF?

Support is at $0.87 and the key resistance (neckline) sits at $1.29. A clean breakout above $1.29 on daily closes would target $1.40 and higher, while failure to break could keep price consolidating around $0.87–$1.29.

How risky is trading WIF with rising Open Interest?

Higher Open Interest indicates more leverage in the market; it can amplify gains but also increases liquidation risk. Traders should size positions and use risk management tools when OI is expanding.

Which on-chain and exchange indicators should I monitor for confirmation?

Monitor Spot Taker CVD for taker-side conviction, exchange netflows for withdrawals/inflows, and Open Interest for derivatives participation. Confluence across these metrics strengthens breakout validity.

Key Takeaways

- Buy-side momentum: Spot Taker CVD favors buyers, indicating demand absorption.

- Positioning rising: Open Interest +8.65% to $397.72M signals increased speculative interest.

- Accumulation signals: Negative exchange netflows (-$1.69M) reduce sell-side supply; watch $1.29 for breakout confirmation.

Summary table

| Spot Taker CVD (90-day) | Buy-side tilt | Buyer conviction |

| Open Interest | $397.72M (+8.65%) | Higher leverage, stronger positioning |

| Exchange Netflows | -$1.69M | Net withdrawals, reduced sell pressure |

| Chart levels | Support $0.87 / Neckline $1.29 | Breakout target $1.40+ |

Conclusion

dogwifhat (WIF) presents a constructive short- to medium-term outlook driven by buy-side CVD, rising Open Interest, and sustained exchange outflows. Traders should watch a confirmed daily close above $1.29 for pattern validation while managing risk around $0.87 support. COINOTAG reports and monitors ongoing flows and derivatives activity for updates.