Key Notes

- Glassnode highlighted that 95% of Bitcoin supply is in profit, but weaker spot flows and profit-taking are creating fragile sentiment.

- Around 30,000 BTC options worth $3.52 billion are set to expire today on Deribit, with a bearish put-call ratio.

- Investors are positioning for the dips, before BTC resumes journey to new all-time highs.

Bitcoin BTC $116 544 24h volatility: 0.6% Market cap: $2.32 T Vol. 24h: $36.66 B price hasn’t shown much movement following the 25 bps Fed rate cut this week, and continues to flirt with $116,000 level. All eyes are on the $3.5 billion Bitcoin options expiry today, which could set the stage for the next price action. Analysts believe that BTC could see one more dip before its next leg of rally begins.

Bitcoin Price Faces Strong Rejection at $117K

Following Jerome Powell’s monetary policy pivot with interest rate cuts this week, BTC volatility has remained subdued as the crypto flirts in the $115K-$117K range. Popular crypto analyst Rekt Capital noted that it is important for the Bitcoin price to give a daily close above $117,200.

Following this, BTC can rally further to $120,000 levels, setting the stage for the next leg of the rally. However, failure to close above $117,200 could lead to a sharp BTC correction, all the way to $105K, as per the chart below.

#BTC

Can Bitcoin do it?

Can Bitcoin Daily Close above ~$117.2k to kickstart the reclaim of the blue-blue range?

Only less than a couple of hours until the new Daily Close is in $BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) September 18, 2025

Blackchain analytics firm Glassnode noted that it is important for Bitcoin price to hold $115,200 levels, to prevent further downside. It noted that 95% of its current circulating supply is currently in profit.

The derivatives market reflects strong activity , as futures show signs of short squeezes while options open interest has reached a record 500,000 BTC ahead of the September 26 expiry. Thus, it noted that if BTC fails to $115,200, it would open the gates for a correction to $105,500.

$BTC recovery has been fueled by macro momentum, ETF inflows, and futures. Yet weaker spot flows, softer funding, and profit-taking highlight emerging sell pressure, leaving sentiment improved but still fragile.

Read more in this week's Market Pulse👇

— glassnode (@glassnode) September 15, 2025

$3.5 Billion in Bitcoin Options Expire Today

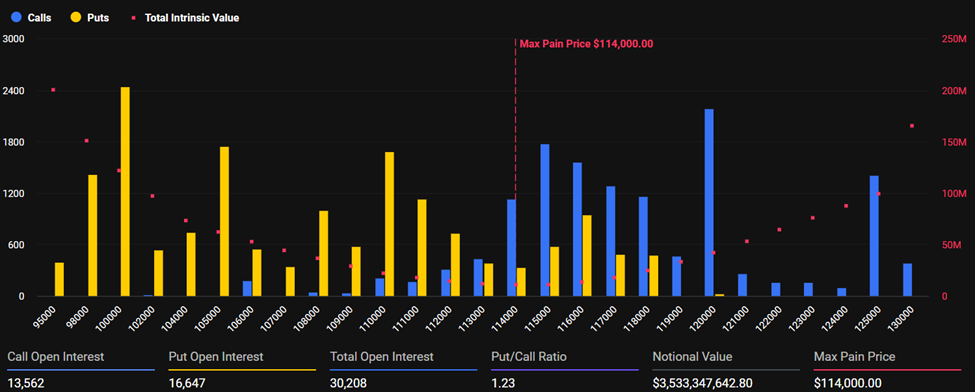

The Bitcoin options expiry on Sept. 19 is one of the largest in history, with 30,000 BTC options worth $3.53 billion set to expire on Deribit.

$3.5 billion in Bitcoin options expiring | Source: Deribit

Market sentiment remains mixed ahead of the expiry. The overall put-call ratio stands at 1.23, reflecting bearish positioning as traders hedge after the recent market rally. However, in the past 24 hours, the ratio dropped to 0.77, with call volume exceeding 22,300 compared to 17,250 puts.

The max pain price is calculated at $114,000, well below Bitcoin’s current levels, with puts heavily concentrated around the $100,000–$108,000 strike range. Analysts warn that traders may attempt to steer prices closer to the max pain point during settlement.

next