AVAX rallied 11.2% to an eight‑month high after South Korea’s first KRW‑backed stablecoin, KRW1, launched on Avalanche; the move boosted daily active addresses, futures/perpetuals volume and pushed AVAX toward resistance near $36.5 while $28 remains key support.

-

KRW1 stablecoin launch on Avalanche sparked the rally.

-

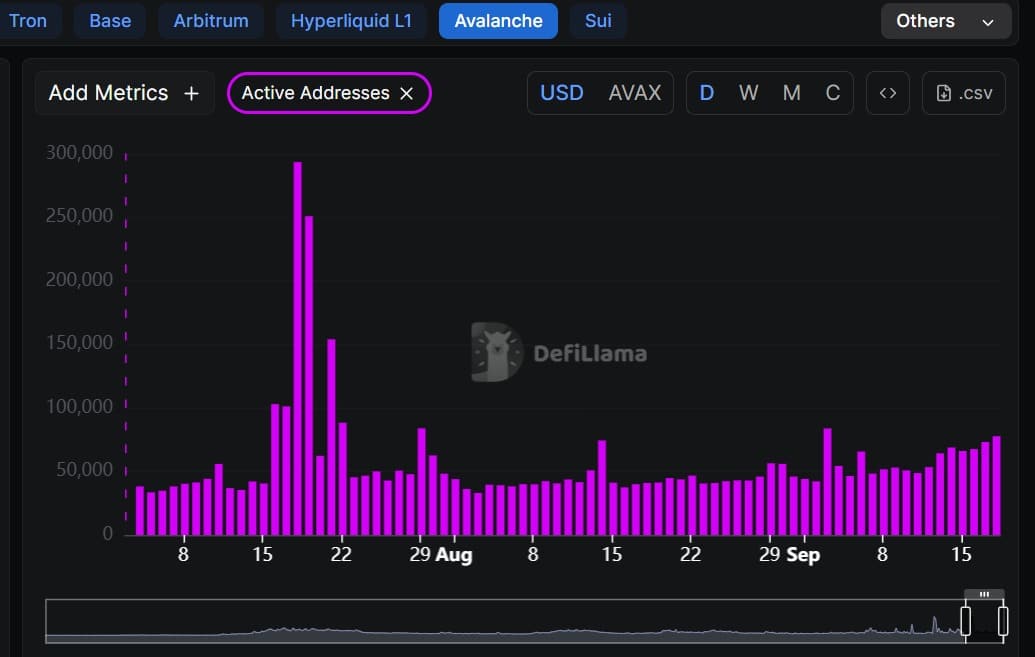

Daily active addresses and platform users spiked, signaling renewed on‑chain demand.

-

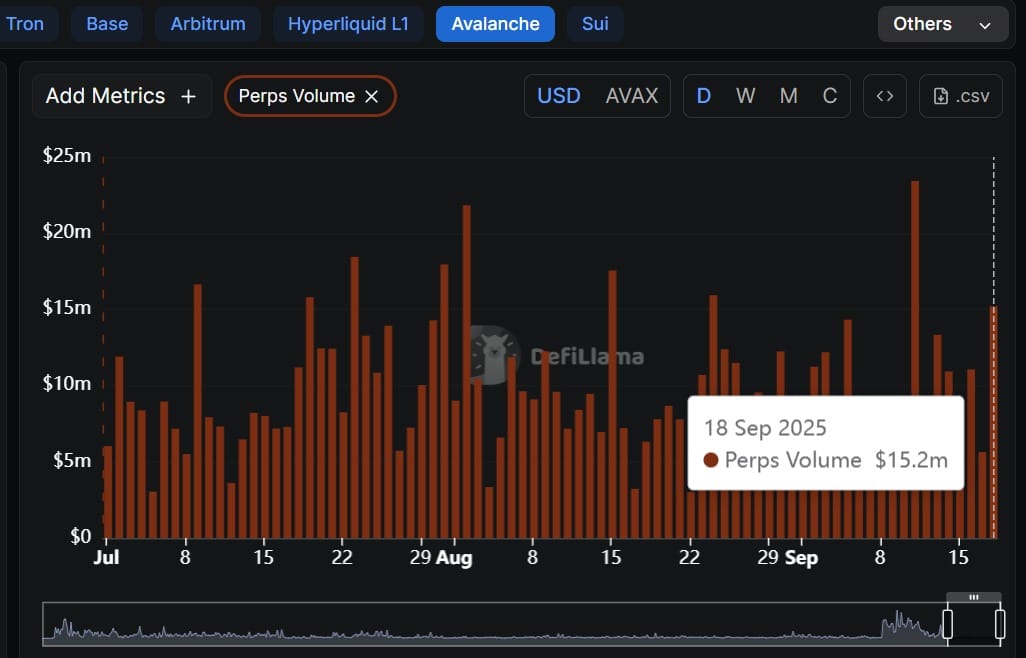

Perpetuals volume leapt ~200% in 24 hours; AVAX faces upside to $36.5 or a retrace to $28.

AVAX rally: Avalanche surged 11% after South Korea’s KRW‑backed stablecoin launch; read on‑chain metrics, futures flows, key levels to watch, and analyst insights.

What triggered AVAX’s 11% rally to an 8‑month high?

AVAX’s rally was driven primarily by the launch of South Korea’s first KRW‑backed stablecoin, KRW1, on the Avalanche network. The announcement coincided with sharp increases in daily active addresses, platform users and perpetuals trading volume, prompting speculative and position‑taking behavior across spot and futures markets.

How did on‑chain activity and user metrics change?

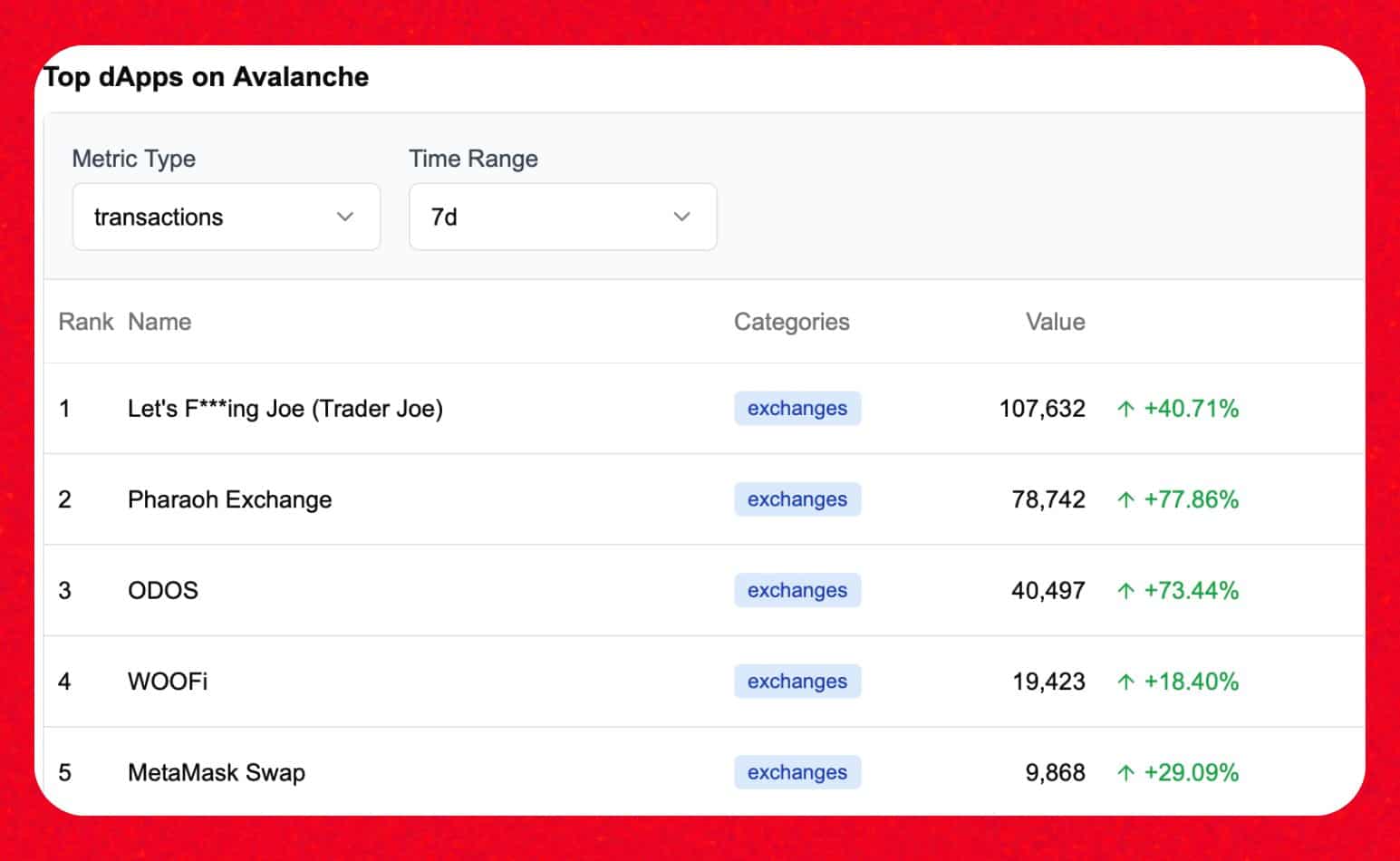

Network activity rose immediately after KRW1 deployment. Daily Active Addresses reached a two‑week high of ~70k, according to Defillama data cited by market observers. Platform-level users also jumped: LFJ_gg users up ~40.7% to 107.6k, PharaohExchange users up ~77.9% to 78.7k, and Metamask interactions increased by ~29% to 9.9k.

The Korean market and KRW1

Market flows were concentrated in South Korea, where BDACS issued KRW1 on Avalanche. The stablecoin is reported to be fully collateralized by Korean Won held at Woori Bank, following a proof‑of‑concept phase. That institutional backing helped validate KRW1 and sparked localized demand for AVAX on the network.

On‑chain activity chugged along

Following KRW1 news, Avalanche’s ecosystem recorded higher transaction counts and new wallet interactions. Analysts noted the mix of retail and institutional interest, visible through rising on‑chain metrics and exchange activity.

Data sources referenced in reporting: Defillama, Token Relations, TradingView (sources cited as plain text only).

Such a spike in active addresses and platform engagement indicates genuine on‑chain demand rather than purely off‑chain speculation. Higher user counts at key dApps and wallets supported the narrative of renewed adoption momentum on Avalanche.

How did derivatives markets react?

Futures and perpetuals volumes surged as traders took directional positions. Perpetuals volume rose from roughly $5 million to $15.2 million within 24 hours, pointing to a significant inflow of leverage and short‑term interest, per exchange‑level and on‑chain metrics.

What technical indicators confirm the move?

Momentum measures reflected the surge. The Directional Momentum Index (DMI) rose to ~35 and the Relative Vigor Index (RVGI) increased to ~0.34, suggesting bullish directional strength at press time. These indicators, together with rising volume, support the short‑term uptrend.

What are the key price levels to watch?

Short term: resistance near $36.5 if momentum and futures flow continue to favor longs. Support: $28 is the immediate retracement level to watch if speculative buying fades. Traders should monitor open interest, liquidation events and DEX inflows for confirmation.

Frequently Asked Questions

Why did AVAX spike after KRW1 launched?

KRW1’s issuance on Avalanche increased local demand for AVAX as on‑chain activity and institutional validation attracted both spot buyers and leveraged traders, leading to an 11.2% price jump and elevated volume.

Is this rally sustainable?

Sustainability depends on continued adoption, stablecoin utility in Korea and whether futures inflows translate to longer‑term holders. If on‑chain metrics and developer activity persist, momentum could hold; otherwise a retracement to $28 is possible.

Key Takeaways

- KRW1 catalyzed demand: South Korea’s KRW‑backed stablecoin on Avalanche drove concentrated buying and network usage.

- On‑chain proof: Daily active addresses and platform user counts spiked, indicating real activity beyond headline price moves.

- Watch volume and perps: Perpetuals volume surged and technical momentum supports near‑term upside to $36.5; $28 is key support.

Conclusion

AVAX’s recent 11% rally reflects event‑driven demand from South Korea’s KRW1 stablecoin launch combined with elevated on‑chain activity and derivatives flows. Market participants should monitor on‑chain metrics, futures open interest and developer signals for confirmation. Coinotag will continue to track updates and provide data‑driven analysis.

Published: 2025-09-18 | Updated: 2025-09-18 | Author: COINOTAG