Solana breakout looks increasingly likely as SOL scarcity tightens: 70% of circulating SOL is staked, institutional wallets hold ~15.83M SOL and a $4B ATM equity program by Forward Industries could convert capital into SOL, creating a supply squeeze that may push SOL toward $300+ by mid‑Q4.

-

70% of SOL staked reduces liquid supply, creating a squeeze.

-

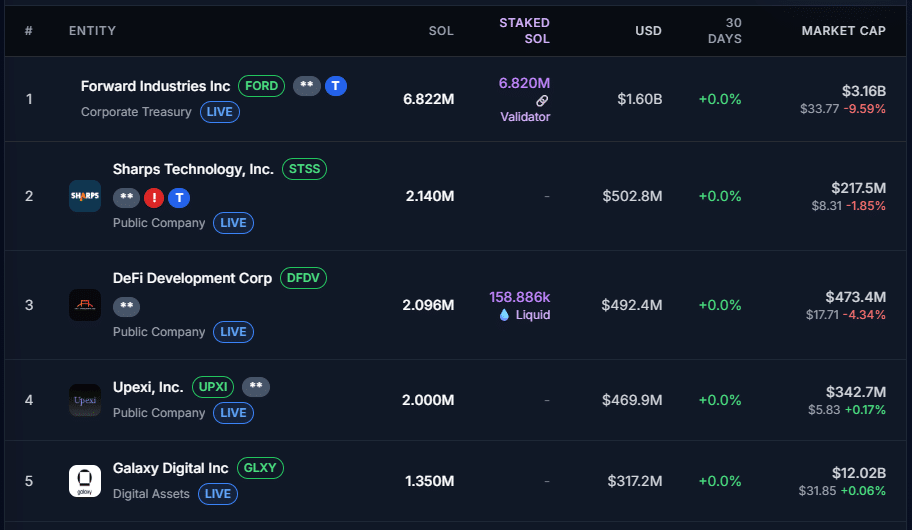

16 institutional wallets hold ~15.83M SOL; Forward Industries holds 6.822M SOL.

-

At current accumulation rates, on‑chain analysts estimate the tradable float could shrink in ~45 days.

Meta description: Solana breakout: SOL scarcity and institutional accumulation tighten liquidity, potentially driving SOL to $300+ by mid‑Q4 — read tactical on‑chain insights.

What is driving Solana’s breakout potential?

Solana breakout is being driven by a severe liquidity squeeze: roughly 70% of circulating SOL is staked and 16 institutional wallets control about 15.83 million SOL, removing tradable supply and increasing the probability of price discovery if demand persists.

How is institutional accumulation affecting SOL’s liquidity?

Institutional accumulation concentrates available float. According to Strategic SOL Reserve, 16 institutional players hold ~15.83M SOL (≈2.75% of circulating supply). Forward Industries (holding 6.822M SOL) alone represents 43% of that institutional float, making any position change market‑moving. On‑chain flow data shows nearly 2M SOL moved into these wallets this month, signaling active accumulation.

Source: Strategic SOL Reserve; SolanaCompass (data references shown as plain text).

Solana’s staking rate — about 411M SOL locked (~70% of circulating supply) — further reduces immediate liquidity. A top on‑chain analyst estimates only ~85M SOL remain truly tradable off‑exchange. At current accumulation, that tradable pool could tighten significantly within ~45 days, amplifying volatility and potential upside.

Forward Industries has launched a $4 billion at‑the‑market (ATM) equity program. While the firm may issue shares to raise cash, management signals indicate a portion of proceeds could be allocated to SOL accumulation. This creates a dual effect: newly issued equity supplies cash that could flow into SOL while the institutional buy reduces available float, producing asymmetric upside when combined with high staking rates.

When could SOL test higher targets?

Technically, SOL is retesting its $250 yearly peak. With tight liquidity and strong bid support, the first meaningful resistance break would target ~$295, with a breakout above $300 plausible by mid‑Q4 if institutional buying continues and staking remains unchanged.

What are the key risk factors?

- Concentration risk: Heavy holdings by a few institutions (Forward Industries ~6.822M SOL) can amplify price impact if positions change.

- Macro conditions: Broader crypto market sell‑offs or macro tightening could negate the supply squeeze effect.

- On‑chain flow reversal: Rapid offloading from exchanges or large wallets would relieve pressure and cap upside.

Expert commentary: a top on‑chain analyst noted that at the current daily accumulation pace, the liquid float could approach critical lows in roughly 45 days, forcing a re‑rating if buying persists. Strategic SOL Reserve and SolanaCompass are cited as on‑chain data sources (plain text references).

Frequently Asked Questions

How much SOL is currently staked and why does that matter?

About 411 million SOL are staked, representing roughly 70% of circulating supply. High staking reduces tradable supply, tightening liquidity and increasing the likelihood of sharper price moves when demand rises.

Who are the biggest institutional SOL holders?

On‑chain data reports 16 institutional wallets hold ~15.83M SOL, with Forward Industries holding 6.822M SOL. This concentration gives institutions outsized influence on SOL liquidity.

What could push SOL above $300?

A continuation of institutional accumulation, support from Forward Industries’ $4B ATM program used to buy SOL, and a tightening tradable float due to high staking could combine to push SOL above $300 by mid‑Q4.

Key Takeaways

- Supply squeeze: 70% of SOL staked reduces immediate liquidity and intensifies price sensitivity.

- Institutional concentration: 16 wallets hold ~15.83M SOL; one firm (Forward Industries) holds 6.822M.

- Timing and triggers: Continued accumulation and the ATM equity program are primary catalysts for a potential mid‑Q4 breakout; monitor on‑chain flows and exchange balances.

Conclusion

Solana’s tokenomics and concentrated institutional accumulation create a clear setup for a potential Solana breakout. With most SOL locked in staking and large holders continuing to accumulate, the market faces a structural supply squeeze that could drive SOL into price discovery. Monitor on‑chain metrics and institutional flow for confirmation, and expect heightened volatility as liquid float tightens.