ADA Climbs as Short-Term Sellers Retreat, Targets Rally Above the $0.92 Wall

Cardano’s ADA has soared 12% in the past three days and is now testing a critical resistance level that has capped its upside since mid-August.

The uptrend comes as on-chain data shows that short-term holders (STHs) have slowed their selloffs, with broader market demand for ADA also rising. These could set the stage for a breakout above the $0.92 wall.

Cardano’s Rally Backed by Real Inflows

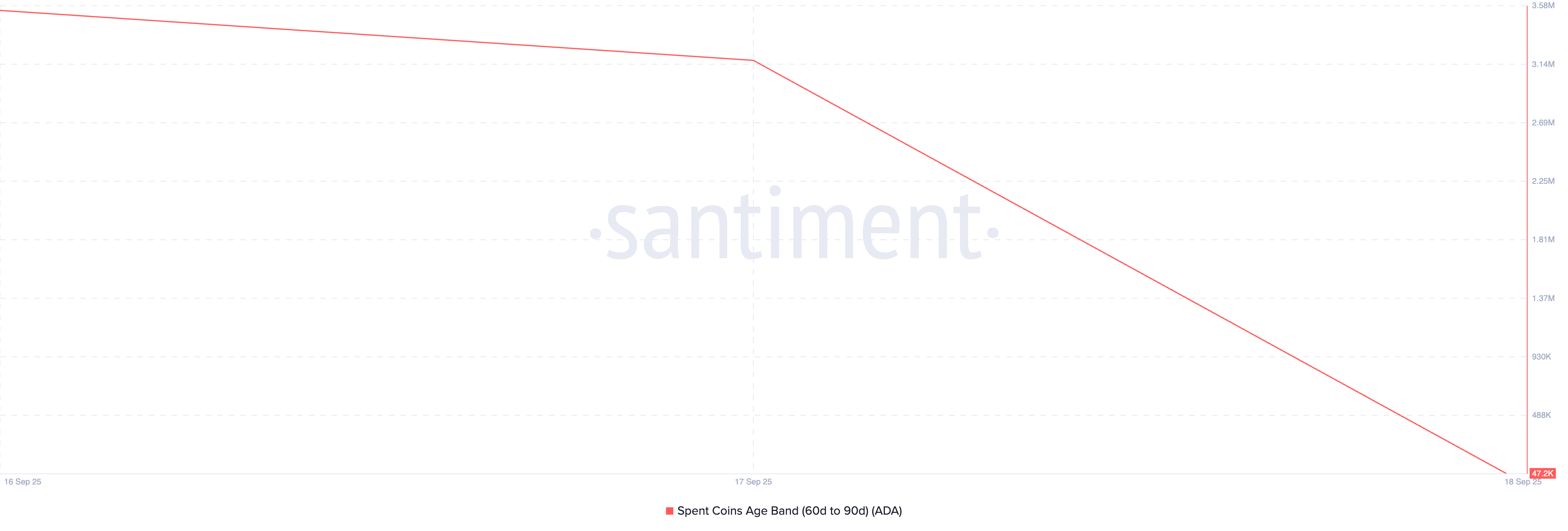

An assessment of ADA’s Spent Coins Age Band (30d–60d) reveals that it has fallen steadily since September 16. At press time, this is at 47,230 ADA.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

According to Santiment, this metric tracks the movement of ADA coins that have been held in wallets for between 30 and 60 days before being spent. Put simply, it tracks whether short-term holders (STHs) are selling their coins or choosing to hold.

A rising value in this band signals increasing sell pressure from STHs, as coins held for just a month or two are moved to exchanges or liquidated.

Conversely, as with ADA, a decline suggests that fewer recently accumulated tokens are being spent. Since STHs often drive price volatility, their decision to hold reduces selling pressure and may have contributed to ADA’s double-digit rally over the past three days.

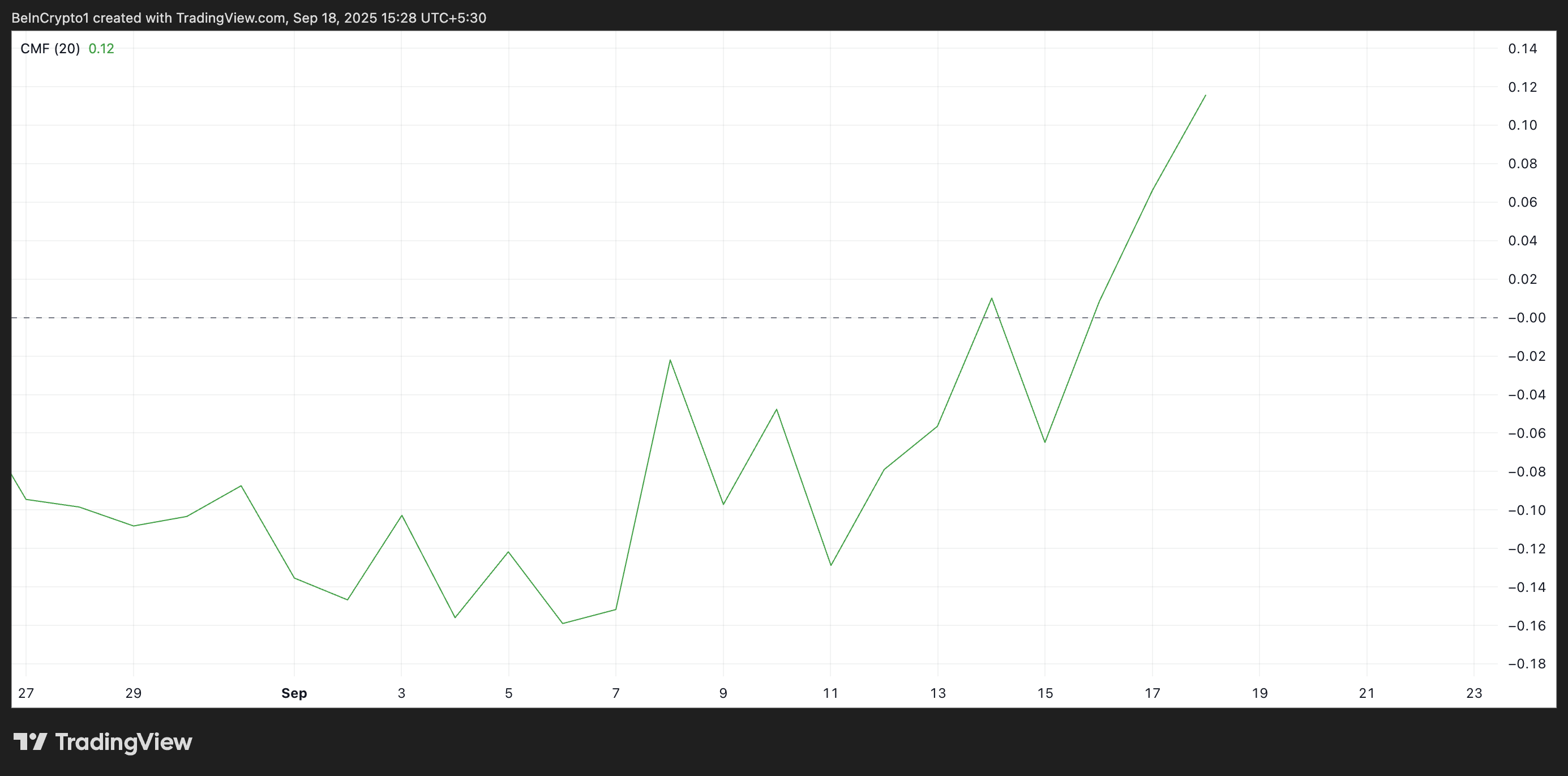

Furthermore, readings from the ADA/USD one-day chart confirm the bullish bias toward the altcoin. For example, its Chaikin Money Flow (CMF) has trended upward strongly, and now sits at a 42-day high of 0.11.

The CMF indicator measures the volume-weighted flow of capital into and out of an asset, with positive values like this signaling that buying pressure outweighs selling pressure.

For ADA, the strong uptick in CMF highlights that real inflows are backing its recent rally and could open the door for further upside in the near term.

Cardano Bulls Push for Breakout, Bears Ready to Drag to $0.84

The slowdown in STH selloffs and increased buying activity suggest that ADA is building the momentum needed to challenge the $0.92 resistance level. A successful close above this barrier could drive ADA’s price to $0.98.

However, if the bears regain dominance, they could trigger a price decline toward $0.84.

The post ADA Climbs as Short-Term Sellers Retreat, Targets Rally Above the $0.92 Wall appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Federated Learning to Decentralized Agent Networks: ChainOpera Project Analysis

This report explores ChainOpera AI, an ecosystem aimed at building a decentralized AI Agent network. The project originated from the open-source foundation of federated learning (FedML), was upgraded to a full-stack AI infrastructure through TensorOpera, and eventually evolved into ChainOpera, a Web3-based Agent network.

ETH worth $11.3 billions is being unstaked—how does "V God" view this trend?

The reliability of Ethereum depends on ensuring that validators cannot instantly abandon their duties.

From Treasury Insights: Which Altcoins Are Enterprises Really Paying For With "Real Money" in 2025?

This wave of treasury allocation marks the convergence of three important trends.

The United States continues to ease digital asset regulations as the SEC significantly lowers the threshold for "cryptocurrency ETF" applications.

The market expects that the first beneficiaries will be ETFs tracking Solana and XRP.