ChatGPT Suggests Smart XRP Trading Strategy For Potential 10x Gains

For the past few months, XRP price has been stuck between $2.60 and $3.40. In September, the altcoin moved by only 5%. As XRP trades within a tight range, we have leveraged the advanced analytical capabilities of ChatGPT 5.0 to develop a potentially effective trading strategy.

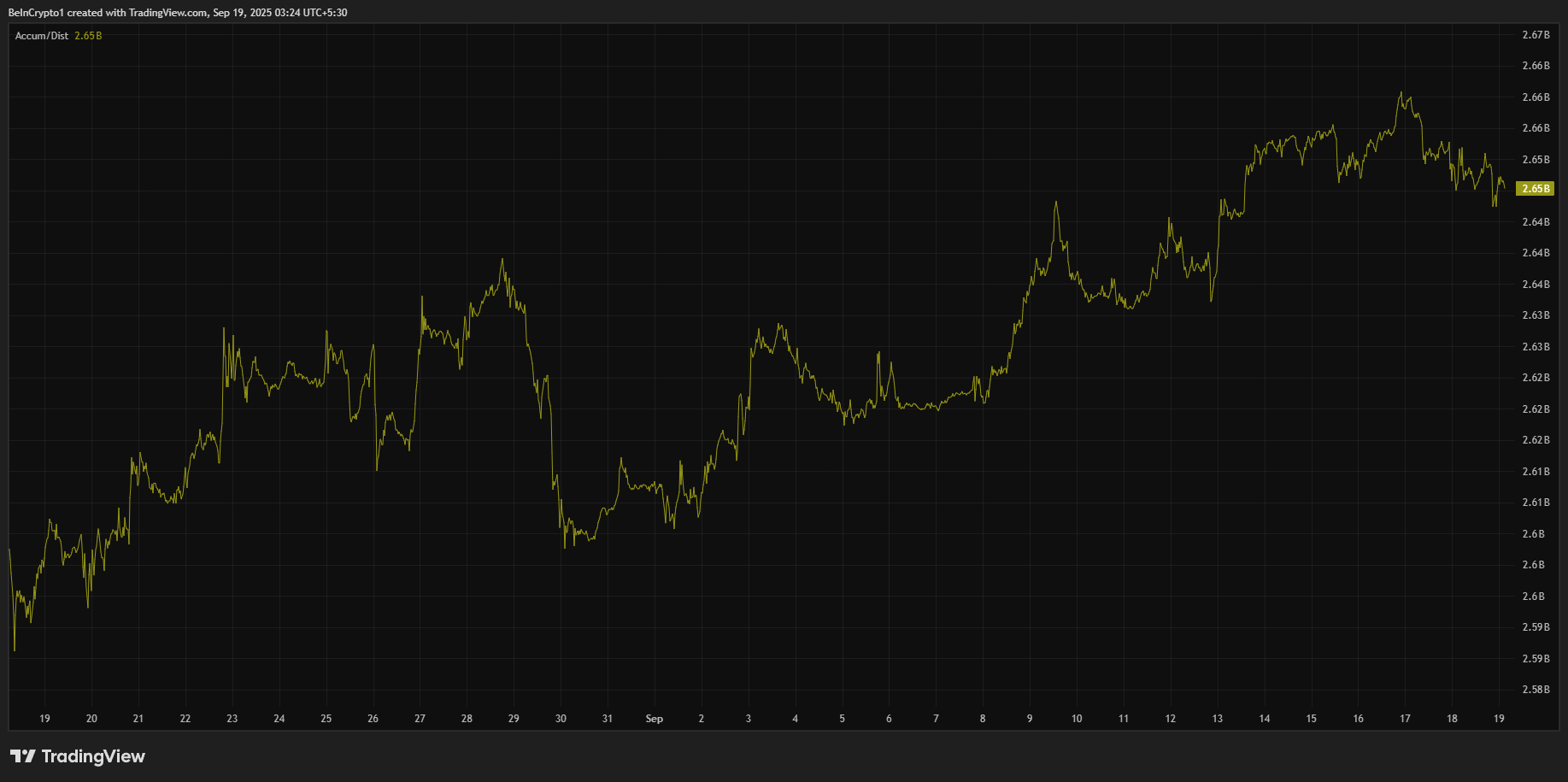

Notably, the prompts provided the latest XRP market developments, important price analytics such as the historical RSI and Accumulation/Distribution pattern, and other key indicators.

Market Context

XRP has been trading around $3.00–3.10 throughout September 2025. Strong support sits between $2.70 and $2.80, while resistance is visible near $3.30–3.70. These levels have been tested repeatedly, showing where buyers and sellers are most active.

Several catalysts shape the outlook. The Rex-Osprey hybrid ETF launch on September 18 could unlock institutional inflows. US monetary policy is easing, with rate cuts adding support for risk assets.

On-chain data shows mixed signals: whales have offloaded large amounts of XRP, but accumulation earlier this month confirms strong demand at lower levels.

Together, this creates a market for consolidation. XRP is neither strongly trending nor breaking down, but it is preparing for a decisive move.

Building the 10x XRP Trading Strategy

For beginners and intermediate traders, a core-satellite strategy balances long-term conviction with active trading. This means holding a large portion as a core investment while using a smaller portion to capture shorter swings.

- Core holding (60%): Buy and hold through 2025 to target long-term gains.

- Swing trading (40%): Actively trade around support and resistance to compound profits.

This approach reduces risk, ensures you don’t miss major upside, and builds discipline.

Entries and Accumulation

Smart entries make the difference between chasing hype and capturing value. The best accumulation zone is $2.70–3.00, where XRP has found strong support.

A step-by-step entry plan:

- Buy 40% of your position if XRP dips close to $2.80.

- Add 20% if price reclaims $3.10 with strong volume.

- Keep 40% in cash to deploy either on deeper dips ($2.50–2.60) or on a confirmed breakout above $3.50.

Scaling into positions like this avoids going all-in at one level and provides flexibility in fast-moving markets.

Taking Profits and Managing Exits

Profits are best managed in stages. Swing traders should target resistance zones first.

- Take 20–25% profit if XRP reaches $3.70–4.00.

- Rebuy on dips back to $3.00–3.20 if momentum holds.

For the long-term core, the key is patience.

- Lock partial profit if XRP reaches ~$5 to secure gains.

- Hold the rest for larger targets in the $8–10 range.

- If conditions align — ETF inflows, institutional adoption, and a strong bull cycle — XRP could stretch toward higher price points in the long-term.

Risk Controls To Protect Capital

Every strategy needs clear rules to protect against losses. For XRP, a stop loss is essential.

- Cut 20–30% of holdings if the price closes below $2.50 for multiple days.

- Keep XRP to no more than 15–20% of your overall crypto portfolio.

- Once XRP trades above $4, use a 10–15% trailing stop to secure profits as it climbs.

These measures ensure that one bad move does not wipe out gains or capital.

How a 10x Return Could Unfold

The path to a 10x return is ambitious but not impossible. More spot ETF launches could bring new liquidity, while Ripple’s technology continues to gain traction in tokenization and remittances.

If global markets enter a late-2025 bull run, XRP could benefit disproportionately as one of the few assets with regulatory clarity.

Routine For Smart Traders

A simple routine helps keep emotions out of decisions.

- Weekly: Track RSI and Accumulation/Distribution to measure momentum.

- Monthly: Rebalance between core and swing positions.

- Always: Avoid chasing rallies, and buy near support zones instead.

- Monitor: ETF flows, whale wallet movements, and Fed policy decisions.

This rhythm ensures you stay aligned with both technical signals and fundamental catalysts.

Final Thoughts

The smartest strategy now is to accumulate near $2.70–3.00, trade resistance zones at $3.70–4.00, and let a core holding run toward $8 or beyond.

Scaling entries, staged exits, and strict risk controls give traders a structured path while keeping the door open for a potential 10x move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top VC a16z Discusses the Truth About Crypto Hiring: Crypto Veterans vs. Cross-Industry Experts, Who Is the Real Winner?

The article discusses the challenges faced by the crypto industry in recruiting talent, analyzes the advantages of crypto-native talent versus traditional tech talent, and provides recruitment strategies and onboarding advice. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

‘Certainty Assets’ in a Bear Market? Fair3 Uses On-Chain Insurance to Unlock a New Wave of Buying Logic

The article discusses the frequent occurrence of rug pull incidents in the crypto industry and their impact on investors. It introduces the decentralized insurance mechanism of the Fair3 Fairness Foundation, which provides protection through on-chain transparency, position-linked guarantees, and community governance. This mechanism may potentially change the operational logic of tokenomics. Summary generated by Mars AI This summary is generated by the Mars AI model. The accuracy and completeness of its content are still in the iterative updating stage.

Fluence DePIN Day 2025: Building the Cornerstone of Future Web3 Infrastructure

The 12th DePIN Day will be held in Singapore in October, focusing on how decentralized technology is reshaping real-world infrastructure. The event is co-hosted by Fluence and Protocol Labs and will bring together top builders and thinkers from around the world. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

FED's Kashkari confident in achieving inflation targets